First Solar: Make Hay While The Sun Shines

Recommendation Summary

Within close reach of its 12 month high, is First Solar (FSLR) worth investing in?

*Source: Bloomberg

First Solar currently trades around $60, which puts the company’s stock price at a 12 month high. Despite this I find the company undervalued by around 15%. I believe the market has underemphasized the constant development towards better cell efficiency and ever improving CdTe (cadmium telluride) technology, and overemphasized the recently fallen margins.

Company Background and Overview

First Solar is a is an American photovoltaic manufacturer of thin film modules, a provider of utility-scale PV power plants and supporting services that include finance, construction, maintenance and end-of-life panel recycling.

First Solar produces thin film solar panels from cadmium telluride; these panels have 350 times smaller light absorbing layers than the traditional silicon panel. Because of the efficient semi-conductor built into the cells, thin film solar cells are the lightest PV cells you can find. First Solar is considered to be the top innovator and seller in the CdTe space, which makes up around 50% of the market in thin film solar panels.

In the last 3 years (including TTM) the company has experienced declining revenues at an average of 8% per year mostly fueled by a result of lower systems projects in the US and Japan and material delivery delays. This coupled with higher cost of sales contributed to constantly lower operating income in the last years.

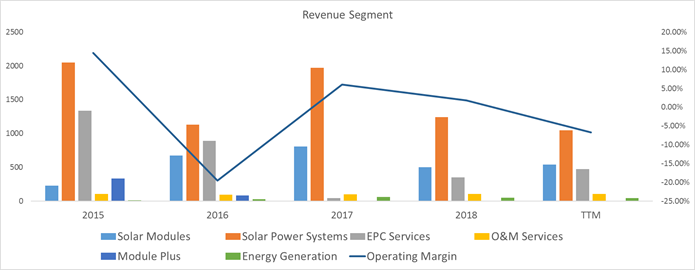

Below you can find the main revenue segments broken down:

*Source: Company filings and author’s own estimates

As we can see from the graph above, operating margin is directly correlated to the growth of the solar power systems revenue segment.

Investment Thesis

Currently, I believe the market sees FirstSolar as a growing innovative market-leader in the solar industry, fueling this is the latest Series 6 panel production and the end-to-end EPC (engineering, procurement, and construction) service the company provides.

However I think the stock is priced imperfectly because of the reasons listed below:

*Although I do acknowledge the Series 6 panel in my valuation I will not include it in my investment thesis since there is enough info on it out there.

Cadmium telluride technology

*Source: Cosmoso

CdTe has several benefits over traditional silicon panels. It uses low-cost manufacturing technology to produce, the material is well matched to the solar spectrum and its nearly optimal for sunlight conversion. Since cadmium is a byproduct of zinc production, it is also much cheaper than silicon.Despite all of the benefits surrounding the usie of cadmium telluride there are also several major drawbacks to using this technology.

Cadmium is much less efficient than the typical silicon panel. The typical cadmium telluride panels have an efficiency of 10-11% and do not reach the efficiencies of standard silicon panels. Despite this, as CdTe technology develops we are seeing new records broken by the year. Recently a company called Calyxo reached 15.4% efficiency and is targeting 18% efficiency in the near future. Also First Solar reached 17%+ efficiency in its latest Series 6 model.

The other major drawback is that tellurium is also considered to be very rare and its abundance in the Earth’s crust is comparable to that of platinum about 1 µg/kg. Мost of the tellurium comes as a by-product of copper. In 2017 it was found that some deep undersea ridges are quite rich in tellurium, having concentrations 50,000 times higher than in deposits on land, but until recently there wasn’t any safe way to mine the deposits. Now a “bus-sized robot” is about to change that. The robot called Patania II is about to descend four kilometers into the ocean and will try to suck up metal-rich nodules through four vacuums in the Clarion-Clipperton Zone. If successful, it will deposit the nodules at a designated spot, since the current model can’t transport them back to the surface. Despite this the company is looking at making a third vehicle in 2023 that will be able to bring the nodules up to awaiting surface ships. But there are many roadblocks accompanying deep-sea mining. First and foremost deep-sea mining could cause vast damages to the oceanic life and secondly the rules of mining in international waters are still being formulated by the International Seabed Authority and are not quite ready yet.

If Patania II can safely mine tellurium from the bottom of the sea and be able to reach the surface, I expect prices of telluride to drastically change, thus making CdTe cell production even cheaper.

The Future of Cadmium Telluride

TCO Improvement: Universities and labs have been focusing on exploring additional ways to allow more light to be absorbed into the cell by focusing on developing innovative TCO (transparent conducting oxides) doping strategies which will reduce resistivity. Transparent conductive oxides are metal oxides with high electrical conductivity and transparency used in solar cells, liquid crystal displays, touch-screens etc… The main strategy of scientists is to dope known TCOs with other elements, thus increasing the conductivity without degrading the transparency.

Combing Silicon and CdTe: Since thin film solar cells are considered to be in high demand because of their low cost to high efficiency ratio, many researchers are focusing on different ways to enhance thе CdTe cell to reach better efficiencies. A study I found focused on researching multijunction solar cells consisting of two or more sub cells. This study focused on combining cadmium telluride with silicon in order to reach better efficiency. After the optimal values of thickness and cell output parameters were found, the results showed an increased conversion efficiency of 28.45% compared to the basic CdTe cell efficiency of 19.7%. It was also found that this cell’s temperature coefficient is −0.15%/◦C, which indicates the better degree of stability of the cell compared to the traditional CdTe cell.

I find such a combination very plausible in the future since it is a very efficient and cost-effective method that can be realized using basic fabrication.

Selenium alloying in Cadmium Telluride: Alloying CdTe solar panels with Selenium has taken efficiencies to a new record of 22.1%. It was well known that adding selenium reduces the bandgap of the absorber material, and hence increases the cell short-circuit current, but this effect alone didn’t explain the high performance. A recent study found that selenium actually passivates critical defects in the bulk of the absorber layer, thus reaching record-breaking efficiency performance. This research may prove to be invaluable because it now provides a route for improvement which can result in even lower costs for solar-generated electricity.

Grain Boundaries: Since CdTe thin-film solar cells are considered to be one of the main alternatives to silicon-based PV, understanding the role of grain boundaries in solar cells is very important to the future of this technology.

CdTe cell production is still reliant on the chloride activation step in order to achieve high conversion efficiencies. The main role of the chloride process is to modify the grain boundaries through chlorine accumulation, thus achieving higher cell voltages and effectiveness. Without such a treatment cell efficiency is typically lower than 5%. Until now the traditional approach to investigate the impact of chloride treatment has been to compare treated and untreated cells and analyze the changes, but this method is considered to be somewhat limited. In 2016 scientists were able to compare different chloride treatments, which allowed them to identify the key roles of chlorine. This helped them find which chloride passivation treatment can increase the cell open circuit voltage, which is the performance-limiting factor for CdTe solar cells. By separating a single combined annealing and chloride in-diffusion process into two, chlorine in-diffusion may be more accurately optimized or even replaced, thus providing manufacturers with a more environmentally safe procedure and reaching better efficiencies.

There are many papers studying the characterization of grain boundaries in solar cells, but there still remains a big level of complexity that is yet to be fully overcome.

Degradation of CdTe solar cells: I find this to be a major obstacle in the industry and I see many studies focusing on redesigning solutions for various devices in order to minimize this phenomenon. I have found studies on overcoming degradation of CdTe solar cells dating back to 1998. The latest study I found focused on correlations between device recipes, stress conditions, and performance degradation with the larger dataset consisting of various CdTe devices. There were several models of physical degradation found including, junction degradation caused by light exposure or forward bias and back contact degradation. Additional studies have found that cell degradation appears to be mainly due to H2O, O2 and illumination in that order, less efficient cells have been found to be less stable than more efficient ones. To date researchers are still looking for ways in minimizing degradation of CdTe solar cells.

EPC Services

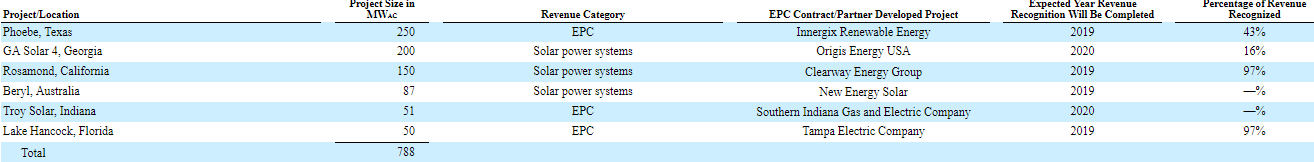

*Source: FSLR 10K. Click to enlarge.

The EPC part of First Solar allows the company to monetize its “know-how” by offering their own technical expertise. With its EPC service First Solar can help companies turn full solar or offers utility providers with an end to end solution for a new power plant.

FSLR recently reported lower than expected first quarter revenue due to challenges in its EPC business in the US and Japan. This was caused by higher labor costs, labor shortage and product failure from third parties. In its latest call management addressed this issue and have taken action by merging their energy systems function with the engineering procurement and construction group. This I think could actually help with the synergy between the departments, thus delivering faster completion times. In addition to this management is reviewing certain supplier and contractor agreements and looking into cost cuts.

As more and more countries tighten their carbon emission regulations I expect FSLRs EPC business to become one of their main revenue driver in the coming future.

Competition

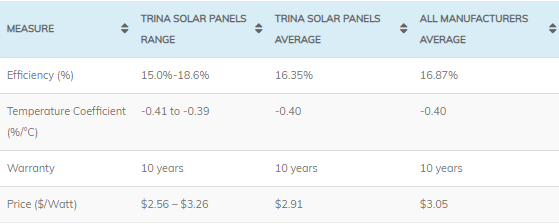

*Source: Energysage

In the analysis below, I have included one of the largest solar companies which according to me could disrupt First Solar’s market share.

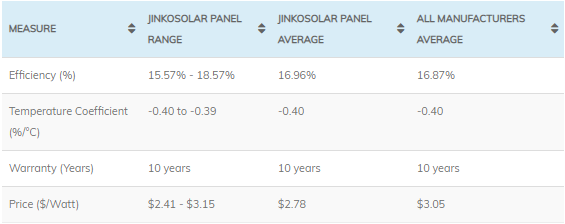

Jinko Solar

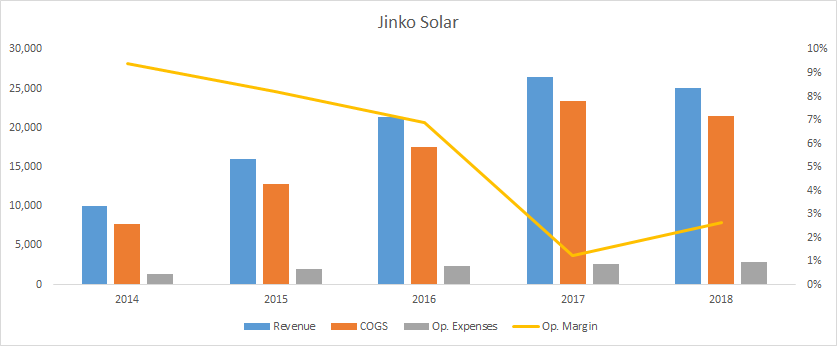

*Source: Company filings and author’s own estimates

Jinko Solar (JKS) is the world’s largest manufacturer of solar panels and the largest solar project developer. JKS was founded in 2006 and manufactures its solar panels in China and Malaysia.

Efficiency: In terms of efficiency the JKS products have an average efficiency range from 15% to 18%, but recently the company broke its record by achieving 24.2% efficiency for its n-type monocrystalline cell. The cell is made by tunnel oxide passivation which directly improves the open-circuit voltage. The company said it used high quality n-type wafers, selective doping technology and advanced fine-line printing technology in order to achieve this.

Performance: The temperature coefficient is used as a performance metric on how well can the panel handle rough conditions. Solar panels perform better when they are kept around 25° C/77° F, so for every degree above that range the panel’s electricity production will drop by its temperature coefficient. JKS panels on average have a temperature coefficient ranging from -0.40 to -0.39s.

Recent Projects: Last year Jinko Solar, partnering with Asunim Turkey a leading EPC company, completed the largest solar power plant in the Aegean region. The power plant in Manisa, Turkey consists of two separate sites that have an outcome of 40.3 MW, built in parallel.

Future: Recently JKS won the 2019 Intersolar Award for its Swan bifacial module with transparent backsheet from DuPont. The Swan module can achieve power output of up to 400W on the front side and up to 20% energy gain from the rear side. I would expect bifacial technology to gain traction as it becomes more and more financially viable in the post subsidy market.

*Source: Energysage

Trina Solar

*Source: Energysage

Trina Solar is the third biggest solar panel manufacturer on the planet. In some cases Trina Solar, although private, has many similarities to First Solar, the company has its own manufacturing, EPC services and site development division.

Efficiency: In terms of efficiency Trina Solar panels on average are in the range of 15% to 18% which would make them a pretty standard company, but recently the company broke its own record. At the end of last year the company released its Tallmax 72 layout monocrystalline module which had a maximum efficiency of 20% and earlier this year Trina released an update to their 72-cell solar modules. These modules reach up to 415 watts, which will help them reduce the levelized cost of electricity (LCoE) by 2.5% to 4.6%.

Performance: On average for every degree above 25° C (77° F), Trina solar panels efficiency will drop by 0.39%, this puts them in a temperature coefficient between -0.41 to -0.37s.

Recent Projects: The company has many big projects under its belt ranging from 5mW systems in India to 90mW utility projects in China. Recently Trina Solar delivered modules to a 20.4MW solar project being developed by PetroSolar Corp in the Philippines. The project is due for completion by Q2 2019 with the overall project standing at more than 70MW of capacity, making it the largest PV project in Luzon.

Future: In May the company announced a new record reaching 24.58% for its new n-type monocrystalline tunnel oxide passivated contact (TOPCon) cell technology. The record was achieved with a bifacial cell using a low-cost process with a boron emitter and a full area rear passivating contact.

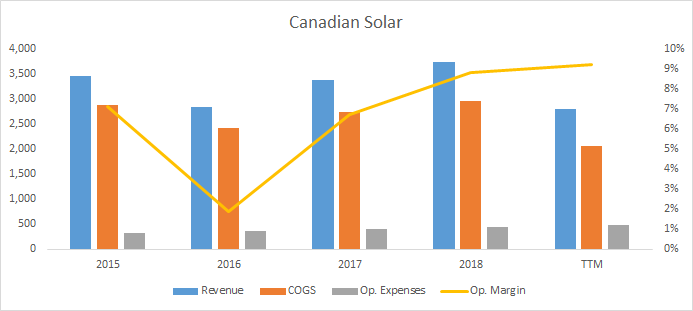

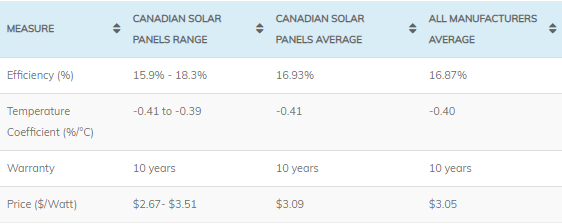

Canadian Solar

*Source: Company filings and author’s own estimates

Founded in 2001 in Canada by Dr. Shawn Qu, Canadian Solar (CSIQ) has business subsidiaries in over 24 countries on 6 continents. To date CSIQ has 4.6GW of solar power projects globally and about 1GW of solar power plants that are owned and operated. In addition, Canadian Solar has a utility-scale solar power project pipeline totaling 9.5 GWp. In 2019 CSIQ announced it will start providing EPC services by partnering with Signal Energy to supply solar modules to ESCO Pacific's 175MWp/133MWac Finley Solar Farm in New South Wales, Australia. If this partnership continues into the future I expect Canadian Solar to become one of First Solar’s biggest competitors.

Efficiency: In terms of efficiency on average Canadian Solar’s panels are between 15% and 18% which makes the panels pretty standard. Recently Canadian Solar released a new HiKu panel. It’s a split solar 330W solar panel and reaches one of the highest poly module power outputs in the solar industry by producing 24% more power than conventional panels. The key features of the panel include, better shade tolerance (decreasing shade loss by 50%), module efficiency of 17.8% and temperature coefficient factor of -0.37%.

Performance: On average for every degree above 25° C (77° F), CSIQtemperature coefficient between -0.41 to -0.39.

Recent Projects: The company’s most recent project was announced in February this year, it’s the company’s first solar solar power project of 68 MWp in Mexico. The plant is powered by over 200,000 Canadian Solar poly modules and will generate 45 gigawatt hours (GWh) of electricity annually, enough to power 20,690 households and offset 72,700 tons of carbon dioxide emission each year.

Future: In December of 2017 a proposition from the CEO Dr. Shawn Qu emerged for taking the company private. Despite the company announcing in November of 2018 that the deal has fallen through, the CEO has stated that he still remains interested in such a deal.

“The special committee formed to review the bid has recommended that the board stops its consideration of the deal due to the time that has passed since it was proposed, the changes in the solar industry during that time and uncertainty around Qu's ability to secure the needed financing.“

Considering all this I would expect the company to go private sooner rather than later.

*Source: Energysage

Perovskite solar panel developers

Since perovskite solar cells are considered by some “the future of solar” I decided to include them in this analysis as a possible risk factor to First Solar’s market share. Pervoskites is a calcium titanium oxide mineral composed of calcium titanate. The main reason the mineral was considered to be used as a new solar-cell building block was because of the low cost and relatively easy manufacturing process. Traditional silicon cells must be processed at a temperature above 1,400 degrees Celsius, while perovskite cells can be processed in liquid solutions at temperatures around 100 degrees using inexpensive equipment.

Efficiency: Since perovskites share a three-part crystal structure, each part can be made from any number of different elements or compounds. Perovskites cells right now sit at lab efficiencies around 20%, but researchers have found that adding additional alkali metals to the mineral in order to homogenize the mixture could improve efficiencies up to about 22%. According to some scientists the theoretical maximum efficiency of perovskite solar cells is 31%.

Companies: Companies developing perovskite solar cells right now are:

- Korver Corp. - An American company with a mission to develop igh-efficiency perovskite/silicon tandem solar cells

- Toshiba – Largest company on this list. In 2017 the company announced a fabrication of a film-based perovskite solar cell. In 2018 New Energy and Industrial Technology Development Organization (NEDO) and Toshiba announced the world's largest film-based perovskite photovoltaic module.

- Frontier Energy Solutions - Korea-based startup

- Microquanta Semiconductor - Based in Hangzhou, China. Works towards commercializing perovskite-based solar cells and owns a super-clean lab, in which it can reportedly produce 6x6 cm scale perovskite solar cells with a reported conversion rate of 16%.

- Oxford PV - spinout from the University of Oxford, in England—which since 2012 has worked on commercializing solar cells made from perovskite. According to its latest post they have reached an efficiency rating of 28%.

With perovskite being cheaper to produce and reaching better efficiencies than silicon in such short R&D times, I see the mineral as the biggest disruptor in today’s solar market.

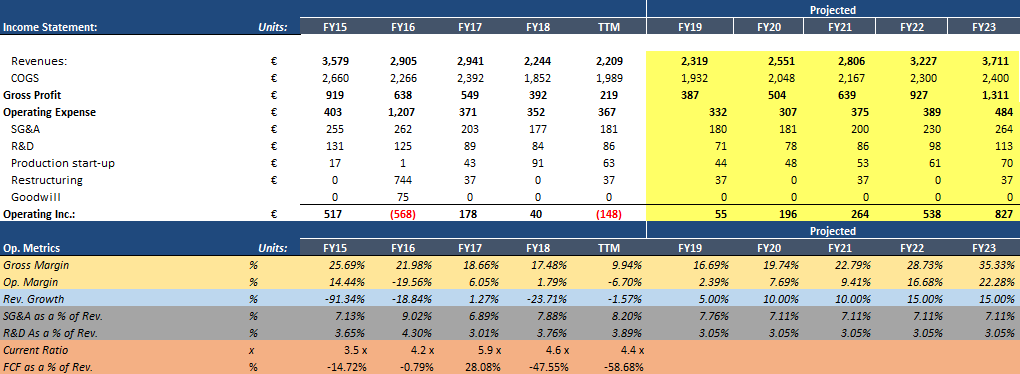

Financial Statement

(Click on image to enlarge)

*Source: Company filings and author’s own estimates

Profitability: In the last TTM the company experienced a fall in margins and it went into negative territory. This fall is mainly attributable to the increase in COGS as a % of Revenue. With the company promising restructuring in its ranks and CdTe technology researchers constantly finding new and improved ways to increase efficiency and cut manufacturing costs, I forecast an increase in gross margins back to the 2015 levels.

Growth: In the years ahead I expect First Solar to capitalize on the growing trend in the renewable energy sector and increasing carbon tightening policies around the world.

Catalysts

Catalysts in the next 12-24 months for the price to increase include:

Growing Solar Trend

*Source: Global Market Outlook

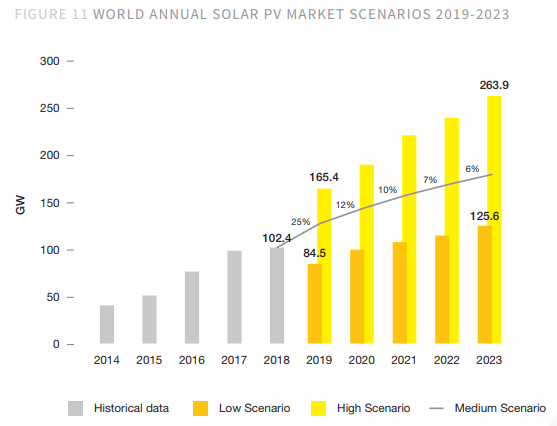

In 2018 a total of 102.4 GW of solar power went on the grid around the world last year. With this achievement solar finally broke the 100 GW threshold of annual installations and reached a cumulative operational capacity of over 500 GW. The demand for solar has been constantly growing in the last years and recently Europe launched its Global Market Outlook 2019-2023 with a very optimistic outlook for the future.

According to the report’s base-case scenario there is anticipation of around 128.4 GW of newly installed PV capacity in 2019, which would translate into a 25% market growth over the 102.4 GW added in 2018. This two digit global growth rate is expected to continue in the next 3-4 years, backed up by the three main solar markets China, India and the US.

China: The return to growth in China for the coming years is going to be key in the fulfillment of this forecast. As the Chinese government is planning on more supportive policies I would expect the country to continue contributing to global solar growth.

India: Recently India missed its 2018-2019 solar target by contributing only 6.5 GW of the planned 11 GW, but that is expected to change in the years ahead. India has a project pipeline of contributing 30 GW per year for the next 2 years ahead, this is expected to be fueled by both utility-scale solar installations and by a government funding for increasing rooftop solar installations.

US: Despite the solar tariffs which are still in effect in the US, the growth in solar is expected to continue for the years ahead. With the decreasing cost of solar, investment tax credit, state incentives and strong public support, the growth in solar in the US is expected to come mainly from utility-scale PV installations adding up to 11% more from 2018.

According to the International Renewable Energy Agency (IRENA) an average of over 400 GW of renewables have to be installed per year until 2050 to keep temperature rise below 2°C.

Valuation

DCF Analysis

The analysis I have done here is a base case scenario built on First Solar’s current and expected future performance in the market along with the increasing R&D around CdTe.

For the DCF analysis I have used the assumptions listed below, which got me to an equity value of $7,311.2 million and a share price of $70 per share with diluted shares outstanding of 105.05:

- A 7% average discount rate for the next 10 years.

- Revenue growth for the next 5 years at an average of 11% per year and then slowly declining when reaching year 10 to the terminal growth rate of 3%.

- Operating Margin at an average of 14.5% for the next 10 years.

- A tax rate at an average of 6% for the next 5 years and then slowly growing to 26% in year 10.

- A ROIC at -0.39% at year 1 and slowly increasing throughout the years until reaching 8% at year 10 getting closer to industry averages.

- A sales to capital ratio of 0.57

Key Takeaway: The growth in operating margin I have given here may seem high, but it represents the high R&D directed towards improving CdTe solar technology, coupled with lowering manufacturing costs and easier access to tellurium.

Risks

Risks in the next 12-24 months for the price to decrease include:

Perovskite solar cells

The development of perovskite solar cell technology could prove to be a very strong disruptor in the market today. Despite the technology being in the early to mid-stage of development and hasn’t been broadly implemented, the low cost of manufacturing and high efficiency rate could be more than enough to shift public attention from silicon and cadmium telluride to perovskite.

Strong Competition

Competition in the solar industry is fierce and could lead to price wars which would put additional pressure on First Solar’s already low margins. With big companies like Jinko Solar, JA Solar (JASO), Trina Solar and Canadian Solar (CSIQ) dominating the market we could see First Solar struggling in taking market share away.

Key Takeaways

In considering all catalysts and risks, I think First Solar is a great investment in the long-term. Despite this I would wait for a better price to entry since I expect the company to struggle with growth in the current year.

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I have no business ...

more