Gearing Up For Auto Tariffs? Revenue Exposure Might Be Useful

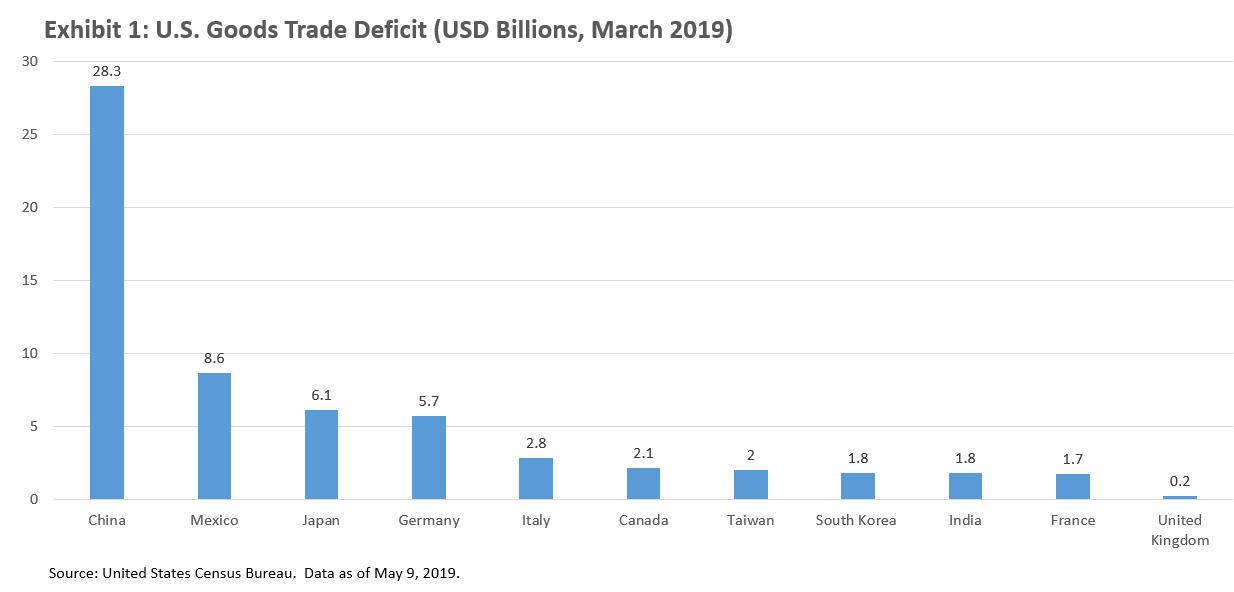

May was categorized by the return of macro fears. Many equities indices and fixed income indicators flashed red – and the S&P 500’s four-month win streak ended – as investors grappled with trade tensions and the potential impact on global growth. Adding to investors’ uncertainty, President Trump’s surprise month-end announcement of tariffs on Mexican goods raised fears that besides China, the U.S. may target other countries with which it has a large trade deficit, especially Japan and Germany (see Exhibit 1).

(Click on image to enlarge)

The perceived prospect of tariff contagion weighed on Japanese and German equities last month – the S&P Japan BMI (-6.5%) and the S&P Germany BMI (-5.6%) both fell in local currency terms. Against that background, we look at the potential impact of auto tariffs on car manufacturers in both countries. In Exhibit 2, we approximate that impact by comparing the U.S. revenue exposure of the Japanese and German Automobiles and Components industry groups.

Quite clearly, both industry groups have greater U.S. revenue exposure than their underlying broad-based indices, which may help to explain their performance in May: the S&P Japan BMI Automobiles and Components and the S&P Germany BMI Automobiles and Components indices plunged 10.9% and 13.0%, respectively, in local currency terms.

(Click on image to enlarge)

As with our previous studies on Brexit, the USMCA trade deal, and the 2016 U.S. Presidential election, understanding the geographic revenue exposures of various market segments can help to explain market performance. And should the recent flashes of red on many of our dashboards persist due to trade tensions, geographic revenue data may become even more important in offering market insights.

Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information ...

more