Global Blockchain Tech: Promising Blockchain Infrastructure Play

TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

While Bitcoin passes the $8,000 mark and grabs all the media hype, not many opportunities exist to invest directly in the companies providing the tools for cryptocurrencies. One new on the scene way to play the underlying blockchain technology is Global Blockchain Technologies (BLKCF).

The small company just completed a large equity offering and ironically hasn't seen any surge due to the involvement in cryptocurrencies and related technologies. Is the market missing out on an opportunity or is this stock too risky for an investment?

Cryptocurrency Surge

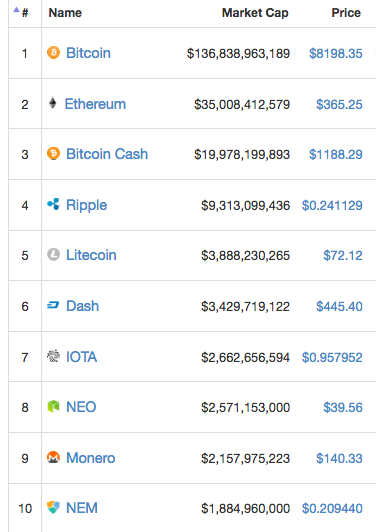

In the last year, Bitcoin and several other cryptocurrencies have soared in value. The top cryptocurrency hit $8,000 last week after starting the year below $1,000. Bitcoin has hit new price milestones nearly every month this year.

The market caps of these currencies have soared in value with the top three cryptocurrencies approaching a value of nearly $200 billion.

Source: coinmarketcap.com

Currencies like Ethereum and Bitcoin Cash have increasingly gained attention while token or ICO (initial coin offering) sales have gained momentum. The common theme is investors betting that these currencies will gain in value and prominence.

These coins, though, don't allow investors to invest in companies that are utilizing the cryptocurrencies or underlying blockchain technology. People buying Bitcoin are investing in the gold rush, but not the shovels and picks used to dig for the gold that offered solid returns at less risk.

Blockchains are being reviewed for the use in numerous financial transactions to even voting records. The State Bank of India is testing smart contracts next month that utilize blockchain technology with a consortium of 27 banks while various other firms see potential in blockchain to bring online voting to the mainstream after utilization in smaller elections.

Most companies are exploring opportunities in blockchain technology whether the corporation believes in the staying power of cryptocurrencies.

Enter Global Blockchain Tech

Global Blockchain Technologies recently entered into the picture. The Canadian investment company was founded by experts in the blockchain and cryptocurrency ecosystems with a goal of creating a vertically integrated investor in blockchains and digital currencies.

The company plans to give investors access to a cryptocurrency mining division that was recently founded along with blockchain startups and investments in crypto holdings like Bitcoin and other undervalued cryptocurrencies and ICOs. The best part is that investors get to purchase at prices below the recent initial offering.

Global Blockchain recently raised up to $50 million in a stock offering. The company sold 15.7 million shares to underwriters at $2.55 per share for $40 million. The deal offers an over allotment of an additional 3.9 million shares that would raise an additional $10 million. The deal offers a sweetener to entice institutional investors in the form of warrants at $3.50 per share with an exercise period of 24 months.

The deal isn't set to close until the end of November so the company doesn't have this cash to invest yet. The investment thesis is mostly based on the projections of the company. Not to mention, the recent rise of Riot Blockchain (RIOT) shows the demand for investing in technology in the sector.

Riot Blockchain announced some strategic investments in blockchain technology including an investment in Verady that is focusing on accounting and audit standards. As the market became more familiar with the stock, Riot soared nearly 100% this month on this news. The company has similar intentions as Global Blockchain Tech to invest in blockchain technology and cryptocurrency mining.

Investing in Global Blockchain is partially a bet that Chairman Steve Nerayoff and CEO Rik Willard can use past experience in this field to reward shareholders. The company will have the ability to invest in firms not available to small investors though some of the coin investments can be made by individuals though that remains a small part of the corporate goals that will diminish over time as currencies stabilize in future years providing less ability to invest or trade for profits.

Investment though isn't based only partially on the management team. Backgrounds in the sector are no guarantees of success.

New Mining Division

One area where Global Blockchain had already made an investment is in the cryptocurrency mining area. The company acquired 49% of CoinStream for 3.8 million shares or what amounts to about $8 million in current value.

CoinStream plans to be the first ever cryptocurrency streaming company in the world with access to low cost power in Manitoba, Canada. The company will fund partners by providing $10 million in capital with a retained ownership in the equipment for the payment of mined Bitcoins.

The cryptocurrency streaming company gains access to 2,500 bitcoins per year for the next five years at a cost of $1,000 per bitcoin. The proposed deals have other restrictions based on the price of Bitcoins and offers the flexibility to adjust the mix of the cryptocurrency if another digital currency offers a better return.

The deals, in essence, provide partners with the capital for equipment needed to start or expand operations and money to cover operating costs. CoinStream diversifies operations and collects the upside gains based on the market price of Bitcoin while taking on the risk of fluctuating prices. The current $8,000 price provides a stream of $100 million in future coins.

As well, the company made a small investment in Distributed Mining Inc. The blockchain software company is working on a network of connected devices such as game consoles that would provide the computing power for optimized cryptocurrency mining. Just another way to participate in the growth of cryptocurrencies that small investors wouldn't have an ability to invest.

Inherent Risks

Investing in a new concept has inherent risks. Cryptocurrencies could turn into a fad that disappears over the next few years. Not to mention, Global Blockchain Tech has limited operating history to prove that the new management team can effectively invest the money recently raised even if digital currencies or blockchain technologies explode in popularity.

As did Riot, Global Blockchain took over a previously public company, Carrus Capital Corporation, starting in October. As well, a new management team was formed at that time. For these reasons, Global Blockchain has no reported history by which to judge an investment. Any analysis of cash burn would be based on the limited old corporate structure and prior to the major capital raise.

What the company will have is some $50 million in cash to invest in the blockchain field and a start investing in cryptocurrency mining with plans to utilize the other funds for venture-type investments in either digital currencies or blockchain startups. One way to view the company is similar to blank check company were money is raised with the promised intention of investing in the intended filed.

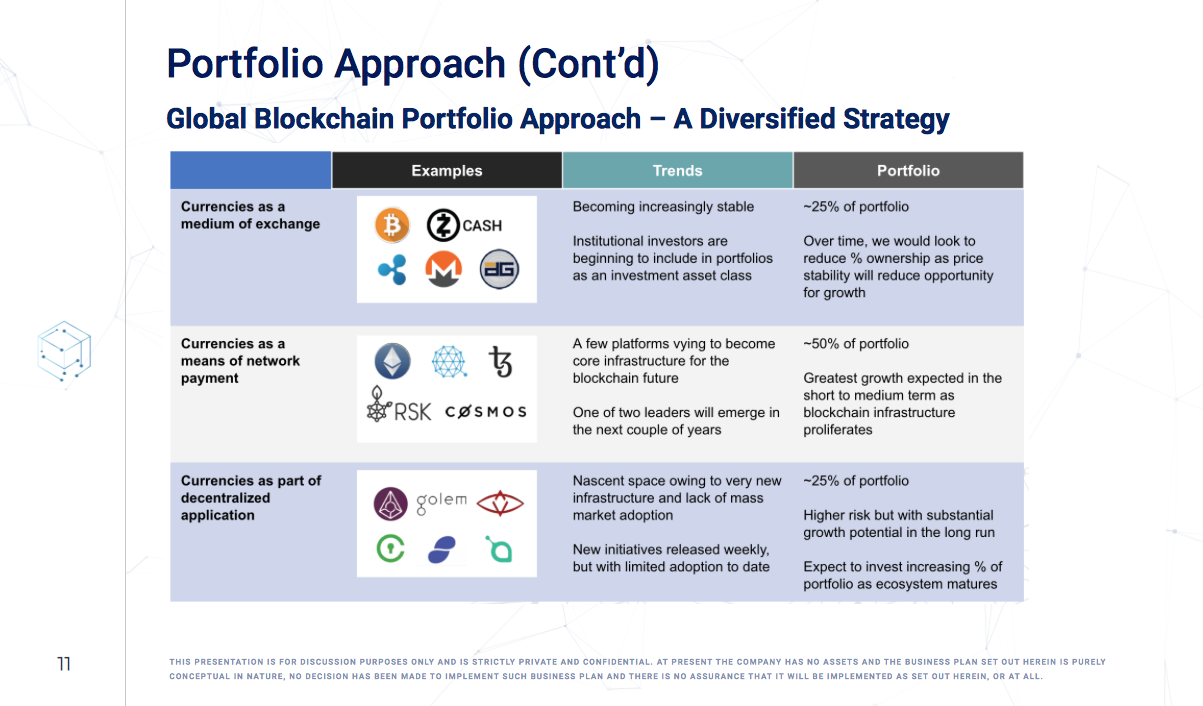

Per the corporate presentation, Global Blockchain intends to invest a large portion of the raised funds in blockchain infrastructure and ecosystem plays. In this matter, an investment is a bet that the company can identify an early stage play in the sector that emerges as a leading technology or platform for blockchain. This strategy is inherently a high risk/return set up.

Source: Global Blockchain Tech presentation

Takeaway

The key investor takeaway is that Global Blockchain has limited operating history and cash only now headed into the bank account making an investment similar to a blank check company. Investors have to believe in the sector and management team or likewise follow the progress of the company until confidence is gained to make an investment.

The risks are large and the stock could easily trade highly volatile as the market becomes familiar with "blockchain" in the name. Investors must be willing to accept capital loss, especially before seeing quarterly reports on the cost structure and how the company invests the up to $50 million raised in the recent offering.

At the least, anybody interested in the sector should keep an eye on this stock as developments in the sector could lead to an attractive investment opportunity in the somewhat overlooked infrastructure plays.

Disclosure: No positions held.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell ...

more