Finding Value In Consumer Durables – A Very Diverse Sector

This is part 3 of a series where I have conducted a simple screening looking for value over the overall market based on industry classifications and subindustry classifications reported by FactSet Research Systems, Inc. In part 1 found here, I covered the Consumer Services Sector. In part 2 found here, I covered the Communication Sector. In this part 3, I will cover the Consumer Durables Sector and its many diverse subsectors.

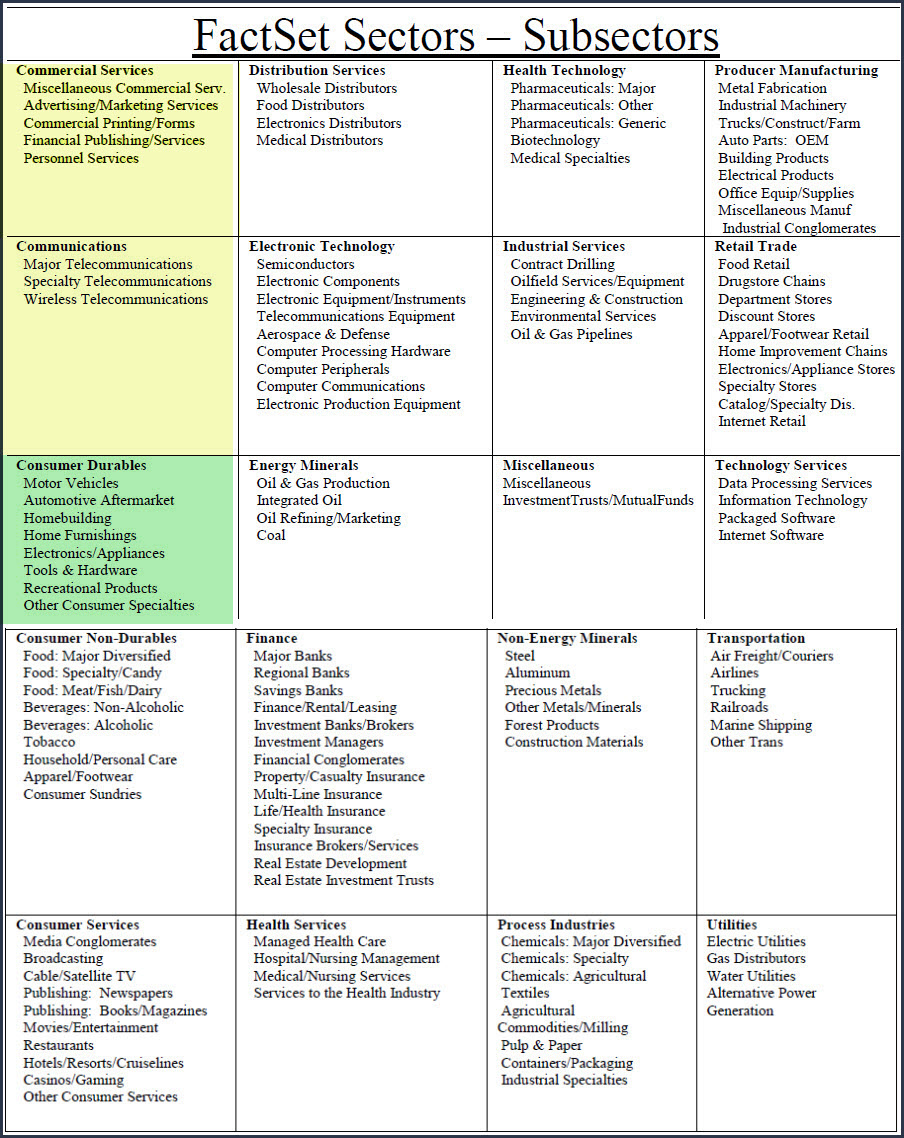

Table of FactSet Sectors and Subsectors

In each article in this series, I will be providing a listing of screened research candidates from each of the following industry sectors, the sector I’m covering is marked in green:

(Click on image to enlarge)

A Simple Valuation and Quality Screening Process

With this series of articles, I will be presenting a screening of companies that have become attractively valued primarily as a result of the bearish market activities experienced in 2018 from each of the above sectors. I will be applying a rather simple valuation and quality-oriented screen across each of the sectors. First, I have screened for investment-grade S&P credit ratings of BBB- or above. Next, I have screened for low valuations based on P/E ratios between 2 and 17. Finally, I have screened for long-term debt to capital no greater than 70%.

By keeping my screen simple, and at the same time rather broad, I will be able to identify attractively valued research candidates that I might have overlooked through a more rigorous screening process. In other words, I’m looking for fresh ideas that I might have previously been overlooking. Furthermore, I want to be clear that I do not consider every candidate that I have discovered as suitable for every investor. However, I do consider them all to be attractively valued. Additionally, I also believe that every investor will be able to find companies to research that meet their own goals, objectives and risk tolerances as this series unfolds.

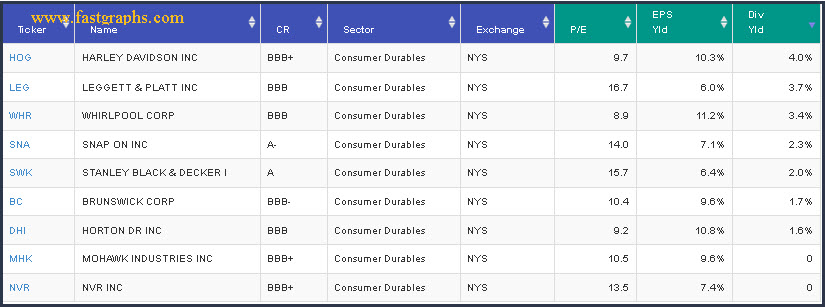

In this part 3, I have found 9 research candidates from the Consumer Durables Sector as follows:

Sector 3: Consumer Durables

Motor Vehicles

Automotive Aftermarket

Homebuliding

Home Furnishings

Electronics/Appliances

Tools & Hardware

Recreational Products

Other Consumer Specialties

As I suggested in part 2, it is not only a market of stocks it is also a market of sectors. Although virtually every sector will contain companies that are quite different from each other, you will commonly also find great similarities for companies in each sector. For example, this Consumer Durables Sector has a lot of things in common within each respective company in the sector. The key is in the name. Consumer Durables are products that have a long shelf life. Consequently, they are also products that typically do not have to be continuously replaced, at least on a short schedule.

Products such as motor vehicles, homes, and home furnishings, electronic appliances, tools, and hardware, etc., can be held onto especially during bad economic times. In other words, consumers can wait to replace or repair these items if necessary when the economy is weak. Consequently, one attribute that many Consumer Durables’ companies share is significant vulnerability to recessions. As I review the 9 research candidates in this sector, I ask that the reader note two things about their operating performance during recessions. First, note that their profitability and their dividends performed horribly during the Great Recession of 2008. Next, note that they all have tended to perform great since the recession ended.

This kind of operating behavior is a primary reason why I believe in first evaluating a company over a long historical period. I believe it’s important to understand, as comprehensively as you can, the “nature of the beast” so to speak. Unfortunately, evaluating a business over a shorter timeframe can often mislead you into believing things about the business that are not necessarily true – at least over the long run. Therefore, when analyzing a stock, I always start with a long timeframe – 20 years or more. Then from there, I will shorten the timeframe incrementally. This process can provide important and significant insights into the business being examined.

For example, I can easily evaluate whether the company is a consistent performer or whether it is cyclical. I can also get a feel for the company’s dividend record if it pays one, and I can evaluate whether the company’s growth is accelerating or decelerating. These are just a few of the perspectives I can gain by starting with a long timeframe and then incrementally drilling down over shorter timeframes.

Although this is clearly overgeneralizing, evaluating the Consumer Durable Sector over the last decade or shorter would suggest operating performance that is better than longer term historical norms. Consequently, investors could easily delude themselves into thinking that companies in the sector can perform better than they are capable. Overconfidence can be just as deadly to an investor as overblown fears. Although it is true that we cannot invest in the past, we can certainly learn from it.

Portfolio Review: 9 Consumer Durables Sector Research Candidates

(Click on image to enlarge)

FAST Graphs Screenshots of the 9 Research Candidates

The following screenshots provide a quick look at each of the 9 candidates screened out of over 19,000 possibilities. I have placed them in order of highest dividend yield to lowest. However, the reader should note that 7 of these candidates pay dividends while 2 do not. Company descriptions courtesy of Wall Street Journal. In the FAST Graphs analyze out loud video that follows the screenshots, I will provide additional details and thoughts on the possible attractiveness as well as the potential negatives of each of these research candidates.

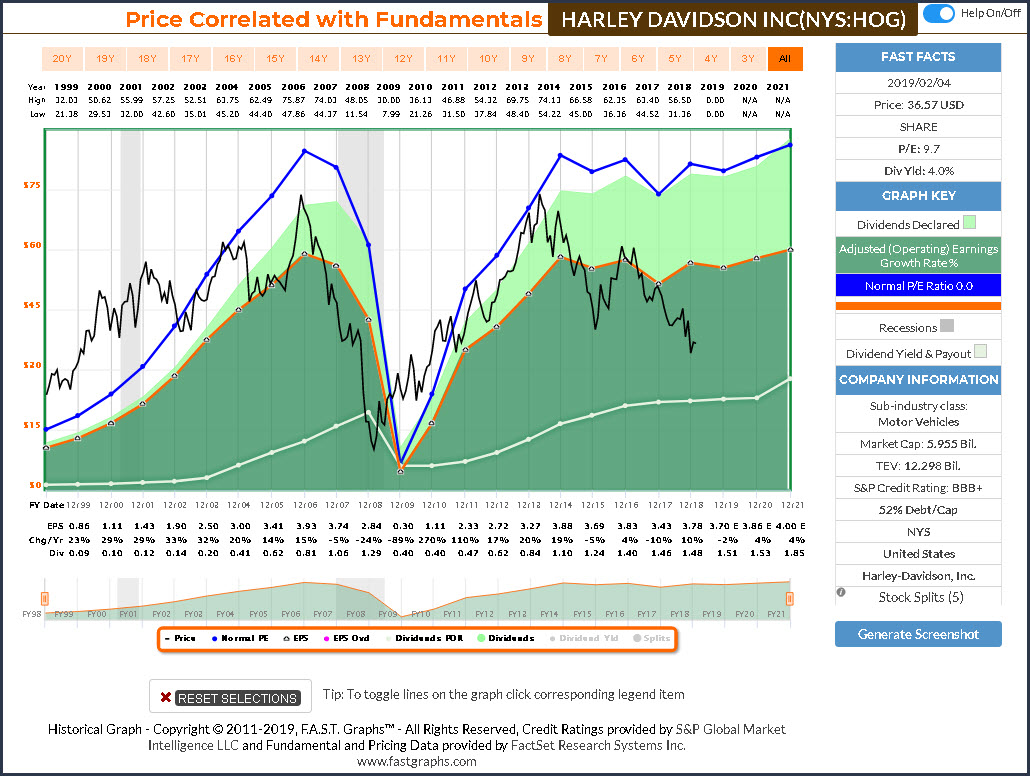

Harley Davidson Inc (HOG)

Harley-Davidson, Inc. engages in the manufacture and sale of custom, cruiser and touring motorcycles. It operates through the Motorcycles and Related Products; and Financial Services segments. The Motorcycles and Related Products segment manufactures, designs, and sells at wholesale on-road Harley-Davidson motorcycles as well as motorcycle parts, accessories, general merchandise, and related services.

The Financial Services segment comprises of financing and servicing wholesale inventory receivables and retail consumer loans, primarily for the purchase of Harley-Davidson motorcycles. The company was founded by William Sylvester Harley, Arthur Davidson, Walter C. Davidson, Sr. and William A. Davidson in 1903 and is headquartered in Milwaukee, WI.

(Click on image to enlarge)

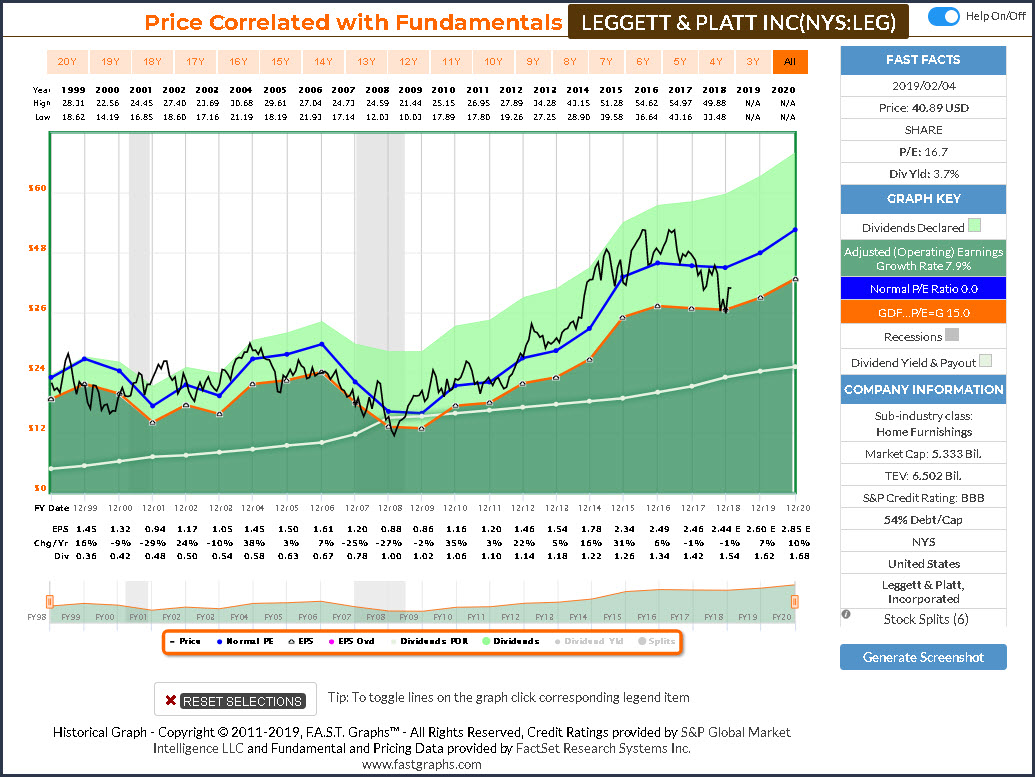

Leggett & Platt, Inc (LEG)

Leggett & Platt, Inc. engages in the manufacture and distribution of furniture and engineered components; and products among homes, offices, automobiles, and commercial aircraft. It operates through the following business segments: Residential Products, Industrial Products, Furniture Products, and Specialized Products.

The Residential Products segment comprises of bedding, fabric and carpet cushion, and machinery. The Industrial Products segment includes drawn wire, wire products, and steel rod. The Furniture Products segment consists of home furniture, work furniture, and consumer products. The Specialized Products segment offers automotive, aerospace, and commercial vehicle products.

The company was founded J. P. Products and C. B. Platt in 1883 and is headquartered in Carthage, MO.

(Click on image to enlarge)

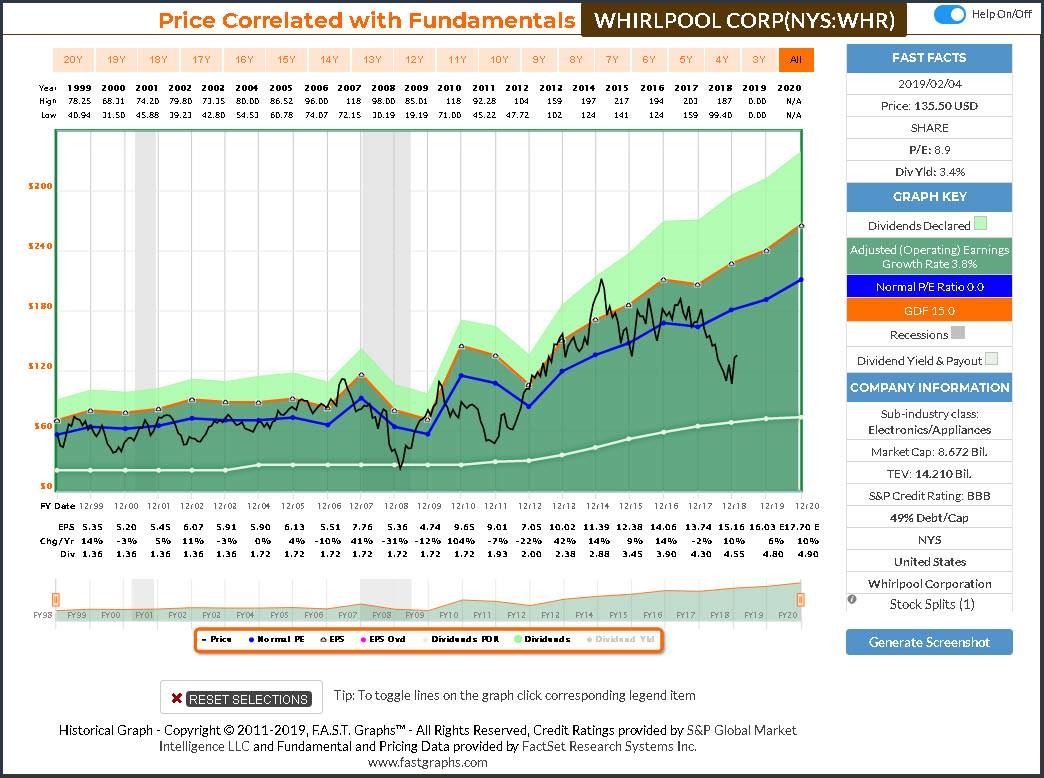

Whirlpool Corp (WHR)

Whirlpool Corp. engages in the manufacturing and marketing home appliances. The company’s products include home laundry appliances, home refrigerators and freezers, home cooking appliances, home dishwashers, and room air-conditioning equipment, mixers, and portable household appliances. Its brands include Whirlpool, Brastemp, Indesit, Maytag, KitchenAid, Jenn-Air, Amana, Bauknecht, Brastemp, and Consul. The company was founded by Emory Upton, Fred Upton, and Louis C. Upton in 1898 and is headquartered in Benton Harbor, MI.

(Click on image to enlarge)

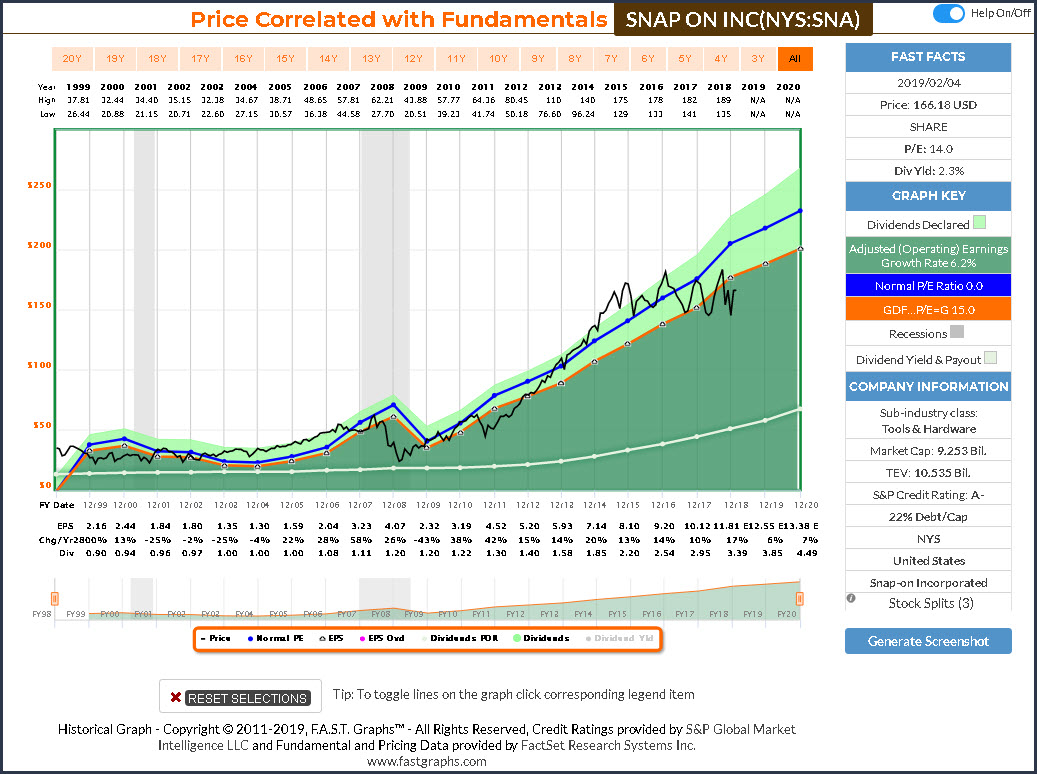

Snap On, Inc (SNA)

Snap-On, Inc. engages in the manufacture and marketing of tools, equipment, diagnostics, repair information, and systems solutions for professional users performing critical tasks. It operates through following segments: Commercial and Industrial Group; Snap-On Tools Group; Repair Systems and Information Group; and Financial Services. The Commercial and Industrial Group segment consists of business operations that serve the aerospace, natural resources, government, power generation, transportation, and technical education markets.

The Snap-On Tools Group segment includes business operations primarily serving vehicle service and repair technicians through worldwide mobile tool distribution channel. The Repair System and Information Group segment serves other professionals vehicle repair customers, primarily owners and managers of independent repair shops and original equipment manufacturer dealerships through direct and distributor channels.

The Financial Services segment comprises of installment sales and lease contracts arising from franchisees’ customers, and business loans and vehicle leases to franchisees. The company was founded by Joseph Johnson and William Seidemann in 1920 and is headquartered in Kenosha, WI.

(Click on image to enlarge)

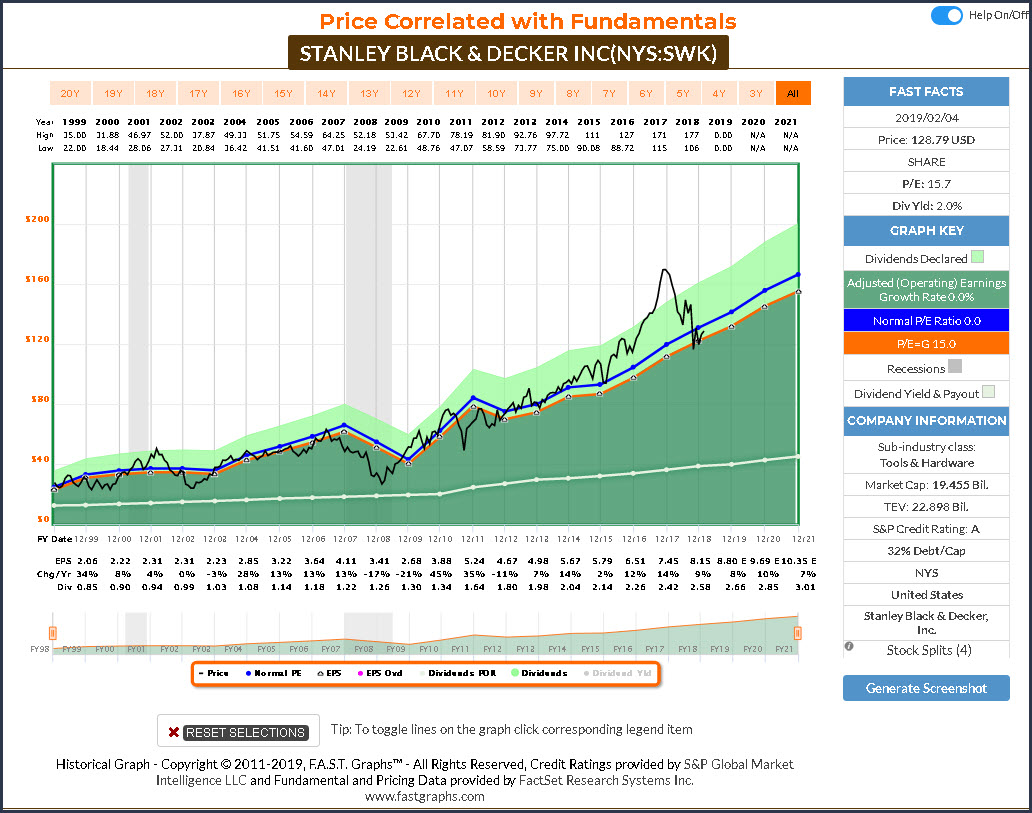

Stanley Black & Decker Inc (SWK)

Stanley Black & Decker, Inc. engages in the provision of power and hand tools, products and services for various infrastructure applications, mechanical access, and healthcare solutions. It also manufactures and markets commercial electronic security and monitoring systems. It operates through the following business segments: Tools and Storage, Security, and Industrial.

The Tools and Storage segment comprises of the power tools and equipment, and hand tools, accessories, and storage businesses. The Security segment includes the convergent security solutions and mechanical access solutions businesses. The Industrial segment encompasses the engineered fastening and infrastructure businesses. The company was founded by Frederick T. Stanley in 1843 and is headquartered in New Britain, CT.

(Click on image to enlarge)

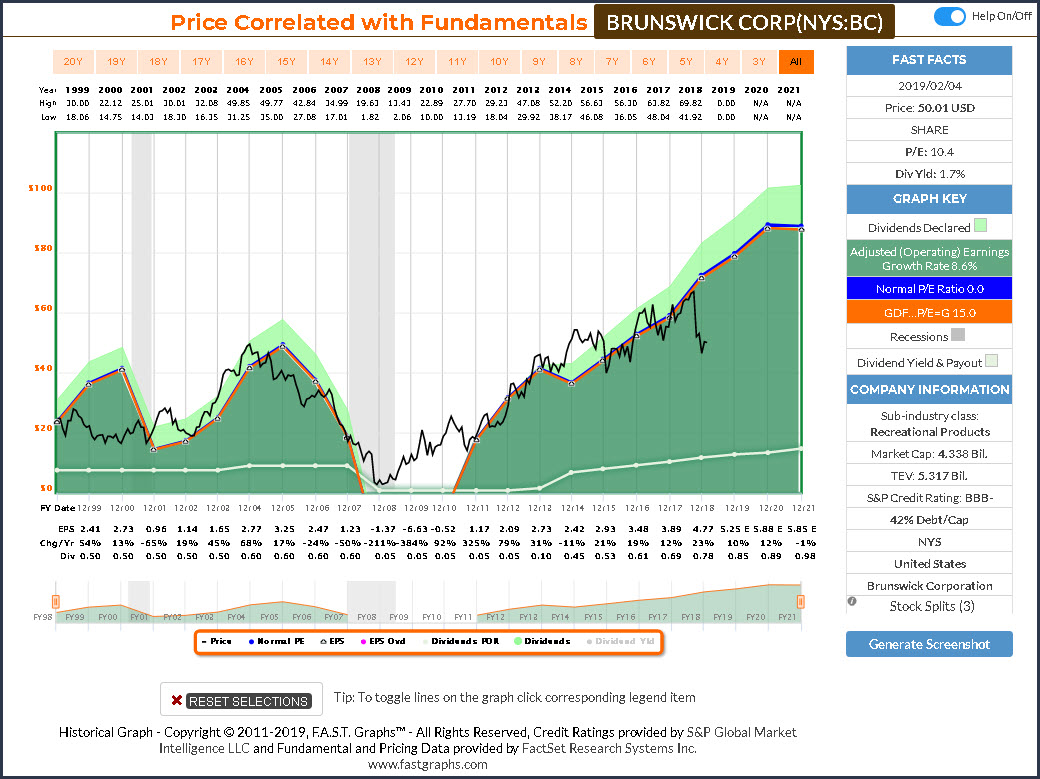

Brunswick Corp (BC)

Brunswick Corp. engages in the design, manufacture, and marketing of recreation products, including marine engines, boats, fitness equipment, and active recreation products. It operates through the following segments: Marine Engine, Boat, and Fitness.

The Marine segment manufactures and sells recreational marine engines and marine parts and accessories. The Boat segment produces and markets boats such as fiberglass pleasure, sports cruiser, sports fishing, and center-console, offshore fishing, aluminum and fiberglass fishing, pontoon, utility, deck, inflatable, and heavy-gauge aluminum. The Fitness segment designs manufactures and markets fitness equipment, including treadmills, total body cross-trainers, stair climbers and stationary exercise bicycles, and strength-training equipment.

The company was founded by John Brunswick in 1845 and is headquartered in Mettawa, IL.

(Click on image to enlarge)

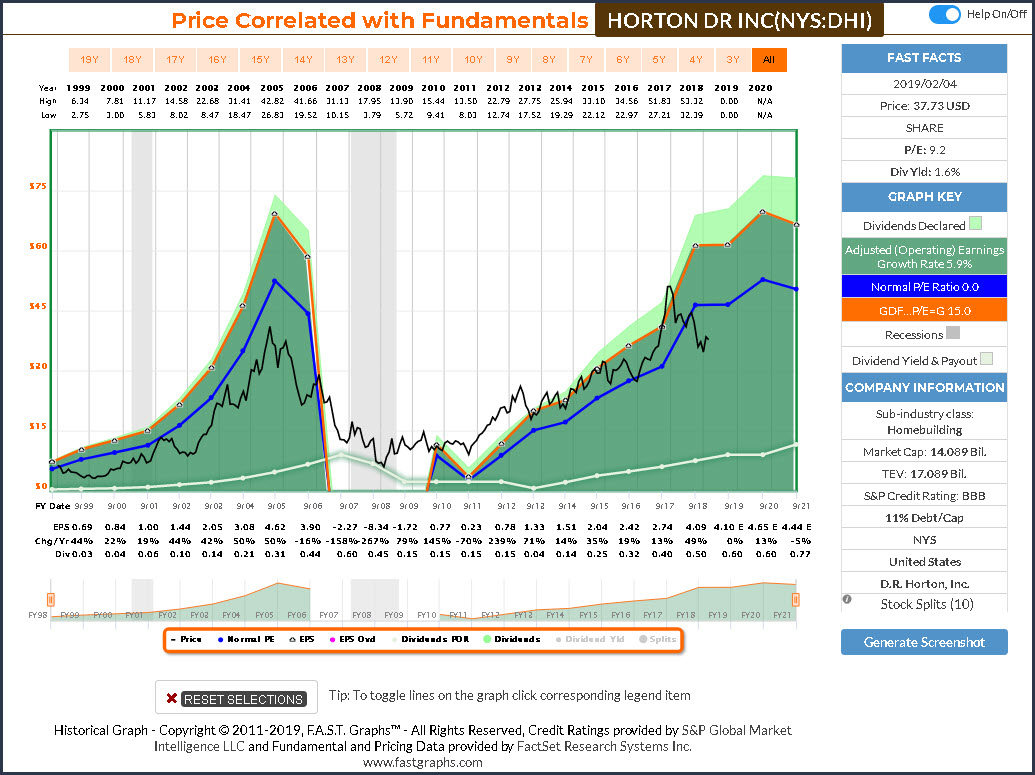

Horton DR Inc (DHI)

D.R. Horton, Inc. operates as a national homebuilder that engages in the construction and sale of single-family housing. It operates through the Homebuilding and Financial Services segments. The Homebuilding segment includes the sub-segments East, Midwest, Southeast, South Central, Southwest, and West regions.

The Financial Services segment provides mortgage financing and title agency services to homebuyers in many of its homebuilding markets. The company was founded by Donald Ray Horton in 1978 and is headquartered in Arlington, TX.

(Click on image to enlarge)

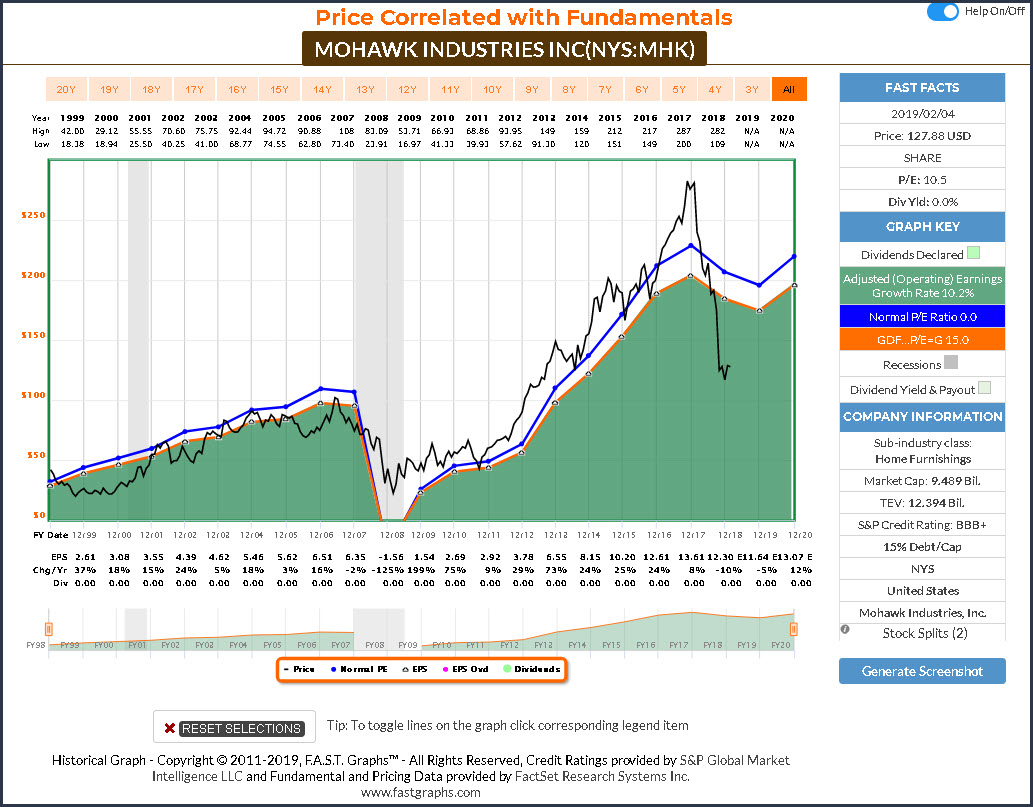

Mohawk Industries Inc (MHK)

Mohawk Industries, Inc. engages in the manufacture, design, and distribution of residential and commercial flooring products. It operates through the following segments: Global Ceramic, Flooring North America (NA), and Flooring Rest of the World (ROW).

The Global Ceramic segment comprises ceramic, porcelain, and natural stone tile products used for wall and floor applications. The Flooring NA segment includes floor covering product lines, in a broad range of colors, textures, and patterns. The Flooring ROW segment consists of laminate, hardwood flooring, and vinyl flooring products, roofing elements, insulation boards, medium-density fiberboard, and chipboards.

The company was founded on December 22, 1988, and is headquartered in Calhoun, GA.

(Click on image to enlarge)

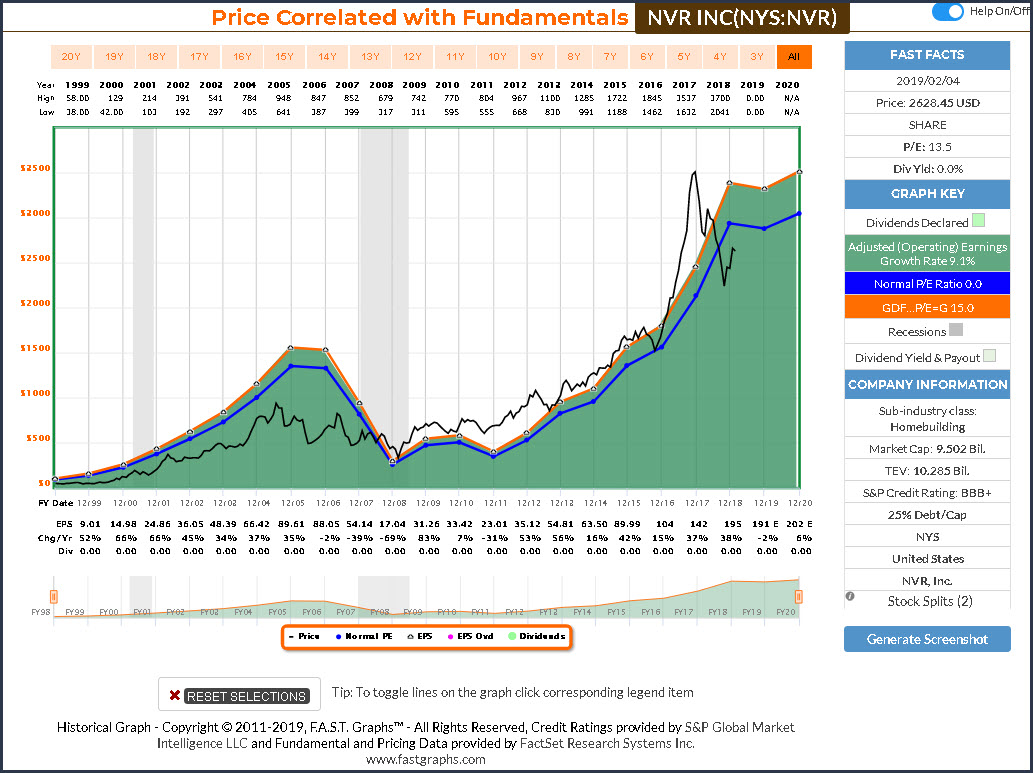

NVR Inc (NVR)

NVR, Inc. engages in the construction and sale of single-family detached homes, townhomes and condominium buildings. It operates through the following segments: Homebuilding and. The Homebuilding segment sells and builds homes under the trade names Ryan Homes, NVHomes, Fox Ridge Homes and Heartland Homes.

The Mortgage Banking segment focuses on serving the needs of the company’s homebuyers. The company was founded in 1980 and is headquartered in Reston, VA.

(Click on image to enlarge)

FAST Graphs Analyze Out Loud Video of the 9 Research Candidates

Video length 00:12:20

Summary and Conclusions

I hope the reader keeps at the forefront of their mind that this series is about identifying attractive valuations in each of the sectors.To be clear, my objective is not to present the very best companies in every sector that I cover. Instead, my goal is to provide potential research candidates that are attractively valued in each of the sectors.

This is very relevant to the Consumer Durables Sector because 6 of the 9 research candidates covered in this article are extremely undervalued in my opinion. Significantly low valuations can be a great risk mitigator for the prudent long-term investor. However, considering the vulnerability that consumer durables have during recessions, even significantly low valuations might not adequately mitigate the risk of investing in them. Therefore, I believe that conducting a comprehensive, and most importantly, ongoing research and due diligence process before investing in any company in this sector is of paramount importance. Although these low valuations portend to produce extremely high short to intermediate term total return potential, investors should remain cognizant of what could happen during an economic downturn.

Finally, I suggest that the reader further note that these are not necessarily great dividend opportunities. Two of the companies covered in this article do not pay a dividend and some that do have a pretty spotty record which includes significant dividend cuts. However, Leggett & Platt and Stanley Black & Decker are Standard & Poor’s Dividend Aristocrats and Snap-On Inc. is a Dividend Challenger. Nevertheless, I believe that investors need to pick and choose to make sure that any of these prospective research candidates are compatible with their goals and objectives.

Disclosure: Long WHR.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the ...

more