Giant Bulls Are Born Big

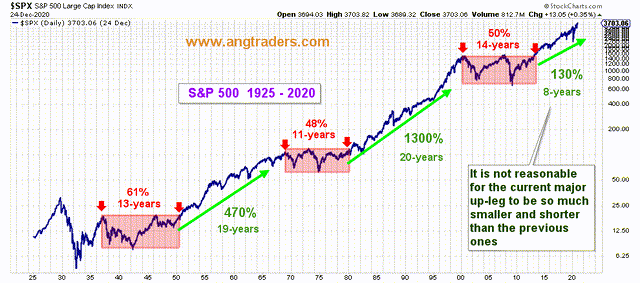

There have been two giant bull markets in the last 100 years. Each giant was born out of an already elevated market that had been range-trading for an average of 12 years, and the individual rallies within each of the giant bull markets started from an even higher level than before. Price itself does not determine the end of a bull market; giant bull markets rise higher than the majority believe possible ... fear makes sure of that.

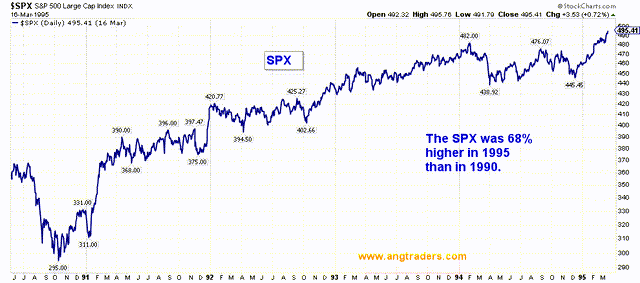

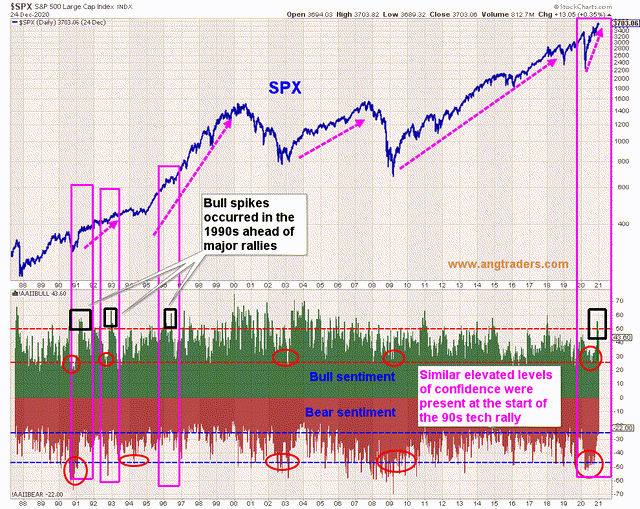

To illustrate, take a look at the market as it was in 1995 (chart below).

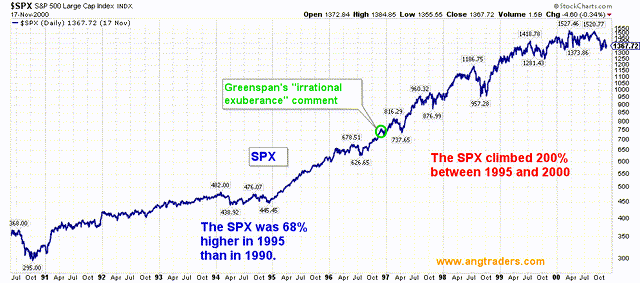

The SPX had increased by 68% in the four-years leading up to 1995. That was a record high level which produced screams of "market top" everyday, including Greenspan's infamous "irrational exuberance" comment in 1996. Of course, along with the fear and doubt came a 200% rise in the price of the SPX over the next 5 years (chart below).

The first ten years of the 1980-2000 bull market saw a 350% growth in the SPX price, and over the 20-year life of the giant bull the market rose a staggering 1300% (see first chart above). We are in the early stages--a 130% rise over 8 years--of what we think is the next giant bull market. It is reasonable to expect another 10 years and several hundreds of percent increase in the price of the SPX before there is another extended range trading period.

The giant bull that started in 1980 was fuelled by a paradigm shift in communication technology. The current giant bull will be fuelled by clean energy technology and the associated physical infrastructure. The former was funded by bank credit and maintained by money-velocity (until the private debt could no longer be maintained). The current bull will be funded by government fiscal and monetary policy--at least at the beginning.

Is There Enough Fear?

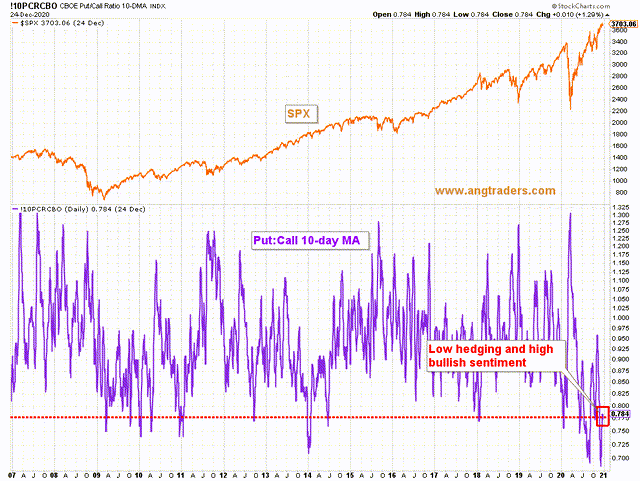

At first glance there seems to be too much complacency in the market. But sentiment is a relative measure; it depends on comparisons of different time frames.

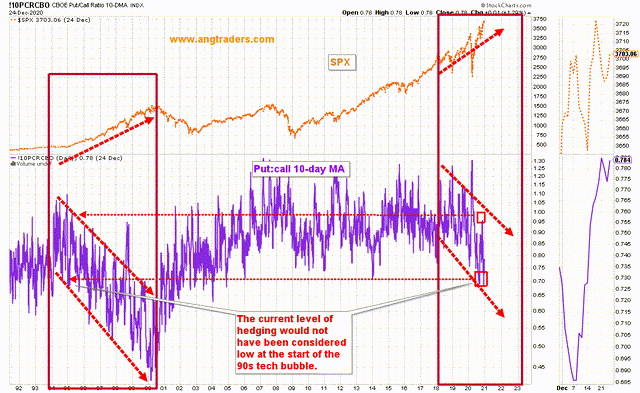

If we compare the 10-day MA of the total put:call ratio to the recent decade-and-a-half, it looks like sentiment is overly bullish and confidence is high (chart below).

But when we look back to the the 1995 period we see that there is room for a lot more optimism and a much higher market (chart below).

The AAII sentiment survey is also showing relatively elevated bullish sentiment, but here again we see that in the 1990s there were similar levels of bullishness ahead of the giant bull rallies (chart below).

Just because the stock market is at a relatively high level, it does not mean it can't go higher. The alternative energy and associated infrastructure should lead the giant bull market higher over the next several years.

Well, done.