Forecasting Market Caps And Aggregate Dividends

We have been experimenting with using a company's market capitalization and its expected forward year aggregate dividends to forecast the future for both.

We have been experimenting with using a company's market capitalization and its expected forward year aggregate dividends to forecast the future for both.

Why these measures, instead of say the company's share price and its expected future dividends per share?

In a nutshell, we chose market cap and aggregate dividends as a way to potentially work around the impact of share buybacks on these more common financial metrics. Because buybacks reduce a publicly-traded company's outstanding number of shares, they can artificially inflate common financial metrics that are linked to its number of shares. That impact can give investors a misleading picture of the relative value of a company's financial metrics, especially when compared with its historic data.

Focusing on a company's market cap and its aggregate dividend payouts could potentially remove the effects of the artificial impact by share buybacks, providing a clearer picture of whether a company itself might be either over- or under-valued in the current market environment.

In our experiments, we've been working with General Electric (NYSE: GE) because the company has been forced to execute dividend cuts that would be expected to reduce its share prices, even as it has been actively engaged in share buybacks during much of the past 10-11 years. The chart below shows the results of our initial cut at using GE's market cap combined with changes in the expectations for the company's future aggregate dividends to forecast where both these measures might end up, along with the data of where it did end up.

Using the historic relationship between GE' market cap and its aggregate forward year dividends, we found we could easily project where these measures might go once GE implemented a drastic dividend cut, which it did on 30 September 2018. But as you can see from this chart, this method set the target range far too low.

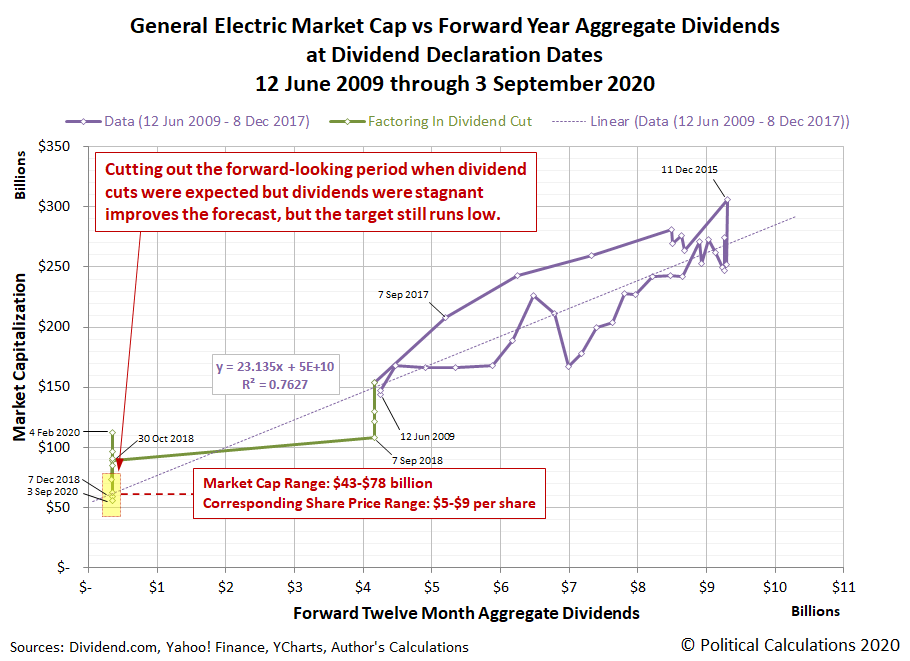

We next opted to tweak this approach and project the future for GE's market cap based only on the portion of the historical data where GE's 30 September 2018 dividend cut was not yet under consideration. The results of that exercise are shown in the next chart.

Here, we found that by eliminating the portion of the historical data that didn't include any of the expectations for GE's last dividend cut, we could improve our results. But not by very much, as it turns out. The projected target range is still set too low compared with where GE's market cap has ranged since its 30 September 2018 dividend cut.

We wondered what might happen if we drew a couple of parallel lines to the main trend line to correspond with the relative position of the highest and lowest market caps that GE has recorded since June 2009. The third chart below shows that result:

We see the upper half of the range we get for potential values for GE's market cap "fits" pretty well with the actual level that the company has recorded since its 2018 dividend cut. Meanwhile, that same upper half corresponds with the levels GE's market cap has recorded since 2015. This observation suggests recent market cap and aggregate dividend historic data may be more relevant for projecting the future.

That latter results suggest we may be onto something better than throwing random darts at a moving dartboard, so we're going to try this method out with a different stock - one that may be acting to cut its dividend in the relatively near future, like GE back in 2018. We'll present the results of that rough experiment in upcoming weeks.

Image source: Photo by Hulki Okan Tabak on Unsplash

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more