Garmin - Chart Of The Day

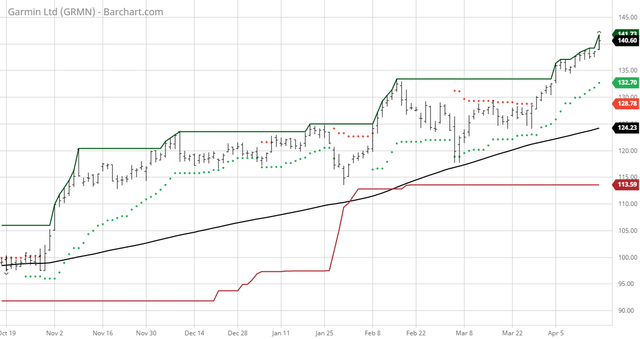

The Barchart Chart of the Day belongs to the technology company Garmin (NASDAQ:GRMN). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 3/29 the stock gained 8.18%.

Garmin Ltd. designs, develops, manufactures, markets, and distributes a range of navigation, communication, and information devices in the Americas, the Asia Pacific, Australian Continent, Europe, the Middle East, and Africa. Its Fitness segment offers running and multi-sport watches; cycling products; activity tracking and smartwatch devices; and fitness and cycling accessories. This segment also provides Garmin Connect and Garmin Connect Mobile, which are web and mobile platforms; and Connect IQ, an application development platform. The company's Outdoor segment offers adventure watches, outdoor handhelds, golf devices, and dog tracking and training devices. Its Aviation segment designs, manufactures, and markets various aircraft avionics solutions comprising integrated flight decks, electronic flight displays and instrumentation, navigation and communication products, automatic flight control systems and safety-enhancing technologies, audio control systems, engine indication systems, traffic awareness and avoidance solutions, ADS-B and transponder solutions, weather information and avoidance solutions, datalink and connectivity solutions, portable GPS navigators and wearables, and various services products. The company's Marine segment provides chartplotters and multi-function displays, cartography products, fish finders, sonar products, autopilot systems, radars, compliant instrument displays and sensors, VHF communication radios, handhelds and wearable devices, sailing products, entertainment, digital switching products, and trolling motors. Its Auto segment offers embedded computing models and infotainment systems; personal navigation devices; and cameras. The company sells its products through independent retailers, online retailers, dealers, distributors, installation and repair shops, and original equipment manufacturers, as well as an online webshop, garmin.com. Garmin Ltd. was founded in 1989 and is based in Schaffhausen, Switzerland.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 76.14+ Weighted Alpha

- 78.74% gain in the last year

- Trend Spotter buy signal'

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 9.60% in the last month

- Relative Strength Index 74.22%

- Technical support level at 139.12

- Recently traded at 140.60 with a 50 day moving average of 128.94

Fundamental factors:

- Revenue expected to grow 10.00% this year and another 8.00% next year

- Earnings estimated to increase .80% this year, an additional 11.00% next year and continue to compound at an annual rate of 6.37% for the next 5 years

- Wall Street analysts issued 2 buy, 10 hold and 3 under perform recommendations on the stock

- The individual investors following the stock on Motley Fool voted 4,128 to 415 that the stock will beat the market

- 18,450 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more