Five Stocks To Watch This Week - June 14, 2016

(Photo Credit: michael kudela)

Wednesday, June 15

![]()

![]()

Thursday, June 16

Ctrip.com (CTRP)

Consumer Discretionary - Internet & Catalog Retail | Reports June 15, after the close.

The Estimize consensus is calling for a decline in earnings of 64 cents per share on $637.33 million in revenue, 3 cents higher than Wall Street on the bottom line and $7 million above on the top. Earnings per share estimates have decreased 1334% in the past 3 months, while revenue expectations have fallen 11%. Compared to a year earlier, this reflects a 656% decrease in EPS with revenue projected to rise 71%.

What to Watch: The booming travel industry in China has been the primary driver of steadily increasing revenue for Ctrip in the last 2 years. Last quarter, revenue grew 50% on increases in net commission, accommodation reservation and transportation ticketing. Leisure and outbound tourism have been the two biggest drivers in the travel market and are seeing the largest gains. Ctrip should have no problem generating revenue as it holds a dominant market share in the region.

Recent partnerships with eLong and Qunar are expected to propel Ctrip’s market share in Chinese hotel and airline bookings to about 70%-80%. Moreover, Priceline’s recent $500 million investment in Ctrip will help bolster its expansion in outbound travel. Ctrip’s consolidation of the Chinese travel industry and growth in the global market gives it the scale and distribution power to generate more meaningful margins.

While Ctrip maintains a stranglehold on the China travel industry, its mounting losses could become problem in the near future, if it hasn’t already. Shareholders could bare the brunt of its shortcomings if Ctrip is unable to turn a profit.

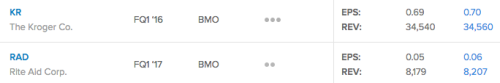

The Kroger Co. (KR)

Consumer Staples - Food & Staples Retailing | Reports June 16, before the open.

The Estimize community calls for EPS of $0.70, a penny above Wall Street. Revenue expectations of $34.5 are in-line with the sell-side consensus. Earnings estimates have increased slightly by 2% over last 3 months, now expected to show YoY growth of 11%. Revenues estimates have remained flat during that time, and are still projected to show 5% YoY growth for the quarter. The grocer has a decent history of beating on the bottom-line, surpassing the Estimize EPS consensus in 71% of reported quarters, but only 36% of the time on revenues.

What to Watch: Kroger has been intently focused on expanding their natural and organic food business and as a result has been able to steal market share from upscale grocers, providing value offerings to customers that are no longer willing to spend their whole paycheck at Whole Foods. The company has shown strong fundamentals, with earnings per share (EPS) growth in the double digits for the past 8 quarters, and double-digit sales growth in four of the past eight quarters, but most recently slowing down to the low single-digits.

Kroger faces some stiff competition from other retailers enforcing the same strategy. However, for the last several quarters, identical supermarket store sales for KR has outpaced much bigger outfits such as Wal-Mart and Target. The fourth quarter marked the 49th consecutive quarter of positive SSS growth excluding fuel. The company expects that trend to continue in 2016, predicting SSS to come in the range of 2.5% - 3.5% for the year.

Kroger is targeting both low-end grocers, as well as the higher-end with it’s two new store formats. Ruler Foods is a warehouse grocery chain going after value shoppers and directly taking on both traditional grocery stores and the likes of Wal-Mart and Target. Main & Vine is targeting those shoppers that prefer specialty stores such as Whole Foods, Sprouts and The Fresh Market. Investor’s will be looking for progress on both during Thursday’s call.

Rite Aid (RAD)

Consumer Staples - Food & Staples Retailing | Reports June 16, before the open.

The Estimize consensus is calling for EPS of $0.06, two cents higher than Wall Street. Revenue expectations of $8.207 billion are also above the sell-side expectation of $8.179 billion. While estimates on the top-line have remained relatively flat since the last quarterly report, EPS expectations have increased 8% since that time, now expected to show growth of 39% YoY, with revenue growth of 23%. RAD doesn’t have a strong record of beating on the bottom-line, however, surpassing the Estimize EPS consensus only 50% of the time, while revenue beats come in much higher at 88%.

What to Watch: Despite beating on the bottom-line last quarter, profits for Rite Aid still showed a steep YoY decline for the third consecutive quarter. Revenue actuals came in light, but in turn supported the third consecutive quarter of double-digit growth. Early last year RAD announced it would be acquiring pharmacy benefit manager (PBM) EnvisionRX. While this move puts the company in the a better position to compete with larger peers which already run PBMs, it came at a cost of $2B, and is the cause of falling profits.

Rite Aid is no stranger to this cycle, after the multibillion-dollar acquisition of Eckard had the company on edge a few years ago, but luckily a recovering economy came to the rescue. Rite Aid also penned a deal to buy RediClinic in fiscal 2015, a health-care clinic operator that provides in-store care, something many of its competitors already offer (which has aided sales).

The company is also reaping the benefits of other initiatives launched in 2015, including it’s wellness+ Plenti program which allows members to earn points on everyday purchases at Plenti partners. The company also announced in the fall that they would begin accepting mobile payments at all of their nearly 4,600 stores.

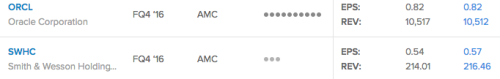

Oracle (ORCL)

Information Technology - Software | Reports June 16, after the close.

The Estimize consensus is calling for earnings of $0.82 per share on $10.5 billion in revenue, 1 penny higher than Wall Street on the bottom line and in-line on the top. In the last 3 months, estimates for both metrics have stayed flat. Year over year comparisons are now projecting a 5% increase in profitability with sales actually decreasing 2%. The company tends to miss the Estimize consensus both on the top and bottom-line more often than not, only beating on EPS 44% of the time historically, and an even lower 28% for revenues.

What to watch: As we close the door on first quarter earnings another opens when Oracle reports its FQ4 2016 on Thursday, one of the first reports of the season. Oracle is coming off a better than expected third quarter in which they beat on the bottom line but missed sales estimates. The continued transition from licensing, where revenues are booked upfront, to a cloud subscription model, where it is realized month to month, will hurt top line growth as witnessed this past quarter.

Oracle’s transition to cloud computing in its Saas, PaaS and Big Data divisions has been nothing but promising. While the company enjoys a leading position in enterprise and database management systems, they are also gaining ground in the rapidly growing cloud sector. Cloud computing continues to be one of the fastest growing sectors in technology and that has benefitted Oracle. Since the beginning of the year, Oracle has made significant advancements in the cloud business and most recently launched its Oracle PartnerNetwork Cloud program which has already received rave reviews. In light of the cloud transition, licensing revenue has declined 9-10% in the past two quarters. Despite a dedicated focus on cloud computing, it won’t be smooth sailing for Oracle. The software provider is operating in a top heavy industry, facing competition from the likes of Google, IBM and Amazon Web Services.

Meanwhile, Oracle just lost it’s multi billion dollar lawsuit with Google over copyright infringement. The dispute is related to claims Google’s Android operating system illegally used Oracle software. The company will now have to deal with the downward pressure from legal fees and related expenses.

Smith & Wesson (SWHC)

Consumer Discretionary - Leisure Equipment & Products | Reports June 16, after the close.

The Estimize consensus calls for EPS of $0.57, three cents higher than Wall Street. Revenue expectations are slightly higher than the sell-side, with the Estimize community expecting $216.5 million, as compared to $214.0 million. Both metrics have been trending upward since the last quarterly report, with earnings and revenue estimates up 25% and 7%, respectively. This puts YoY growth expectations at 26% for EPS and 20% for sales. This is a stock that tends to be a big mover after an earnings report, increasing on average by 4% in the 30-day post earnings period.

What to Watch: For a good part of 2012 and 2013, fears in the U.S. that tighter firearm laws were on the horizon helped drive sales for gun manufacturers and retailers alike. As those fears began to dissipate in 2014, sales of guns and ammunition suffered. In 2015, however, fresh political rhetoric regarding stricter gun laws, prompted by a string of mass shootings throughout the year, boosted the sector once again. During the year the FBI processed a record number of firearm applications.

As for 2016, SWHC stock peaked at $29.37 in March and has since backed off. The Orlando massacre on Sunday has prompted a lot of activity in the stock once again, up nearly 7% today, as staunch calls for gun control directly correlate to firearm sales.

Expectations for Thursday’s report remain rather muted, with the Estimize community in-line with Wall Street on the top and bottom-line, but fall out from the tragedy in Orlando will be reflected in the FQ1 2017 report, with analysts already moving their estimates higher.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.