Global Partners: Still Serving As A Hedge For Our Portfolios

On Thursday, November 5, 2020, retail store and gasoline partnership Global Partners LP (GLP) announced its third quarter 2020 earnings results. This is a company that has generally provided us with a hedge against declines in crude oil prices because margins for gasoline stations usually increase when crude oil prices decline. The COVID-19 pandemic changed that though as it resulted in people being shut up in their homes and generally foregoing travel. We can still see the lingering effects of this in these results as volumes still remain rather depressed compared to a year ago, despite the third quarter usually representing the heart of the summer travel season. This certainly had a negative effect on the company’s revenues, which were down year-over-year and missed the expectations of the company’s analysts.

Image Source: Pixabay

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Global Partners’ third quarter 2020 earnings report:

- Global Partners reported total sales of $2.061382 billion in the third quarter of 2020. This represents a 36.49% decline over the $3.245653 billion that the company reported in the prior year quarter.

- The company reported a gross profit of $169.241 million in the most recent quarter. This compares rather unfavorably to the $187.769 million that the company reported in the year-ago quarter.

- Global Partners had total sales volumes of 1.4 billion gallons compared to 1.6 billion gallons in the equivalent period of last year. Thus, the company saw its overall sales volumes decline.

- The company reported a distributable cash flow of $31.3 million in the reporting period. This represents a 2.96% increase over the $30.4 million that the firm reported last year.

- Global Partners reported a net income of $18.192 million in the third quarter of 2020. This represents a 22.15 % increase over the $14.893 million that the company reported in the third quarter of 2020.

It is certainly not a surprise to anyone reading this that crude oil prices were substantially lower than what they were last year. As we can see here, West Texas Intermediate crude oil was trading for $55.17 per barrel a year ago compared to $42.17 per barrel today. This is a 27.04% decline over the period:

(Click on image to enlarge)

Source: Business Insider

This reduction in oil prices also had an impact on the price of refined products such as the fuels sold by Global Partners. This is because these products are sold based on crude oil prices plus a margin. This had an impact on Global Partners, which saw its sales decline fairly significantly year-over-year due to the lower overall fuel prices. However, the margin between crude oil and refined products prices normally increases whenever crude oil prices decline. This is why Global Partners generally sees its profits increase when oil prices go down. This is how the company can serve as a hedge for the crude oil producers or similar companies that we have in our portfolio since the spread between the two commodity prices essentially represents the company’s profit margin. This did indeed happen this time around too as the spread was higher in the third quarter of this year compared to the year-ago quarter. We can see evidence of this by looking at the fact that Global Partners’ gross profit held up much better than the company’s sales did.

At this point, some readers might point out that Global Partners still saw its gross margins decline despite the improvement in the spread. This is due mostly to the ongoing effects of the pandemic. Global Partners’ President and Chief Executive Officer Eric Slifka addressed this in the earnings press release:

“Global continues to perform well despite near-term uncertainties associated with COVID-19. Our vertically integrated portfolio of supply, terminaling storage, and retail assets are part of the basic infrastructure necessary to power everyday life and the movement of goods, services, and people across all of the markets we serve.

While the pandemic in the short-term has reduced fuel and in-store demand, our strong network and adaptability enables us to continue executing on our strategy while remaining focused on taking advantage of opportunities in the market to grow our business organically and through acquisitions. Throughout our network we are taking steps to increase our flexibility to move renewable fuels and diversify our offerings to serve increasing demand for those products.”

In short, the COVID-19 pandemic resulted in governments throughout the United States curtailing travel and essentially quarantining large swathes of their populations. While things were much more open in the third quarter than in the second, many people have still been reacting in fear of the virus and have chosen to stay at home when they might otherwise travel. This, combined with the increasing emphasis on working from home, generally resulted in lower demand for gasoline than what we usually see due to the fact that people are driving less. This is evident by looking at the company’s volumes. As noted in the highlights, Global Partners sold 1.4 billion gallons across all of its channels in the third quarter compared to the 1.6 billion gallons that it sold over the same period last year. This reduction in sales had a negative impact on the company’s revenues during the period. This makes a great deal of sense since the company sold fewer items to generate revenues and profits from. The reduction here was enough to offset the positive impacts of the higher margins.

As we discussed before, the largest proportion of Global Partners’ profits and cash flows comes from its network of retail gasoline stations and convenience stores, which are mostly located throughout New England and the Mid-Atlantic. As might be expected, this operation was greatly impacted by the reduction in travel that the pandemic inflicted upon the nation. Global Partners notes that fewer people than usual visited its gasoline stations and convenience stores, many of which are located on major thoroughfares. This business unit saw its segment product margin (akin to gross profit) decline to $158.9 million in the third quarter of 2020 compared to $168.7 million a year ago.

In addition to its network of gasoline stations and convenience stores, Global Partners operates as a midstream company. Through what it calls its wholesale unit, Global Partners transports refined petroleum products, renewable fuels, crude oil, and propane by rail, barges, trucks, and pipelines. As is the case with most midstream companies, Global Partners provides these transportation services to its customers under long-term contracts. The company also provides these services under spot contracts, which is rare for a midstream operation. This division of the company earns its wholesale designation by the fact that it sells unbranded gasoline, home heating oil, propane, and other refined liquid products to distributors and retailers. This business unit also delivered somewhat worse performance than last year, with segment margin declining to $27.6 million compared to $34.2 million a year ago. This decline was blamed on weakness in the overall market for gasoline and gasoline blendstocks. Global Partners does not go into any more detail than this but it seems likely that the same pandemic-related problems that resulted in weakness across the company’s own network of gasoline stations was the biggest cause of problems here. This is that the overall demand for these fuels was lower because people were not traveling as much as thus retailers and distributors would not be buying nearly as much fuel from wholesalers like Global Partners.

Finally, Global Partners operates as a distributor of gasoline on its own through its commercial segment. This business unit sells and delivers gasoline and other liquid refined products to public sector entities as well as large industrial and commercial users. It would make sense for this business unit to have also been impacted by the pandemic as non-essential businesses were generally shut down during the second quarter. While many of them were allowed to be reopened in the third, we do continue to see entities like schools and factories suffer temporary shutdowns whenever a COVID-19 infection is suspected. This was indeed the case as this segment reported a segment product margin of $2.8 million during the quarter compared to $7.2 million a year ago. This was by far the largest decline in percentage terms of any of the company’s businesses but since it is also by far the smallest, the decline did not have an outsized effect on Global Partners’ overall performance.

It seems quite likely that the next few quarters will be somewhat weaker for Global Partners than this most recent one was. This is not at all atypical because driving and other travel, and thus the demand for gasoline, is usually lower during the winter months than it is during the summer. In addition to this, Global Partners faces another risk this year in the form of the COVID-19 pandemic. The nation has begun to see an increase in the number of COVID-19 cases recently, which has already prompted the governors of some states, including states in Global Partners’ footprint, to reinstitute lockdowns. Admittedly, although these lockdowns have thus far been less extensive than the ones that we saw last spring, it remains to be seen if more harsh measures will be implemented if conditions fail to improve. In addition, we have seen many governors discourage people from traveling during the holiday season. Even in the absence of these orders though, it seems that people would be less inclined to travel than normal simply out of fear of the virus. This will likely have a negative impact on gasoline demand and thus Global Partners’ profits. It seems likely that the company’s results will be worse than normal on a year-over-year basis for the next few quarters at least.

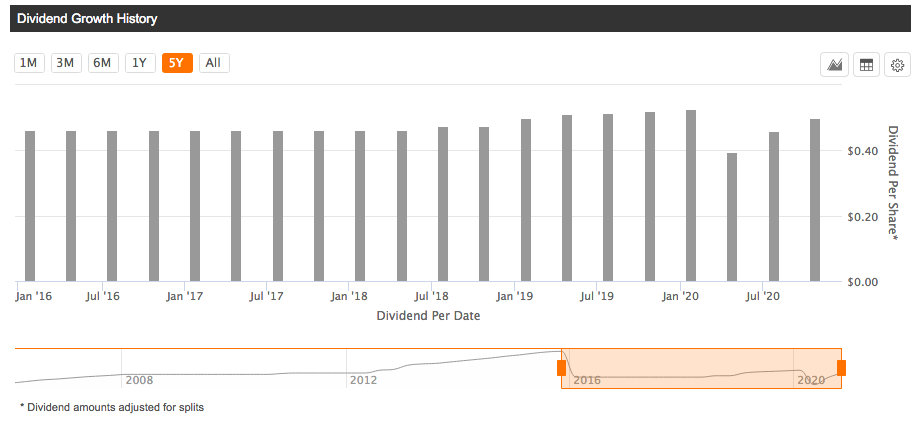

In the aftermath of the lockdowns last spring, Global Partners disappointed many investors by reducing the distribution that it pays out. This was a reversal from the company’s history of maintaining or increasing its distribution every quarter. Fortunately though, it has since begun increasing it again, which is better than what many other master limited partnerships have done:

(Click on image to enlarge)

Source: Seeking Alpha

Global Partners declared a distribution of $0.50 per unit for the third quarter of 2020, which the highest level that it has had this year but it is still less than the $0.525 per unit that the company paid out in the fourth quarter of 2019. As is always the case though, we want to make sure that the company can actually afford this distribution. The way that we do this is by looking at the company’s distributable cash flow, which is a non-GAAP measure that theoretically tells us the amount of money that was generated by the company’s ordinary operations that is available to be distributed to the limited partners. As noted in the highlights, Global Partners had a distributable cash flow of $31.3 million in the most recent quarter. The company had 33.924 million weighted average basic common units outstanding during the period so this distribution will cost the company approximately $16.962 million. As we can clearly see then, Global Partners does appear to easily be able to cover its distribution this quarter. As already discussed though, the future could prove to be somewhat uncertain as we do not know to what extent another round of pandemic-driven lockdowns and resulting lower demand for travel could have on the company.

In conclusion, Global Partners does continue to serve as a hedge in our portfolio against the impact of lower oil prices. The company has still seen itself impacted by the COVID-19 pandemic but the overall impact has been much less than what we have seen in many other companies in the industry. The biggest problem here is that the pandemic has reduced the demand for travel and by extension for gasoline. The company has still managed to increase its distribution over the course of it thus far, which is very nice but we have no real way of knowing what the future may bring. Overall, there are definitely some risks here but it would still be a reasonable way for an income-focused energy portfolio to reduce its volatility and risk.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to ...

more

G.P. has a lot to be thankful for even though profits may not have been as great as hoped or predicted prior to this plague. A profit is better than a loss in the vast majority of situations. Those making some profits today should still be around to make better profits next week. It is those making only losses that will not be around to participate.

Yes, $GLP is a good hedge.