Fiverr International - All-Time High

Summary

- 100% technical buy signals.

- 9 new highs and up 19.1% in the last month.

- 700.21% gain in the last year.

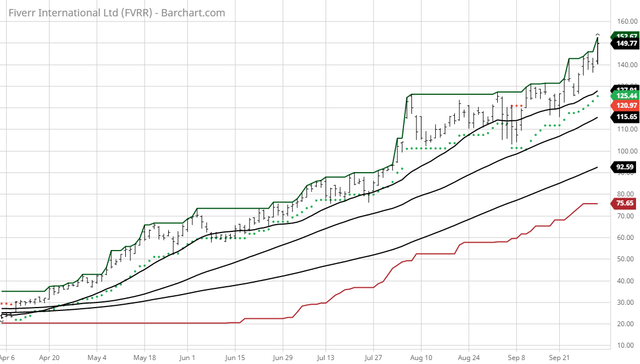

The Barchart Chart of the Day belongs to the online retail company Fiverr International (NYSE: FVRR). I found the stock by sorting Barchart's New All-Time High list first by the highest Weighted Alpha, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 9/10 the stock gained 20.00%.

Fiverr International Ltd. operates an online marketplace worldwide. Its platform enables sellers to sell their services and buyers to buy them. The company's platform includes approximately 300 categories in eight verticals, including graphic and design, digital marketing, writing and translation, video and animation, music and audio, programming and technology, business, and lifestyle. It also offer And.Co, a platform for online back office service to assist freelancers with invoicing, contracts, and task management; Fiverr Learn, an online learning platform with original course content in categories such as graphic design, branding, digital marketing, and copywriting; and ClearVoice, a subscription-based content marketing platform for medium to large businesses. Its buyers include businesses of various sizes, as well as sellers comprise a group of freelancers and small businesses. The company was founded in 2010 and is headquartered in Tel Aviv, Israel.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 638.40+ Weighted Alpha

- 700.21% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 19.10% in the last month

- Relative strength Index 67.64%

- Technical support level at 135.79

- Recently traded at 151.20 with a 50 day moving average of 115.65

Fundamental factors:

- Market Cap $4.31 billion

- Revenue estimated to grow 67.90% this year and another 37.10% next year

- Earnings estimated to increase 139.70% this year, an additional 195.70% next year and continue to compound at an annual rate of 77.10% for the next 5 years

- Wall Street analysts issued 4 strong buy, 1 buy and 3 hold recommendations on the stock

- The individual investors monitoring the stock on Motley Fool voted 199 to 3 that the stock will beat the market

- 10,930 investors are monitoring the stock on Seeking Alpha

Disclosure: None.