Finding Growth Stocks In The Teeth Of A Bear Market

Financial statement updates for the third and pre-election quarter will begin soon. Corporate growth is falling very broadly and on average. Only a few of the largest companies are recording a sales growth improvement in the recent second-quarter update now complete.

The third quarter will give us some evidence of the timing of a recovery from the recent growth decline that began in the third quarter of 2018. What will be of most interest is the decline in the average gross profit margin. An unusually large proportion of US companies are recording a decline. The gross profit margin is a valuable predictor of share prices.

The recent increase in share prices is a recovery rally in a downtrend and should be used to sell shares of companies with falling growth. The current extended share prices are reflecting unusually low interest rates that support stock values relative to sales of 2.3 times. That is the highest price to sales since the peak of the tech bubble in 2000. Extended share prices are also indicating that investors are expecting that growth will rebound shortly and strongly. Evidence from the second quarter indicates the opposite.

That makes the third-quarter financial statement updates more useful than ever. If we see an increase in the frequency of improvement in sales growth and an increase in the frequency of improving gross profit margins, it is more likely than a recovery is underway. Otherwise, the recent share price advance is vulnerable.

Major Bear Market

We are in the teeth of a major bear market now. Average sales growth is down to 6% from 14% at the peak in 2018 and still high relative to 2.2% at the lowest point in 2002 (post tech bubble) and -9% in 2009 (post financial crisis). This decline is so broad and so deep and from such a high level, the bottom is nowhere in sight. Meanwhile, a very weak financial condition makes the survival of many companies unlikely.

Sell falling growth companies now while prices are at a premium. Own only stocks of companies with exceptional attributes. Expeditors International of Washington Inc (Nasdaq: EXPD), which is demonstrating a quality growth pattern with strong fundamentals. Visit Otos.io for more information on how Otos communicates changing fundamentals attributes with the MoneyTree avatar (See Expeditors International’s ’s MoneyTree below).

Expeditors International of Washington, Inc $91.320 BUY this rich company getting better

Expeditors International has been an exceptionally profitable company with a persistently high cash return on total capital of 41.9% on average over the past 21 years. Over the long term the shares of Expeditors International have advanced by 22% relative to the broad market index.

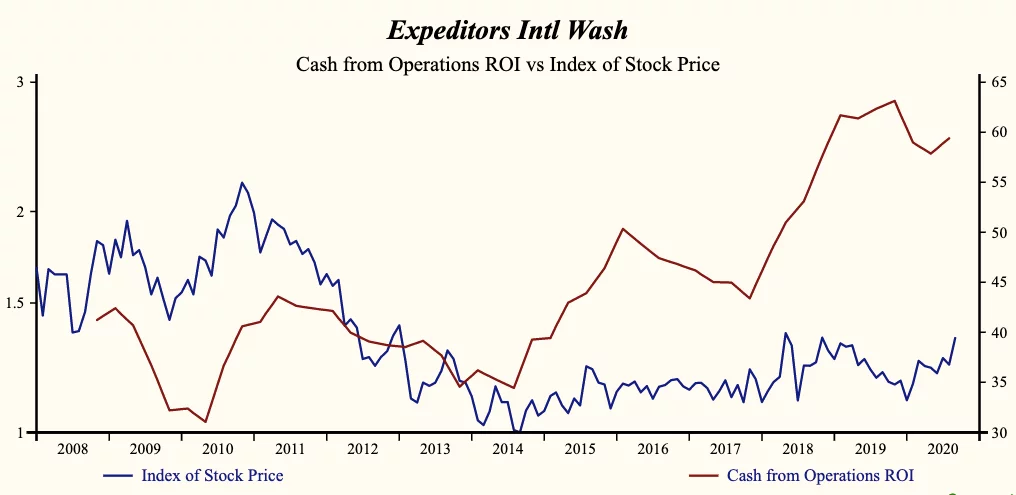

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash flow from operations (ROI) which has been 84% correlated with the share price with a one-quarter lead.

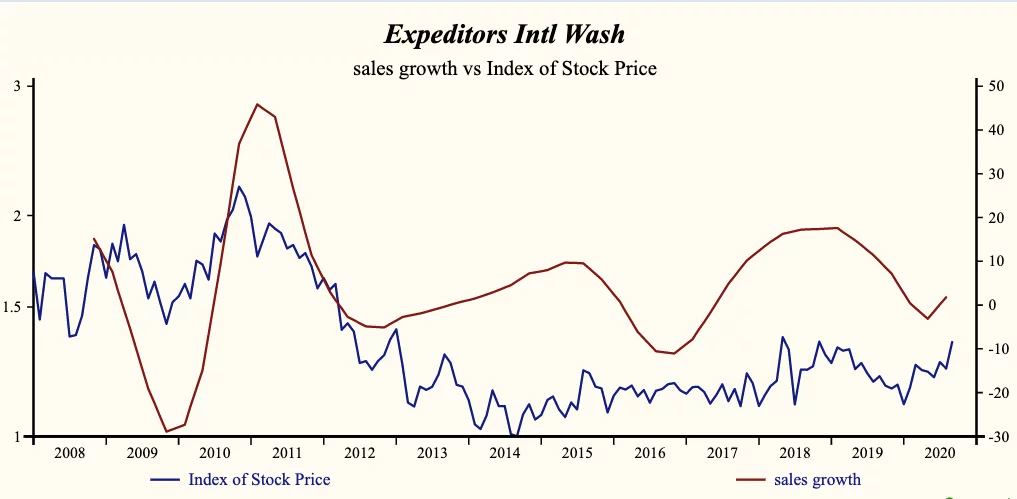

Currently, sales growth is 1.8% which is low in the record of the company but higher than last quarter sand once again positive. Receivable turnover has been falling steadily since 2018 and improves the quality of sales growth.

The company is recording a high, very stable, and mildly rising gross profit margin. Another dominant factor in the Growth group which has been 85% correlated with the share price with a five-quarter lead. The stronger profit margins and continuous reduction in costs has been supporting cash flow from operations since 2018. Currently, cash flow is high and trending upwards once again.

The current indicated annual dividend produces a yield of 1.2%. The current trailing operating cash-flow coverage of the dividend is 4.1 times.

The current share price provides a good opportunity to buy the shares of this evidently accelerating company.

Pierre Raymond is a 25-year veteran of the Financial Services industry. Driven by his passion for financial technology he has transitioned from being a quantitative stock picker, to an award-winning hedge fund manager, credit risk manager to currently a RISK IT Business Consultant. Pierre is the cofounder of Global Equity Analytics & Research Services LLC (GEARS) and a current partner at OTOS Inc.

Disclaimer: This article is not an investment recommendation, Please see our disclaimer - Get our 10 ...

more