FOMC Minutes Confirm Hawkish "Transitory" Inflation Outlook, Remains "Patient For Some Time"

Will the Minutes attempt to walk back Powell's 'hawkish' transitory/transient inflation comments, will they mention frothy prices in financial markets, or will an insurance rate-cut be discussed against trade-war threats?

The answer is mixed:

Hawkish

MANY FED OFFICIALS SAW INFLATION DIP AS LIKELY 'TRANSITORY'

Dovish

*FED OFFICIALS SAW PATIENT APPROACH APPROPRIATE FOR 'SOME TIME'

Key takeaways include:

"Patient" Fed for "some time"

"Members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time, especially in an environment of moderate economic growth and muted inflation pressures, even if global economic and financial conditions continued to improve."

Inflation remains "Transitory"

"Many participants viewed the recent dip in PCE inflation as likely to be transitory, and participants generally anticipated that a patient approach to policy adjustments was likely to be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective."

On a symmetric "overshoot" in inflation

"Several participants commented that if inflation did not show signs of moving up over coming quarters, there was a risk that inflation expectations could become anchored at levels below those consistent with the Committee’s symmetric 2 percent objective—a development that could make it more difficult to achieve the 2 percent inflation objective on a sustainable basis over the longer run."

Meanwhile, risks are declining ...

"A number of participants observed that some of the risks and uncertainties that had surrounded their outlooks earlier in the year had moderated, including those related to the global economic outlook, Brexit, and trade negotiations."

... even so the Fed is scared of rocking the boats

"Participants noted that even if global economic and financial conditions continued to improve, a patient approach would likely remain warranted, especially in an environment of continued moderate economic growth and muted inflation pressures."

On whether the Fed will do a "Reverse Operation Twist"

"The staff presented two illustrative scenarios as a way of highlighting a range of implications of different long-run target portfolio compositions."

"In the first scenario, the maturity composition of the U.S. Treasury securities in the target portfolio was similar to that of the universe of currently outstanding U.S. Treasury securities (a "proportional" portfolio).... In the second, the target portfolio contained only shorter-term securities with maturities of three years or less (a "shorter maturity" portfolio).... "Based on the staff’s standard modeling framework, all else equal, a move to the illustrative shorter maturity portfolio would put significant upward pressure on term premiums and imply that the path of the federal funds rate would need to be correspondingly lower to achieve the same macroeconomic outcomes as in the baseline outlook."

On the composition of the Fed's balance sheet

"Several participants expressed the view that a decision regarding the long-run composition of the portfolio would not need to be made for some time, and a couple of participants highlighted the importance of making such a decision in the context of the ongoing review of the Federal Reserve’s monetary policy strategies, tools, and communications practices."

Fed warnings again on record debt levels

A few participants suggested that heightened leverage and associated debt burdens could render the business sector more sensitive to economic downturns than would otherwise be the case.

Additionally,

- There was little discussion about the U.S.-China trade war, a sign that the worsening of tensions since the meeting probably came as a surprise.

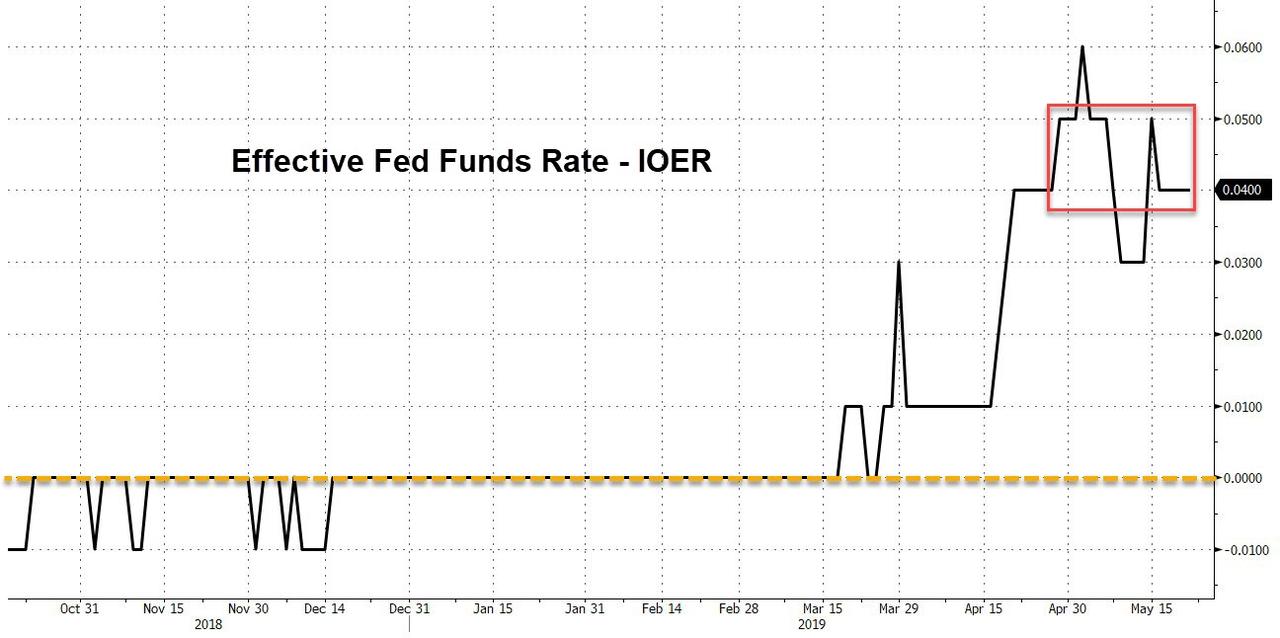

- On the decision to lower interest on excess reserves rate by 5 basis points, the minutes say Fed staff noted that the effective fed funds rate rose to 5 bps above IOER after the federal income tax deadline on April 15; while a similar dynamic occurred in prior years, the magnitude of the change was larger this year.

Finally, and perhaps most notably, Bloomberg's Matthew Boesler notes that one thing that really ended up being completely absent from the minutes was any discussion of the possibility of a rate cut, despite how heavily investors are betting on such an outcome. It's just not in there at all.

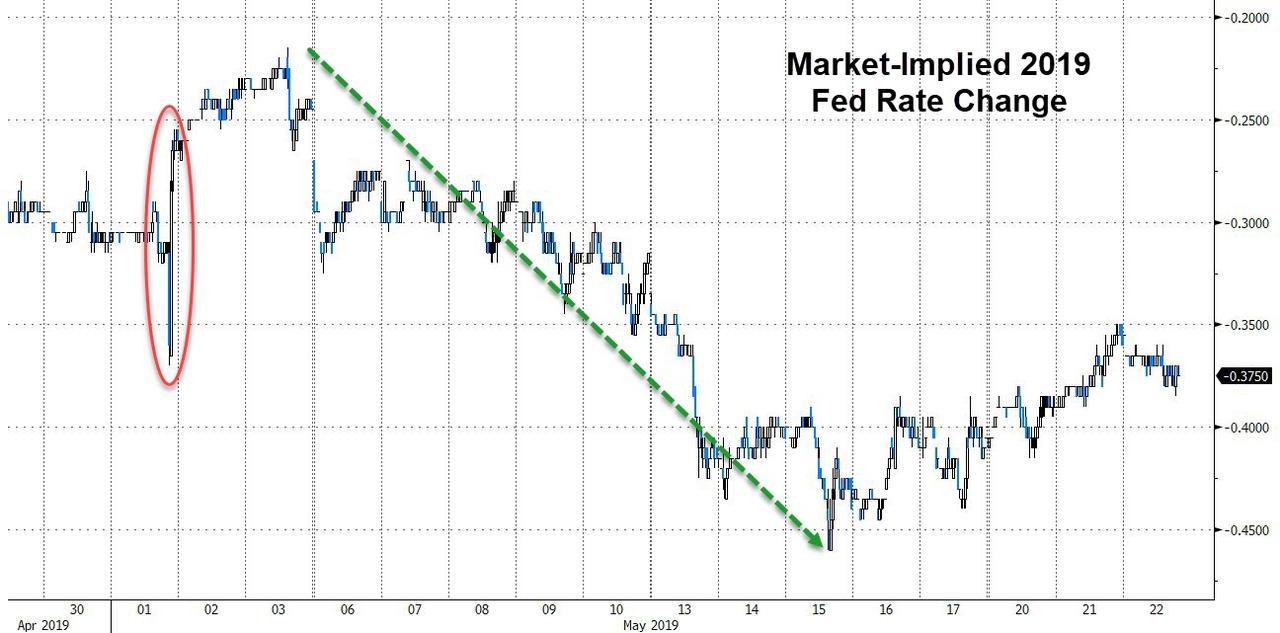

The market-implied Fed rate-change expectations have plunged dovishly since the FOMC meeting...

(Click on image to enlarge)

***

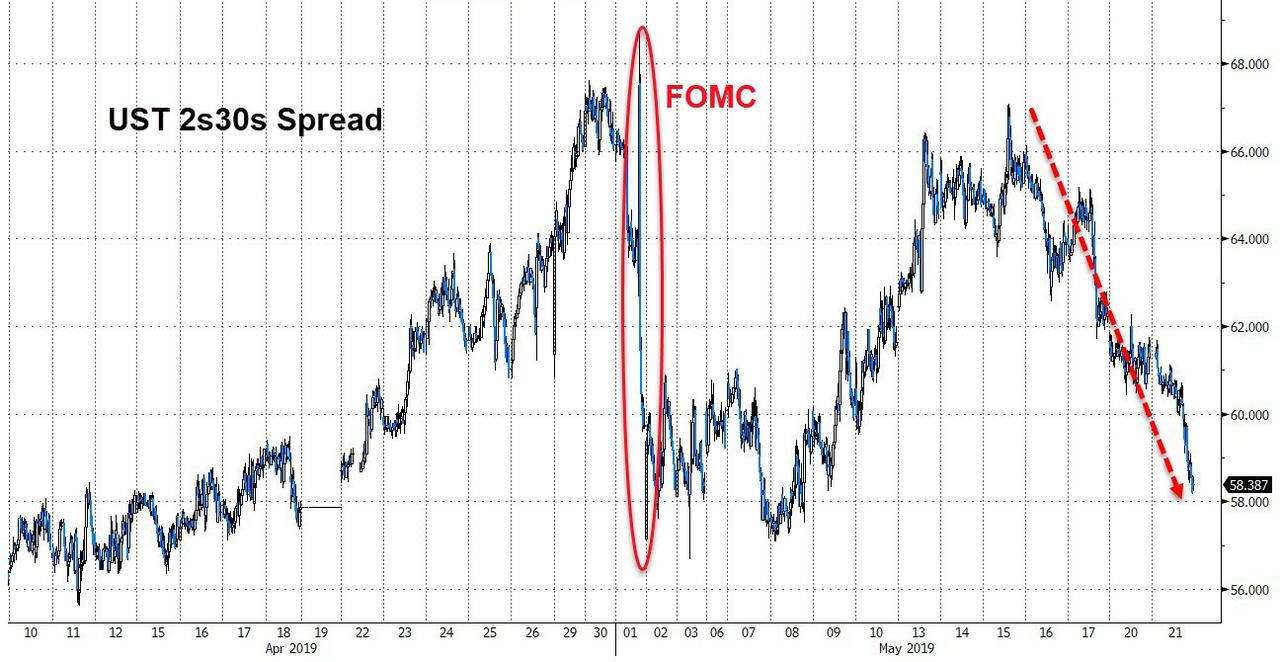

Since the FOMC Meeting on May 1st, the yield curve has had a wild ride but overall has collapsed...hardly a signal that Fed policy is approved by the market.

(Click on image to enlarge)

Stocks and Gold have been the worst hit with bonds and the dollar rallying since Powell's transitory press conference...

(Click on image to enlarge)

And, perhaps most notably, despite The Fed's actions on IOER, the short-term liquidity market remains broken...

(Click on image to enlarge)

***

Full Minutes below:

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more