GM And Ford Are One Step Closer To Losing Billions On Used Car Price Plunge

The finance arms of Ford and GM are inching closer to billion dollar losses as a result of a plunge in used car prices.

While the impact has been expected for several weeks, the plunge in used car prices has worsened, with prices falling "faster and steeper" than analysts had predicted. We had pointed out worries about used car pricing just days ago.

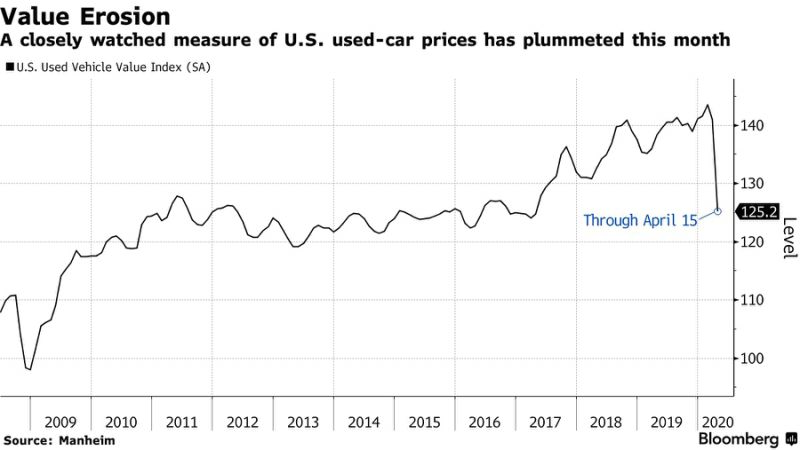

Mid-month data from Manheim showed that the used vehicle value index had fallen 11.8% for the first 15 days of April, a decline on a record setting pace, according to Bloomberg.

JP Morgan analyst Ryan Brinkman said on Monday: "The real losers of the development are likely the captive-finance subsidiaries of automakers like GM and Ford, and the rental-car companies. If prices finish the second quarter 10% lower than envisioned, losses could total $3 billion at GM Financial and $2.8 billion at Ford Credit."

Jennifer Laclair, the chief financial officer of Ally Financial Inc., said on an earnings call: “What we’re seeing right now is essentially the market is illiquid -- and that’s the physical auctions as well as the digital auctions.”

They had been expecting a 5% to 7% drop in used car prices. And they may not be the only ones way off base. Recall, we reported days ago that GM was only bracing for a 4% drop in prices.

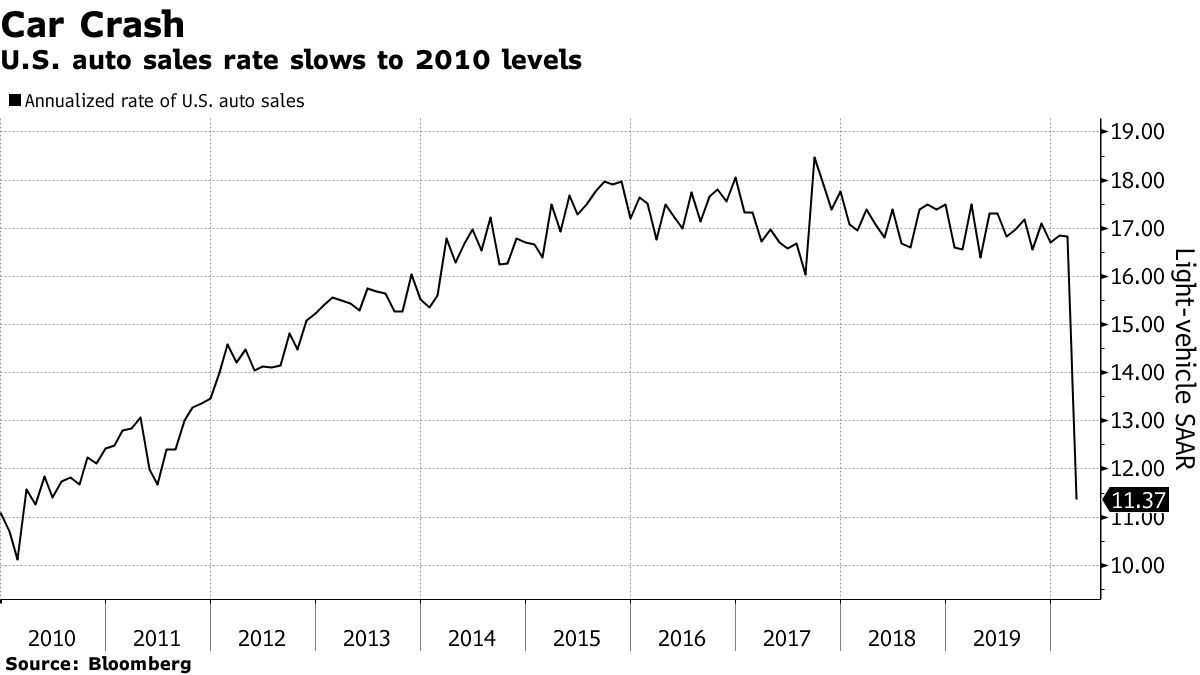

The collapse is coming as a result of used vehicle auctions grinding to a halt - along with the rest of the country - and vehicles piling up at places where buyers and sellers transact secondhand cars, according to Bloomberg.

A price drop in used vehicles could be another headwind for automakers and their lending units, which could be forced to write down the value of lease contracts that had previously assumed vehicles would retain more value. GM, for example, has $30.4 billion worth of leased vehicles on its books at the end of last year. Every 100 bps it has to raise its estimate for depreciation costs the company $304 million.

Joel Levington, a credit analyst with Bloomberg Intelligence said: "GM assumed a 4% decline in residual values this year. If the 10% drop Manheim has seen recently persists, depreciation expense could counter the $1.9 billion that GM Financial earned in pretax profit last year."

A similar headwind could be felt by rental car companies, who would likely get less money from selling their used fleet of vehicles, which are also sitting idly by as the pandemic paralyzes the nation.

Hertz, Avis and Enterprise have all sought help from the Treasury Department for loans, tax breaks and other types of support.

Hamzah Mazari, a Jefferies analyst, said: "For Hertz and Avis, every 1% increase in fleet costs saps about $20 million from earnings before interest, taxes, depreciation and amortization."

Dale Pollak, an executive vice president of Cox Automotive said: “Six months from now, there will be huge, if not unprecedented, levels of wholesale supply in the market. Cars are coming in, but they aren’t selling. Today’s huge supply of wholesale inventory suggests supplies will be even larger in the months ahead.”

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more