Freeport-McMoRan: A Bullish Bet On Copper Prices

Freeport-McMoRan (NYSE: FCX) has been affected by weak copper prices in recent months, but management is focusing on the long term and leading the company in the right direction. Importantly, the stock looks quite cheap at current levels, and there are reasons to think that copper prices could significantly improve going forward. In such a scenario, Freeport-McMoRan could offer substantial upside potential for investors.

Moving In The Right Direction

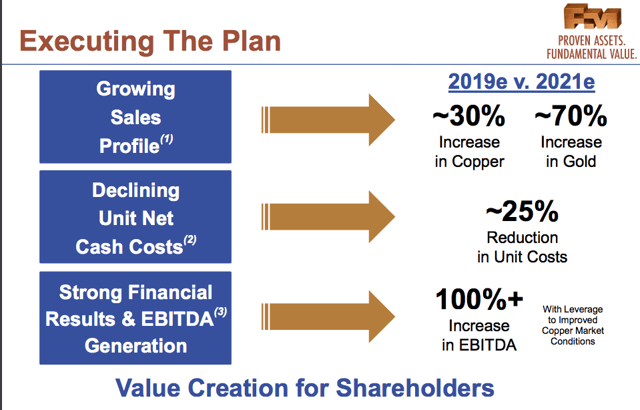

In spite of the difficult environment for copper miners over recent months, management remains focused on the long-term direction of the business. The company has ambitious plans to increase production, reduce fixed cost per unit, and substantially increase both earnings and free cash flows over the next few years. Management calculates that EBITDA could practically double if the plan is executed as expected.

(Click on image to enlarge)

Source: Freeport-McMoRan

This plan is based on 3 main initiatives: The Grasberg underground ramp-up, the commissioning of the Lone Star Project in Arizona, and the implementation of technology tools such machine learning and artificial intelligence to make operations more efficient and profitable.

Regarding the operations in Grasberg, much of the ramp-up is already completed, and management said in the most recent conference call that the company is seeing "very positive results". CEO Richard Adkerson expressed strong confidence in the company's ability to deliver on the ramp-up schedule.

In the Lone Star project, the company is within budget and on schedule to developing and mining oxide ores, and copper production is expected next year. The development is two-thirds complete, and there are new expansion opportunities that have already been identified.

Regarding new technologies, the company has tested these technologies in Arizona with "remarkable success" according to management. These technologies will be introduced in other mines in the Americas over the coming months in order to increase production and decrease cost without making major capital investments. Freeport-McMoRan aspires to add 200 million pounds of copper from these initiatives with very little capital investment in the near term.

Attractive Valuation

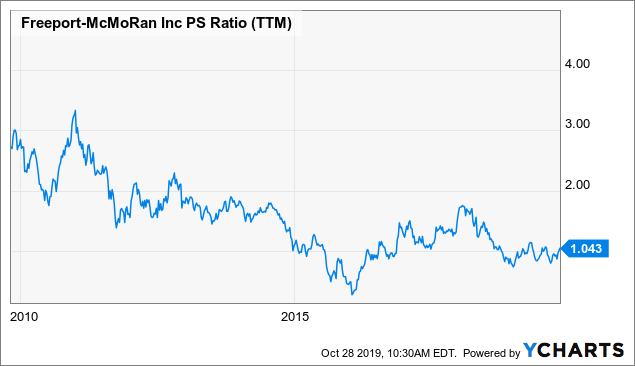

Freeport-McMoRan stock is very reasonably priced by historical standards, with a price to sales ratio currently on the low end of the valuation spectrum over the past decade.

(Click on image to enlarge)

Data by YCharts

For 2020, Wall Street analysts are currently forecasting $14.99 billion in revenue from the company, which would put the price to sales ratio at a remarkably attractive 0.98.

We can reverse-engineer the valuation levels in order to analyze some reasonable price targets for the stock. At $12.5 per share, Freeport-McMoRan would need to rise 22% from current levels. But this would still mean a fairly modest price to sales ratio of 1.1 for next year, a very reasonable and even conservative assumption to make.

This scenario is obviously based on current market estimates for the company, if copper prices improve in the coming months, upside potential would be much larger than what current assumptions are implying.

Long-Term Supply And Demand In Copper

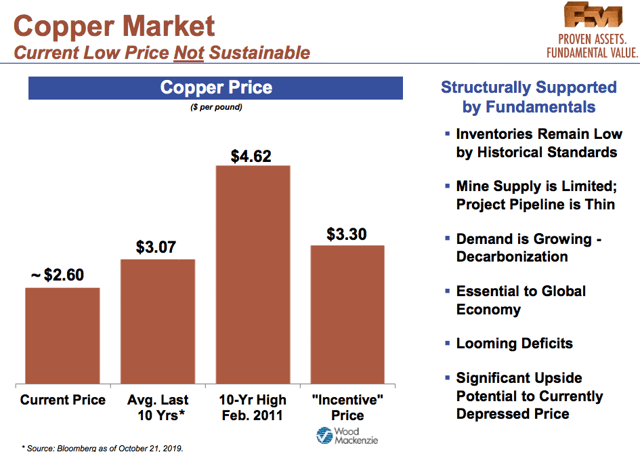

Copper prices have been materially affected by the trade war uncertainty and related factors such as the global slowdown in manufacturing activity. However, over the long term, copper is an essential necessity for key applications such as clean energy, electric vehicles, and all kinds of electronic products in general.

According to estimates by Wood Mackenzie, copper prices need to be above $3.3 per pound to incentivize new production. This would mean an increase of nearly 27% versus current levels.

(Click on image to enlarge)

Source: Freeport-McMoRan

From a fundamental perspective, copper prices depend on economic activity to a good degree, and this is always a source of uncertainty. But over the long term, the supply and demand dynamics look quite strong.

The Outlook For Copper Over The Middle Term

The chart shows the evolution of copper futures and positioning among different kinds of players in the futures market. Commercial hedgers (green line below) are typically the smart money in future markets. These kinds of traders are deeply involved in copper production, and they follow the supply and demand dynamics closely, so they understand where the market is going.

A long position among commercial hedgers in copper futures is generally a bullish indicator for copper prices, and commercial hedgers are now aggressively long the industrial metal.

(Click on image to enlarge)

Source: FinViz

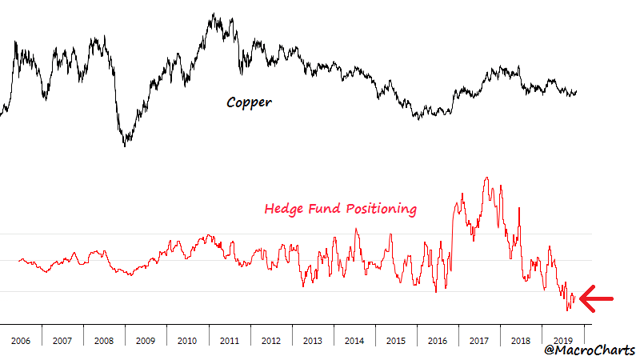

Offering a similar perspective, the chart from MacroCharts shows that hedge fund positioning in copper prices remains quite indifferent. From a contrarian perspective, this is a bullish factor to keep in mind. If copper prices start showing strength and hedge funds start jumping on board, there is plenty of buying power on the sidelines that could provide lots of upside fuel for copper prices.

(Click on image to enlarge)

Source: Macrocharts

In spite of all the negative news flow regarding the economic slowdown and the trade war, copper prices remain above key support levels in recent months. Commercial hedgers, meaning the smart money, have long exposure to the metal, and the more speculative traders in the market show no interest in buying whatsoever.

Considering these factors, copper prices have more upside potential than downside risk at these levels, which could be a powerful tailwind for Freeport-McMoRan stock.

Moving Forward

Freeport-McMoRan operates in a difficult industry with plenty of operational hazards. Both regulatory and legal risks are always major considerations for companies involved in mining all over the world. Since copper demand is quite sensitive to economic conditions, the global macroeconomic risk is a key variable to keep in mind when analyzing a position in Freeport-McMoRan.

Those risks being acknowledged, the company is making significant improvements in key areas, and the stock is fairly attractively valued at current prices. Over the long term, the supply and demand equation for copper looks quite strong, and there are reasons to believe that copper prices could offer substantial upside in the middle term. If this happens, Freeport-McMoRan stock would benefit in a big way from an upside move in copper prices.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FCX over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more