Ford Dividend Analysis: Attractive 6.6% Yield, But A Recession Could Spell Trouble

Some investors are very focused on owning stocks with very high dividend yields. The attraction to high yields makes sense as they provide shareholders with a much higher income than do lower-yielding stocks. You can see our full list of stocks offering at least a 5% dividend yield here.

Investors do need to be careful when choosing to purchase stocks with higher yields, as this is sometimes a warning sign that the company is facing difficulties that could result in a reduction of the dividend payment down the road. If the reason for investing in a particular stock is due to income needs, a dividend reduction could be devastating to the investor.

High-yielding stocks might be seeing earnings growth slow down or decline. At the same time, high-yield stocks that are struggling to grow earnings are at risk of cutting their dividend if the business fundamentals deteriorate. Therefore, investors need to look past the high dividend yield and examine the company’s business model to determine whether the dividend is sustainable before making an investment decision.

This is particularly important if a recession hits the U.S. economy. Increasing a dividend during a period of growth is one thing, but being able to maintain payments to shareholders during a severe economic downturn shows that the company’s business is able to withstand a recessions.

Ford Motor (F) stock has a high dividend yield of 6.6%, which is very attractive for income investors. But while the dividend appears sustainable today, it could be in trouble should the U.S. economy enter a deep downturn.

Business Overview

Ford was founded by Henry Ford and 12 others in 1903. Ford was very interested in understanding how machines worked from a very early age. At the age of 12, he began working in a small machine in Michigan. By 15, he built his first steam engine. By the late 1890s, Ford completed the first Ford engine, a one-cylinder gasoline model, in the kitchen of his Detroit home. The Quadricycle, which used a later version of this original engine strapped to four bicycle wheels, would become Ford’s first car. The first Ford car sale occurred on July 15th, 1903.

The company’s famous Model T went into production in 1908. The car was very affordable and durable. Because there were fewer than 18,000 miles of paved road in the U.S. at the time, Ford used a light and strong steel alloys for important components so that the car could withstand the bump and grind of primitive roads. Mass production allowed Ford to market the car to the masses, helping the company to sell more than 15 million units through 1927 when production of the Model T ended.

Today, Ford is one of the world’s largest automakers and is the second-largest domestic automaker. The company operates a manufacturing division, which produces popular cars, like the Mustang, trucks, like the F-150 and SUVs, like the Explorer, and a financing division. Ford trades with a market capitalization of $35 billion and generates $148 billion in annual revenues.

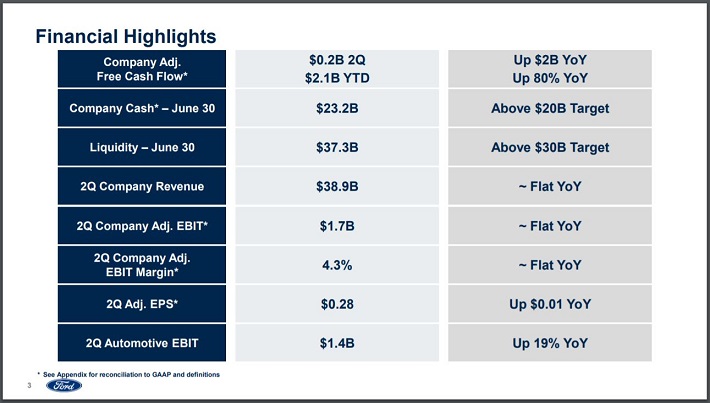

Ford reported second-quarter earnings results on July 24th, 2019.

(Click on image to enlarge)

Source: Ford’s Second Quarter Results Presentation, slide 3.

Revenue of $38.9 billion was flat year-over-year, though this was higher than the average analysts’ estimate. The company’s adjusted earnings-per-share was $0.28 for the quarter. This was $0.03 below expectations, but a 3.7% increase from the previous year. Gains in pricing and volume and mix were more than offset by foreign exchange, which reduced revenue results by more than 3%.

Automotive earnings before interest and taxes, or EBIT, increased 19% to $1.4 billion, the second consecutive quarter of growth. This marks the first time in three years that EBIT has shown growth in back-to-back quarters. EBIT margins of 4.3% were flat from the prior year.

Improvements in EBIT were primarily due to strength in North America. EBIT for this region was $1.7 billion, down slightly from last year’s $1.8 billion results. Wholesale sales were lower by 7%, but vehicle mix and pricing were strong. This region had lower volumes for the new Ford Explorer and Police Interceptor models while the Lincoln brands performed very well during the quarter.

The F-Series pickup truck was the top selling truck in its market. Ford benefited from lower incentive spending, helping to increase revenues for the product group. Total pickup sales were the best they had been since 2004. New SUVs, notably the Expedition, EcoSport and Edge, were up 14%.

Europe posted negative EBIT in last year’s second quarter, but produced $53 million this quarter. This was the first improvement in profitability in two years. The company’s Transit model had a quarterly record profit, increasing 2.7% from the second quarter of 2018. Ford plans to launch a Transit Hybrid model later this year and an all-electric Transit is set to launch in 2021.

China EBIT loss improved from a loss of $328 million last year to a loss of $155 million. Consolidated revenue improved 48%, due to higher demand for the Lincoln brand. Retails sales were up 13% from the first quarter of 2019. Dealer inventory was at extremely low levels. The company’s new Territory SUV has been the best-selling Ford SUV in China this year.

Growth Prospects

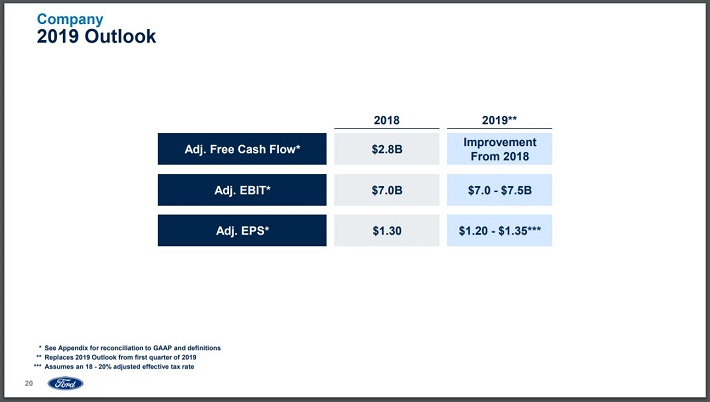

Despite multiple potential headwinds, including a slowing global economy and margin pressures, Ford sees the potential for growth across multiple key metrics this year. And, the company expects 2019 to be another highly profitable year.

Ford’s guidance for 2019 is as follows:

(Click on image to enlarge)

Source: Ford’s Second Quarter Results Presentation, slide 20.

Adjusted EBIT is expected to be flat to up 7% while cash flows should also improve. The midpoint for adjusted earnings-per-share is $0.02 below last year’s result.

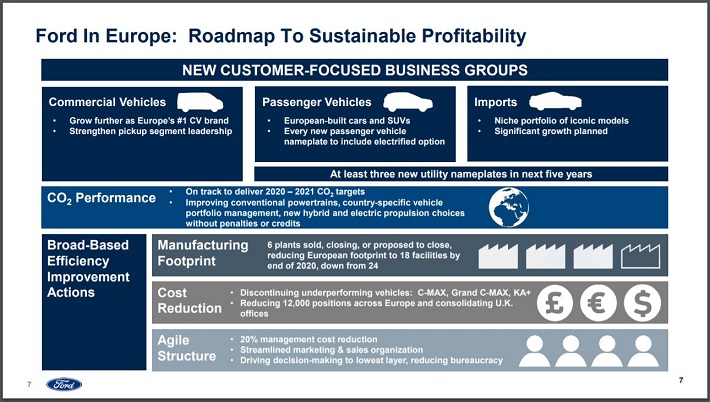

Ford is in the process of restructuring its business in certain regions, most notably Europe.

(Click on image to enlarge)

Source: Ford’s Second Quarter Results Presentation, slide 7.

In order to manage costs, Ford in the process of closing or selling six of the company’s 24 facilities in Europe. The company is also discontinuing unpopular brands C-MAX, Grand C-MAX and KA+. This will reduce Ford’s employee headcount by 12,000 people across the region. The goal of this restructuring is that Ford will be able to return to growth in Europe after several years of difficulties.

While quarterly results were decent and Ford saw some improvements in regions where they had previously struggled, not all was good for the company.

The company’s market share worldwide was 6.2%, a drop of 50 bps from the same period a year ago. This year-over-year decline was due to a 9% decline in wholesale units. Almost every region that Ford operates saw a drop-in market share, with North America market share down 20 bps to 12.8% on 7% lower wholesale units.

China market share dropped to 2.3% due to a 32% decrease in wholesale volumes. The company’s European market share declined 20 bps to 6.7% despite a 3% increase in wholesale volumes. These gains in Europe volumes were offset by a 1% decline in revenue for the region. The only region to increase market share was the Middle East/Africa, which was up 50 bps to 3.1% although revenue was lower by 26% during the quarter.

Surrendering market share is something that investors should keep an eye on as it is quite possible that this will only worsen during a recession. When that happens, Ford’s dividend could be at risk.

Dividend Analysis

Despite a nearly 7% dividend yield, Ford’s dividend history leaves a lot to be desired. Leading up to the last financial crisis, Ford cut its dividend by 38% from $0.40 in 2005, to $0.25 in 2006. The company eliminated its dividend the very next year as the automaker suffered severe declines for both revenue and earnings-per-share.

Listed below are Ford’s adjusted earnings-per-share results before, during and after the last recession.

- 2004 adjusted earnings-per-share: $2.13

- 2005 adjusted earnings-per-share: $1.25

- 2006 adjusted earnings-per-share: $1.50

- 2007 adjusted earnings-per-share: $0.19

- 2008 adjusted earnings-per-share: $3.13

- 2009 adjusted earnings-per-share: $0.00

- 2010 adjusted earnings-per-share: $1.91

- 2011 adjusted earnings-per-share: $1.95

— - 2018 adjusted earnings-per-share: $1.30

As you can see, adjusted earnings-per-share bottomed out at $0.00 in 2009. Ford has rather consistently alternated between years of earning growth and decline for much of the past 15 years or so. The company has still not regained its high prior to the last recession. With results like this, it is not surprising that the company cut its dividend leading up to the last recession.

Ford paid a quarterly dividend of $0.15 per share in the second quarter of 2019. Using adjusted earnings-per-share of $0.28, this equates to a dividend payout ratio of 54%.

Looking out over a longer-term horizon, Ford has produced adjusted earnings-per-share of $1.31 over the last four quarters while paying out $0.60 in dividends during this same period of time. This results in a payout ratio of 46% over the last year.

These payout ratios are above Ford’s average payout ratio of 34% since 2012, the year the company started distributing dividends again.

Let’s examine Ford’s free cash flow, as this is often the preferred method to measuring dividend safety. Ford generated $4.5 billion of free cash flow in the second quarter and distributed $599 million of dividends for a payout ratio of just 13%.

Ford has generated $8.9 billion of free cash flow over the last four quarters. The company paid $2.4 billion to shareholders in the form of dividends, giving the company a free cash flow payout ratio of 27% in that period.

Ford has been prone to wild swings in free cash flow. For example, in the first quarter of the2019, free cash flow was $1.9 billion, less than half of the total for the most recent quarter. Free cash flow swung to negative in the fourth quarter of 2018 following an amount of nearly $3.2 billion in the previous quarter. The company is not a consistent producer of free cash flow.

These cash flow payout ratios are very low, but the variation in results helps explain why the company hasn’t increased its dividend since 2015. Given the changes in cash flow from quarter to quarter, the company is likely making the prudent move keeping the dividend at the current level.

Also factoring into a dividend’s safety is the company’s balance sheet. At the conclusion of the second quarter, Ford had $38 billion in cash and securities and $118 billion in total current assets against $98 billion in current liabilities and $226 billion in total liabilities.

While interest on automotive debt declined to $230 million from $287 in the most recent quarter and to $461 million from $562 million for the first half of the year, Ford’s total debt is immense and could make a dividend cut likely if business suffered through a prolonged slump, such as a recession.

Final Thoughts

Ford’s dividend yield of 6.6% is extremely attractive at first glance. Even without any dividend growth, this yield could offer investors a significant amount of income.

A closer look at the company reveals that Ford’s dividend could be at risk in the next recession. The company needed to cut its dividend twice before the last recession, including eliminating it altogether in 2007. The company hasn’t been able to reach its pre-recession high for adjusted earnings-per-share either.

While earnings-per-share and free cash flow payout ratios are in a good position right now, Ford’s earnings and cash flows are very inconsistent. We fear that a prolonged downturn in the world’s economies could result in Ford lowering or eliminating its dividend once again.

For this reason, we feel that the stock should only be bought by investors who understand that they are taking a risk of owning shares of Ford for its dividend.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more