Finding Value: Determining The Equity Bond Rate From Shareholder Yields

Self-directed stock investors can and should measure shareholder yields beyond just dividends. When researching stocks for inclusion in my family portfolio I consider a company's returns to shareholders as a leading barometer of the worthiness of owning a slice of that business.

I measure the average of the sum of yields per share on trailing earnings, free cash flow, and dividends and then weigh against the 10-year Treasury rate.

The proprietary equity bond rate modeling gives me a sense of whether a stock is worthy of the assumed higher risk profile compared to the allegedly safer intermediate-term government issue.

Here is an alternative methodology to confirm whether your stocks’ shareholder yields are collectively exceeding the 10-year Treasury rate without the limitations of the dividend growth strategy or the risks of high yield dividend investing.

Shareholder Yields as the Equity Bond Rate

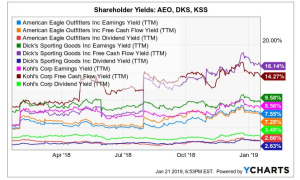

A simple definition of a stock's equity bond rate is how its yields compare to the rates of government-issued bonds. Dividend yields are the typical comp, but I also use two other metrics to measure a stock's current return to shareholders.

Earnings Yield

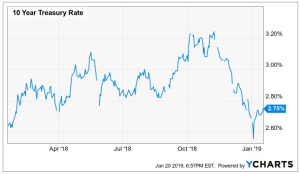

Earnings yield is the annualized trailing GAAP earnings per share divided by the most recent stock closing price. I view earnings yield, the inverse of the price to earnings ratio as the equivalent of a stock's equity bond rate or how a company's earnings compare to the 10-year Treasury rate, which was yielding 2.75% as of this writing.

Thus, I am looking for stocks with earnings yields exceeding 5% or at least 225 basis points (two and a quarter percentage points) above the current 10-year Treasury yield. Targeting earnings yields above 5% is the equivalent of price to earnings ratios below 20 times.

Naturally, the higher the earnings yield (and lower the P/E ratio), the more out of favor the stock appears with Mr. Market. Nevertheless, as a value investor, quality enterprises with high earnings yields get my attention for further research.

Free Cash Flow Yield

Some investors trust free cash flow over earnings due to the GAAP/non-GAAP controversy surrounding earnings calculations. I prefer to analyze the returns for both earnings and free cash flow as opposed to picking one over the other.

To be sure, having more information about a company and its underlying stock is to our advantage. Nonetheless, keep in mind that free cash flow is a byproduct of earnings.

Free cash flow yield is trailing free cash flow per share divided by the most recent closing stock price. I consider a free cash flow yield above 7% as an ideal target as that would signal a free cash flow multiple of under 15 times.

Dividend Yield

I target companies with a dividend yield or the annual dividend rate divided by the most recent stock price that is exceeding 2%; although I will buy the dividend-paying stock of a quality company trading at a reasonable price regardless of its yield.

Avoided are stocks with payout ratios – the percentage of net income allocated to dividends – that approach or exceed 100%.

Ultimately, dividends keep investors compensated in the short term as he or she waits patiently for capital appreciation of the stock over time.

Averaging the yields on trailing earnings, free cash flow, and dividends provide a snapshot of the stock's performance against the benchmark ten-year Treasury rate.

Three Retail Stocks Generating High Shareholder Yields

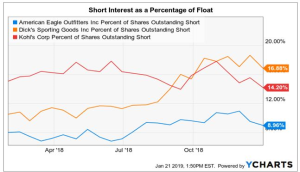

Based on the sentiment meters of short interest – the number or percentage of shares sold short by investors that believe the stock is overvalued – as well as price performance versus the S&P 500 benchmark, three of my favorite traditional retailers are arguably out-of-favor on Wall Street.

Here are my picks, including an elevator pitch for each company as the legendary stock-picker, Peter Lynch reminds us:

Never invest in any idea you can't illustrate with a crayon.

American Eagle Outfitters (AEO) - debt-free, strong online presence, plus the rising star Aerie division.

Dick's Sporting Goods (DKS) - the seemingly last national sporting goods store standing is fundamentally sound with limited competition.

Kohl's (KSS) - masters at the illusion of price discounting, but offers quality merchandise and branding to boot.

Howard Marks, author of the must-read book on controlling investment risk: The Most Important Thing (New York: Columbia University Press, 2011) writes:

The safest and most potentially profitable thing is to buy something when no one likes it.

I empathize with Howard's wisdom and currently rate each stock as consensus picks based on bullish ratings in all five areas of my proprietary research methodology: value proposition, return on management, valuation multiples, downside risk, and shareholder yields – the primary focus of this article.

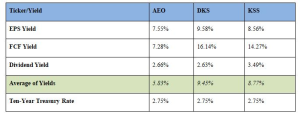

Each company was recently yielding more than double the ten-year treasury when averaging all three metrics: earnings yield, free cash flow yield, and dividend yield.

Table Key

(CSP = current share price at close on Friday, January 18, 2019)

EPS Yield: 12-month trailing GAAP earnings per share divided by CSP

FCF Yield: 12-month trailing free cash flow per share divided by CSP

Dividend Yield: most recent trailing full-year dividend divided by CSP

Average of Yields: average the earnings, free cash flow, and dividend yields

Ten-Year Treasury Rate: U.S. 10-Year Treasury Yield as of article writing

A Balanced Approach to Value-Oriented Investing

Earnings per share are controversial because of creative financial engineering, and that is why free cash flow - or the net cash available after capital expenditures and other asset costs - is arguably a more precise measurement of a company's real net earnings after taxes and investments.

Nonetheless, earnings and cash flow yields are first and foremost valuation tools for measuring a business's market sentiment based on the relationship of its bottom line to its current stock price.

Dividend growth and high yield investors might be satisfied solely by the dividend yield far exceeding the ten-year treasury rate. I take caution that dividends are susceptible to stock price fluctuations, dangerously high payout ratios, and unexpected rate decreases.

The dividend payout from an expensive stock is just that, a costly dividend. Value and price prevail in all areas of investing.

Thus, I believe a more balanced approach to value-oriented, buy-and-hold investing measures the per share yields of earnings and free cash flow as well as dividends.

Measure Shareholder Yields Beyond the Dividend

I advocate that self-directed investors measure shareholder yields beyond the more conventional dividend payout. Earnings and free cash flow yields are telling valuation alternatives, especially if investing in the stocks of non-dividend-paying companies.

As a shareholder, you deserve a compounding return or yield from all legs of the operation's earnings vertical.

And if the shareholder yields are collectively not exceeding the ten-year government bond benchmark, it may signal that the company is not worth the risk of taking an ownership slice.

If the thoughtful, disciplined, and patient investor's measure of the value proposition of the enterprise's products or services; management effectiveness; current value of its stock price; downside risk; and shareholder yields are not compelling, perhaps the stock is no better than a holding a Treasury bond or note backed by the alleged full faith and credit of the U.S. government.

My approach to measuring the equity bond rate is one example. What do you attempt to uncover as a do-it-yourself investor to foster confidence that a targeted stock is potentially more valuable than a conventional government bond over a long-term holding period?

Disclosure: My family portfolio is long AEO, DKS, and KSS.

Copyright 2019 by David J. Waldron. All rights reserved, worldwide.

Disclaimer:

David J. Waldron's ...

more