Fiverr: Accelerating Growth And Big Upside Potential

Fiverr (FVRR) came into the most recent earnings report facing demanding expectations, and this is always risky. Fortunately for the bulls, the numbers released on Wednesday morning show that Fiverr keeps firing on all cylinders across the board.

Both revenue and earnings are growing very soundly, management raised guidance, and the company is driving strong user growth and engagement levels. Even more important, Fiverr is executing strongly in its key growth initiatives, and this bodes well for the company going forward.

The stock is not cheap at all at these levels, but the long-term uptrend remains intact and the business fundamentals allow for further upside in the years ahead.

Firing On All Cylinders

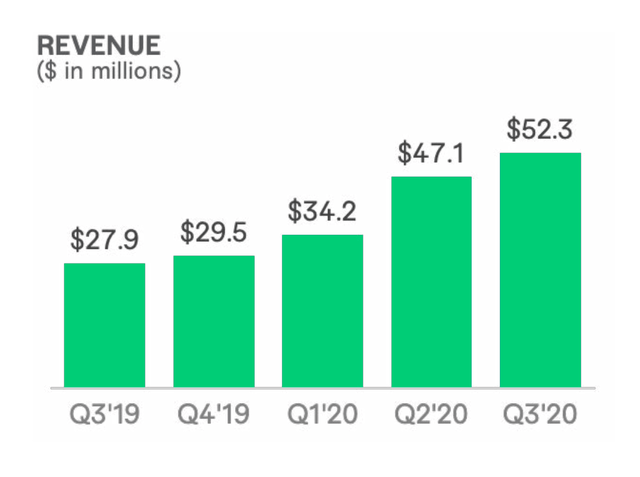

Revenue in the third quarter of 2020 was $52.3 million, an increase of 88% year over year. This number represents a strong acceleration versus an 82% increase in the second quarter of 2020 and a 44% increase in the first quarter this year. Sales for the third quarter also exceeded Wall Street expectations by $3.48 million.

Source: Fiverr

In a sign of confidence, management raised guidance for the full-year 2020 to $186-187 million; this would represent a year-over-year increase of 74-75% versus 2019 levels.

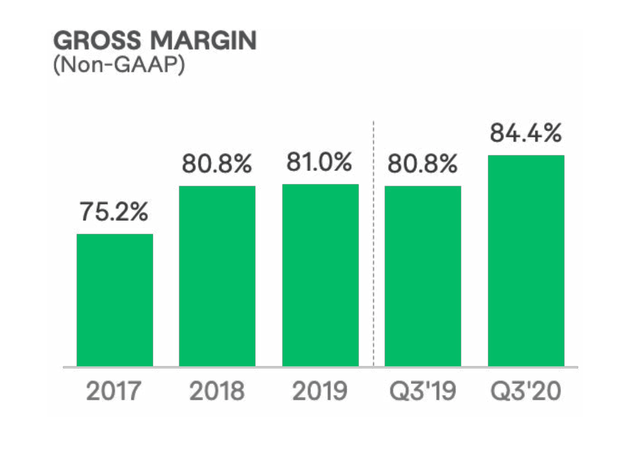

Most high growth companies in the market are burning money due to aggressive investments for growth. This is perfectly understandable and it is even the right thing to do when you have to allocate large sums of money to R&D and marketing to sustain growth in a big market. On the other hand, Fiverr has a very scalable business model, and the business is benefiting from an expansion in profit margins while revenues keep growing vigorously.

Source: Fiverr

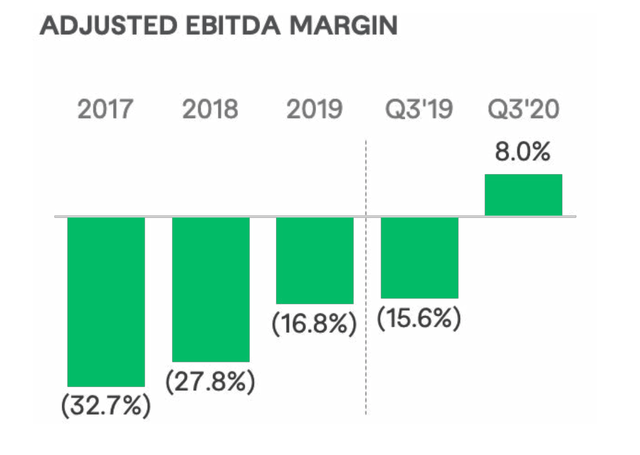

Management is now expecting $8.5-9.0 million in Adjusted EBITDA for 2020 versus prior guidance of $4.5-6.5 million. Profitability is not only moving in the right direction but also doing it faster than expected, which provides a lot of predictability to investors because it makes the business model more sustainable. Profitability also reduces the need for external financing, which is obviously a major plus on its own merits.

Source: Fiverr

Strong Operational Performance

It is great to see the company driving accelerating growth and expanding profit margins, but we also need to make sure that these improvements in financial metrics are being produced by solid performance at the operational level. At the end of the day, the company needs to create value for users and clients if it is going to continue creating value for investors in a sustainable way.

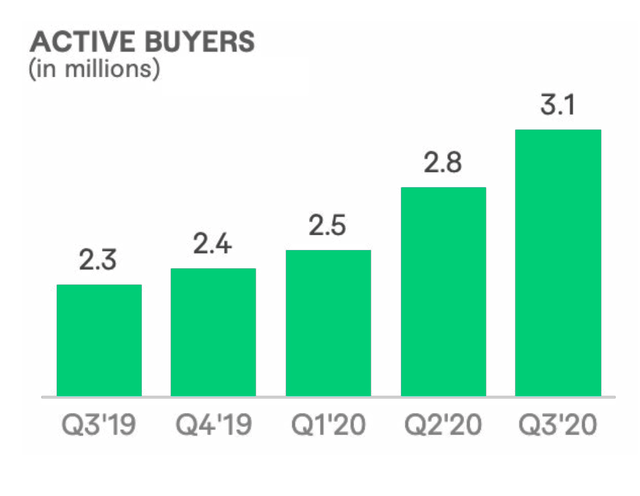

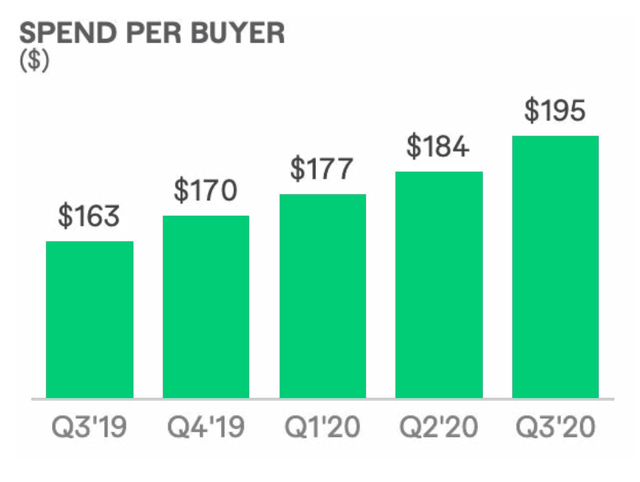

The company's active buyers reached 3.1 million, an increase of 37%. The annual spending per buyer grew to $195, up 20% year over year. Fiverr is not only attracting more buyers to the platform but also making more revenue per buyer, which provides a double boost to revenue growth.

Source: Fiverr

Management has been focusing on attracting buyers with bigger budgets and hence higher lifetime value to the company. Many buyers are also starting to buy from different categories while also paying higher average prices per purchase and this combination of factors is driving increased spend per buyer.

Source: Fiverr

The take rate was 27% last quarter, an increase of 40 basis points year over year. This increase is being driven by continued growth in areas such as back-office software subscriptions, e-learning courses, and content marketing subscriptions.

On one hand, Fiverr has really elevated take rates in comparison to similar companies, which could be a problem for Fiverr if pricing competition increases. However, the fact that users are willing to pay larger take rates is also reflecting that the company is consistently adding value to those customers with more and better solutions.

Future Growth Strategies

Fiverr's growth strategy is based on 5 key drivers going forward: bringing new buyers to the platform, going upmarket, expanding the gig catalog, technology and services innovation, and expanding the geographic footprint.

Fiverr is still driving most of its buyer growth via organic channels, with strong word-of-mouth, brand traffic, and virality among social media and influencer channels. The company revamped its brand identity with a new logo this quarter and it launched a new brand campaign “It starts here” with a series of short and long-form videos across both digital and TV channels.

The tROI - time to return on performance marketing investment - remained at slightly above 1.0x during the quarter, indicating that Fiverr still has a lot of potential to accelerate growth via marketing investments with attractive returns. As the company is now benefiting from expanding profit margins, it has more financial firepower for marketing investments.

Fiverr Business was officially launched in September, enabling larger teams to collaborate and transact in a seamless fashion. The company also launched a new personalized home page for Fiverr Business buyers to include team projects and service recommendations for each project.

The company is launching a new user experience to allow buyers and sellers to break large projects into milestones, or incremental steps. Fiverr will also introduce features that will allow buyers to make recurring purchases, which are especially relevant when it comes to ongoing digital investments such as SEO or content marketing. The main idea is making it easier for buyers to make larger purchases and to buy from Fiverr more frequently.

The company launched Fiverr Logo Maker beta earlier this year and it is now fully integrated into the marketplace. This offering allows buyers to tweak sellers' original designs to their own taste using the editor and then download the logo immediately. This way Fiverr is leveraging AI technology to enable sellers to increase their earnings through passive income, also allowing the company to enjoy a higher take rate than a typical transaction.

These kinds of innovations have clear benefits to buyers, sellers, and the company itself from a financial perspective, and the possibilities regarding further innovation in this area are clearly intriguing.

The company has recently launched its 6th non-English website in Portuguese, allowing it to expand its country presence into Portugal and Brazil. Fiverr also integrated with a local payment solution provider in Brazil to streamline the local payment experience. Regarding marketing, Fiverr is ramping up performance marketing infrastructure across international markets and it has expanded its Affiliate program in Germany and France.

Affiliate programs are working very well in the international markets in a similar way to the U.S. markets in terms of efficiency and scalability. This clearly bodes well for Fiverr in terms of international growth potential.

Timing And Valuation

Fiverr stock is trading at a forward price to sales ratio of 21 times revenue estimates for 2021. This puts the company in line with many of the best companies in an already expensive sector. But recent performance in terms of revenue and margins clearly justifies an elevated price tag for Fiverr.

In terms of market capitalization, the company is currently worth only $5.2 billion. Since Fiverr still has abundant room for growth in the long term, the upside potential in valuation is still very attractive over the years ahead.

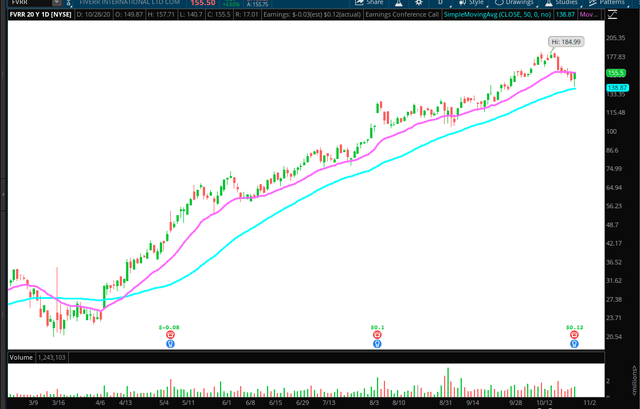

The stock is in a vigorous uptrend since April, it has recently pulled back with the rest of the market and it seems to be finding support around the 50 days moving average after earnings. The uptrend remains intact in the middle term and the stock is not too overbought.

Source: TOS

Fiverr is obviously priced for growth, but not necessarily too expensive considering recent performance and long-term potential. Market volatility can hurt all stocks in the market, but Fiverr is seeing acceleration during the pandemic, so the stock can provide some protection in that regard.

In the years ahead, the stock offers abundant upside potential if management continues executing well and capitalizing on its long-term opportunities.

Disclosure: I am/we are long FVRR.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more