Four Stocks To Buy For Growth, Value, And Yield

Invest in these four stocks for capital appreciation and an accelerating income without risking your cash to over the top downside risk. These safe dividend paying stocks should produce high single-digit returns this year even if the broader market goes nowhere.

The market staged a remarkable comeback to close the first quarter after its horrendous start to the year. However, it is hard to believe that equities will see this rally continue in any significant way given the current global environment.

Stocks are selling at slightly higher than historical valuations based on a variety of metrics. Unfortunately, investors cannot count on multiples expanding so we will have to look to earnings growth for any substantial rise from these levels. Unfortunately, the prospects of that look unlikely at this point.

When earnings soon come rolling in for the first quarter, it will likely show the fourth straight quarter that profits from the S&P 500 (SPY) have shrunk on a year-over-year basis. With global economic activity still at its lowest levels since 2009 and global markets seemingly depending more on major central banks’ continued largess than organic demand, I believe caution is warranted here.

That does not mean there are no bargains to be had in this market. Most of my “dry powder” is going into large cap stocks that have three qualities. They are cheap. They can show earnings and revenue growth despite a tepid global economy. They all pay decent dividends to boot. In what I think will remain a market that will end flat or slightly down for 2016, hitting consistent singles will lead to outperforming the overall market this year.

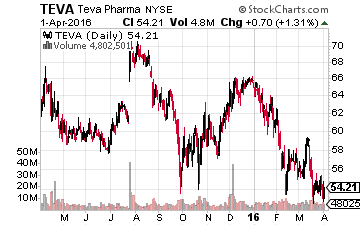

Let’s start with Teva Pharmaceuticals (NYSE: TEVA). The company is the largest generic drug manufacturer in the world. The company is digesting its acquisition of Actavis, the former generic drug business of Allergan (NYSE:AGN), which it bought for some $40 billion last year. This will cement Teva as the market share leader for generic drugs.

In addition, the company has a rapidly growing specialty drug business led by its multiple sclerosis drug Copaxone. Shares are down some 25% from their 52-week highs, but the stock has been unfairly punished party due to the fallout around one-time market darling and now pariah Valeant Pharmaceuticals (NYSE: VRX). The company’s business models could not be more different, and Teva has a fortress balance sheet. The company should post five percent earnings growth this year which will accelerate to 10% next year as it integrates its Actavis purchase. The stock is too cheap at 10 times earnings with a yield of 2.5%.

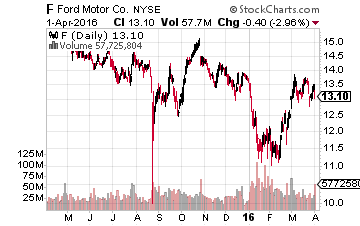

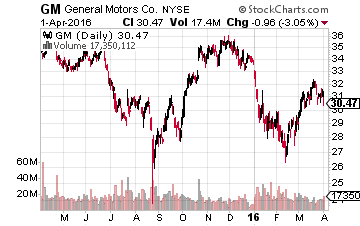

I still like automakers. Ford (NYSE: F) and General Motors (NYSE: GM). Outside of a domestic recession, which I don’t see in the cards, it is hard to believe these stocks can stay this cheap given their large dividend yields. Both companies are benefiting tremendously from low gas prices which is leading consumers to buy much higher-margin trucks and SUVs instead of fuel-efficient mid-size cars. 2015 was a record year overall for vehicle sales in the United States.

Ford and General Motors continue to take market share in China through joint ventures. The Middle Kingdom has now become the largest auto market in the world. Even the prospects for lower losses from European operations seem likely as auto registrations on the continent are growing.

General Motors is the slightly cheaper of the two auto makers. Its stocks goes for just six times earnings. Profits should grow in the high single-digits both in FY2016 and FY2017 and the company has crushed earnings expectations each of the last three quarters. The shares yield nearly five percent as well so even if the stock does nothing for the rest of the year, the investment will probably beat the returns of the overall market thanks to those dividend payouts. Ford is slightly more expensive at just over seven times earnings and yields 4.6%. Both are good bets to beat the market in 2016.

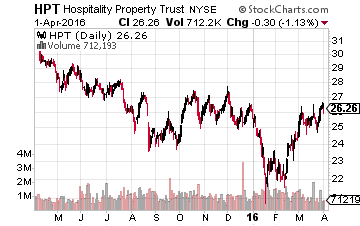

I continue to like the lodging real estate investment trust (REIT) sector. Some of these names have come down 25% or more on the spike in volatility in the high-yield credit markets early in the year and fears the domestic economy will be in recession by the end of the year. I recently picked up some

Hospitality Properties Trust (NYSE: HPT) for the income part of my portfolio.

The company is geographically diversified, owning near 300 hotels in some 40 states and almost 200 travel centers in 45 states and Canada. Stifel Nicolaus just launched coverage on this name with a Buy rating. The most attractive feature about owning Hospitality Properties Trust is its almost eight percent dividend yield.

The REIT is seeing solid revenue and earnings growth. FFO (Funds from Operations) should grow some 15% year-over-year in FY2016 on a revenue increase in the high single-digits. The stock sells for less than seven times forward FFO, way too cheap given its growth and high dividend yield.

None of these selections are going to be home run stocks, but it is hard to see much downside at current levels. Decent capital appreciation with a nice dividend yield looks like winning combination in a sideways market.

Disclosure: Long ...

more