Fleet Sales To Plunge 56% In June, Pressuring US Auto Market Further

Over the last few months we detailed how used car prices were set to cripple what little interest in new cars remains, how dealers are scrambling to offer incentives, and how ships full of vehicles are being turned away at port cities due to the lack of space and inventory glut.

And just as the industry was hoping for some respite, weak fleet orders for June are making it seem as though a recovery is still far away. Cox Automotive is forecasting that fleet sales will fall 56% to 1.3 million vehicles in June, after plunging 83% in May and 77% in April, according to Reuters.

Cox is also predicting that further job cuts could occur if production at U.S. automakers doesn't eventually ramp back up. Zohaib Rahim, economic and industry insights manager at Cox Automotive, said: “If we don’t see a rebound in 2021, this will be a problem for automakers. But right now, they’re using all their production to supply dealers.”

Cox is still predicting, however, that commercial sales will bounce back in 2021, despite government orders taking a hit.

While fleet sales aren't a main concern for automakers - higher margin sales to customers are - they can still put pressure on the industry as a whole. And with rental companies like Hertz (HTZ) now in the midst of bankruptcy, there is sure to be a profound effect not only on dealer sales, but the used car aftermarket, as well. 62% of vehicles sold to fleet buyers in 2019 went to rental car companies.

In 2019, fleet sales accounted for about 22% of General Motor (GM)'s sales, with about half going to rental fleets, and the other half going to corporations and government agencies. Fleet sales made up about 28% of Nissan (NSANY)'s 2019 sales, with 93% of those going to rental car companies.

John Ruppert, Ford (F)’s general manager of commercial and government fleet sales said it "could be some time in 2021" before sales recover. He cites more people working from home as a headwind, despite it catalyzing the need for more delivery vehicles.

Commercial vehicle contract talks, which usually start in March or April, were non-existent up until this month. Now, they look to be commencing, to some degree. Ruppert said: "We’re seeing those contract talks happening now in earnest. Some orders could be delayed a quarter or two; meaning overall commercial fleet sales should recover some time in 2021."

Meanwhile, GM's strategy seems to be ignore reality and just hope for the best. The company stated: “Rental companies have been an important customer of ours. We expect that to continue in the future, when the rental market recovers.”

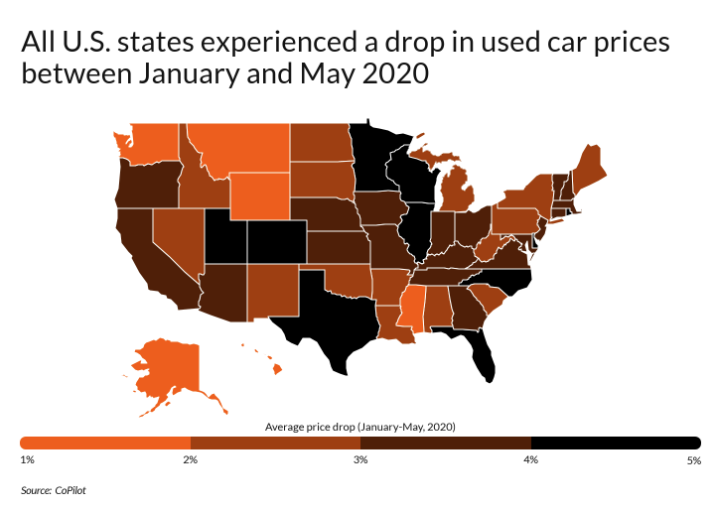

Recall, earlier this month we laid out where used car prices are crashing the most in the U.S.

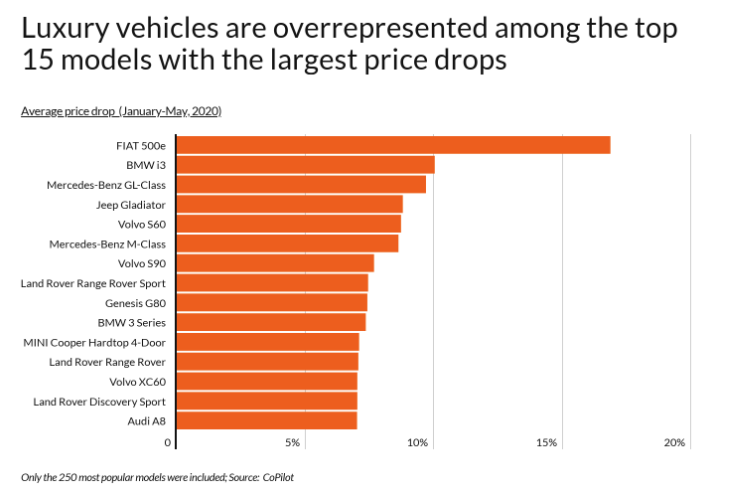

That report predicted a sharp drop in retail prices in the coming weeks, stating that "a combination of record supply, damaged consumer confidence, and new car incentives will ultimately create a perfect storm causing retail prices to drop sharply in the coming weeks."

Between January and May, individual U.S. states experienced price drops ranging from 1%, to 5%, the report shows. "Luxury vehicles and electric vehicles are disproportionately represented among the top 15 models with the biggest drop in used car prices so far," we noted in early June.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more