Get In At The Bottom: Buy These 3 Stocks Starting To Rally

Recently oil prices have bounced from just over $40.00 a barrel for West Texas Intermediate (WTI) to almost $50.00 a barrel. This recent rally has boosted the performance of the beaten down and bedraggled energy sector in recent weeks. I continue to view the oil complex as too opaque to make an educated guess on which way crude will head through year end 2015 and into 2016.

On one hand, Saudi Arabia continues to pump full out to enforce its position as “swing producer,” maintain its market share and to punish Iran, Russia and to a lesser extent U.S. shale producers. In addition, the global economy continues to decelerate lessening demand for energy. Iran also should be returning to the worldwide oil market as sanctions are slowly lifted when the recent nuclear deal gets implemented.

On the flip side, oil rig counts are at the lowest level since the 2008/2009 recession in the United States and Russia’s recent escalation in Syria could roil markets or persuade Saudi Arabia to relent its full blown production.

In short, it is hard to ascertain the direction of oil over the next six months given the myriad, complex, and contrary forces at work in the oil market. My best guess is that crude remains parameter bound in a fairly loose range of $40.00 to $65.00 a barrel over the next half year.

I am remaining deeply underweight in both energy and commodity stocks given the lack of conviction in underlying prices as well as my concerns about how serviceable the levels of debt are in a good portion of these companies. Giant offshore services provider Transocean’s (NYSE: RIG) debt was downgraded to junk status on Thursday, something that is starting to happen throughout the energy sector as well as in commodity based exporters like Brazil.

However, the recent rise in oil prices has also boosted the stocks of tertiary plays associated with the price of oil but not as directly intertwined to its price as some investors believe. If oil rallies further, their shares should continue to benefit as sentiment grows more positive. Regardless, they should also be just fine earnings wise should oil head back down to $40.00 a barrel. I like the risk/reward of this strategy and it has started to pay off in recent weeks.

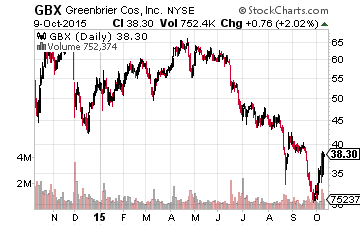

Let’s start with rail car maker Greenbrier Companies (NYSE: GBX) which has been unfairly punished due the perception that the company earnings will suffer as demand for oil tank cars dries up. However, some three-quarters of its huge order backlog is made up of non-energy sector demand. Its backlog is over 40,000 cars and near all-time highs, about two years of demand at current production rates.

The stock started to move up nicely last week as the company’s management raised earnings guidance for the year. Greenbrier also announced a new 1,200 rail car order from Saudi Railway Company. The stock is cheap at under seven times the mid-point of guidance for earnings in 2015. The shares also pay just under a two percent dividend.

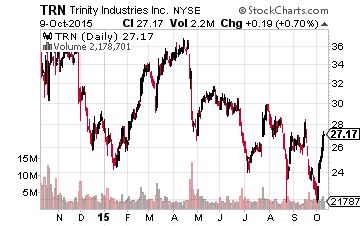

Trinity Industries (NYSE: TRN) is another rail car maker I have a smaller stake in. The company also builds barges, wind towers, and energy structures in addition to rail cars. The company just raised full-year earnings guidance for 2015 to $4.60 a share from around $4.30 a share. Trinity also has almost a $7 billion order backlog in its rail car division which is equal to about one year’s of annual revenues for the entire company.

This stock has also demonstrated recent strength. The shares are slightly cheaper than Greenbrier’s at six times this year’s projected earnings. Trinity also pays a tad higher dividend payout. The only reason I have this stock less heavily weighted than Greenbrier is it is working through a litigation issue concerning some alleged deaths due to some guardrails it manufacturers. This possible liability seems fully priced into the stock price at this point.

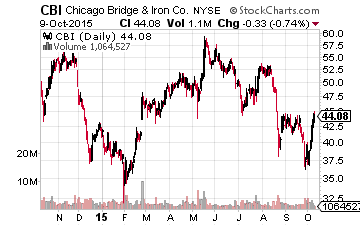

Finally, we have the giant energy construction firm Chicago Bridge & Iron (NYSE: CBI). The stock has been unfairly hurt by cost overruns at a nuclear complex it is a subcontractor on as well as a perception it will be hurt by the slashing of capital budgets at exploration and production companies.

However, most of the order demand the company sees from the energy sector comes from the mid and downstream sectors for facilities like refinery upgrades and LNG plants. Chicago Bridge & Iron has very little exposure to the challenged upstream sector. In addition, the company has a massive order backlog of $30 billion currently. This is more than two times annual revenues. Finally, the main contractor should bore most of any cost overrun settlement on the nuclear build. Earnings should increase a bit over 10% year-over-year in FY2015. The shares are still cheap even with the recent rally at under eight year’s 2015’s earnings projections, about half the overall market valuation multiple.

Regardless of whether oil is $40.00 a barrel six months from now or $65.00, these plays should prosper.

Disclosure: more