Floor & Decor Set To Continue Climbing Ahead Of IPO Quiet Period Expiration

The 25-day quiet period on Floor & Decor Holdings Inc. (NYSE: FND) will come to an end on May 22, allowing the firm's IPO underwriters to publish detailed positive reports and recommendations of Floor & Decor Holdings, which operates as a multi-channel retailer of hard surface flooring and accessories.

Since the company's IPO, underwriters have been restricted from releasing reports or recommendations. We expect underwriters will be eager to release reports once restrictions are lifted; subsequently, we expect a flood of (most likely positive) information to investors to lead to a bump in stock price.

We covered FND ahead of its IPO and recommended that investors buy in. Strong cash flow from operations, growing revenue, steady gross margin and strong prospects for future growth were all factors, which lead us to recommend the stock. The stock is up 74% (pre-market 5.8) from its IPO price, and we view the upcoming quiet period expiration as a second buying opportunity for investors.

FND's influential underwriters include: Barclay's Capital, BofA Merrill Lynch, Credit Suisse Securities, UBS Investment Bank, Goldman Sachs, Houlihan Lokey Capital, Jefferies LLC, Piper Jaffray, and Wells Fargo Securities.

Our firm has studied price movement around many IPOs and found above market returns between 2-3% in a short window of time surrounding the QP expiration date for a subset of our sample.

Business Overview: Specialty Retailer of Hard Surface Flooring

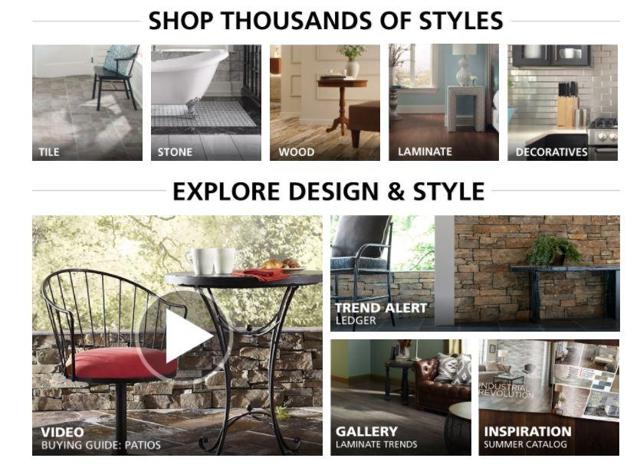

Floor & Decor Holdings, Inc. operates as a multi-channel specialty retailer of hard surface flooring and related accessories. The stores offer wood, tile, laminate, and natural stone flooring products, in addition to decorative and installation supplies. The company operates 72 warehouse-style stores across 17 states, with the average size of its stores being 72,000 sq. ft. Its customer base includes DIY customers, professional installers, and commercial businesses. In addition to its brick and mortar stores, the company markets its product portfolio through its website, FloorandDecor.com.

Floor & Decor credits its success to product and category breadth, competitive pricing, in-stock inventory, credit offerings, and free storage options. Additionally, it views itself as "Amazon-Proof", as customers tend to prefer shopping in the stores where they have expert guidance when purchasing hard surface flooring material.

Early Market Performance

(Click on image to enlarge)

Floor & Decor Holdings Inc. went public on April 26, 2017. The company raised $185M through the offering of 8.8M shares. Shares were priced at $21, above its expected price range of $16 to $18. The share price continued to move up on the first day of trading, closing at $32.05, a 52% increase. Since then, the share price has risen steadily and is currently trading at $37.31 (market close on 5/12).

Management Team

Thomas Taylor serves as CEO and director on the board, positions he has held since 2012. He began his career at Home Depot in the Miami store, and he worked his way up through manager, district manager, VP, SVP, and EVP positions in the company. In 2006, he left Home Depot for Sun Capital Partners as a managing director.

Trevor S. Lang, serves as Executive Vice President and Chief Financial Officer, positions he has held since joining the company in 2011. His previous experience includes senior financial positions at Zumiez, Carters, and Blockbuster. From 1994 until 1999, Lang worked in the audit division of Arthur Andersen reaching the level of audit manager. He graduated from Texas A&M University with a B.B.A. in Accounting and is also a Certified Public Accountant.

Financial Highlights

Revenue and net profits have grown steadily throughout FND's history. The company generated revenue of: $584.5M, $784.0M, and $1.5B in 2014, 2015, and 2016, respectively and net income of $15.1M, $26.8M, and $43.0M over the same time period. Gross margins have remained steady at 40%, which is above average for the industry. As of December 31, 2016, Floor and Decor had cash and cash equivalents of $318M, total assets of $748.8M, and total debt of $177.9M.

The company's strong financial results are due to pursuing a differentiated business model in the hard surface flooring category. They have had seven consecutive years of double digit comparable store sales, with the average growth in sales reaching 14.7%. At the same time, its expanded its store base from 38 in 2013, to 57 in 2015, and to 72 currently.

Floor & Decor believes that it can capture significant market share in the fragmented $10 billion hard surface flooring market with estimated retail sales of $17 billion. It plans to expand its store base to approximately 400 within 15 years, basing its projections on internal research on housing density, demographic data, competitor concentration, and other variables. The company expects to expand its store base by approximately 20% per year.

Conclusion: Buy Ahead of Event To Take Full Advantage Of Likely Price Increase

We were bullish on the stock going into the IPO and view the upcoming quiet period expiration as a second buying opportunity for investors.

We expect a stock bump in short window of time around the quiet period expiration scheduled for Monday, 5.22. Its large team of underwriters will be eager to release reports once restrictions are lifted leading to increased interest in the stock from investors.

We recommend purchasing shares ahead of the 5.22 quiet period expiration to benefit from this expected price increase.

Disclosure: I am/we are long FND.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more