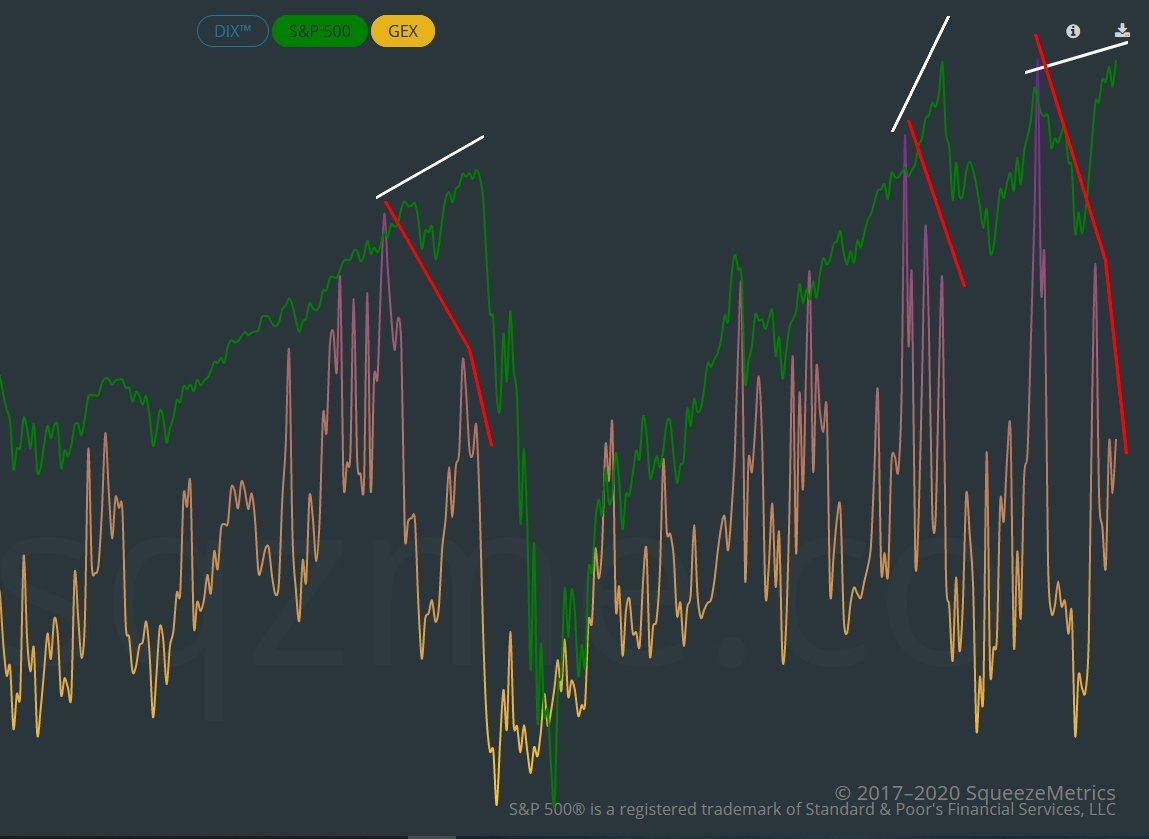

GEX Says Beware

The Gamma Exposure Index (GEX) has made some seriously large negative divergences coming into the recent highs. In a simple sense, this shows that net option positioning has turned more and more negative the higher the S&P500 has become. It looks remarkably similar to March. Are we in for a repeat?

(Click on image to enlarge)

If you would like to read more about the GEX, please click here.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!