Fidus Investment Corporation Announces First Quarter 2016 Financial Results

EVANSTON, Ill., May 05, 2016 (GLOBE NEWSWIRE) -- Fidus Investment Corporation (NASDAQ:FDUS) (“Fidus” or the “Company”), a provider of customized debt and equity financing solutions primarily to lower middle-market companies based in the United States, today announced its financial results for the first quarter ended March 31, 2016.

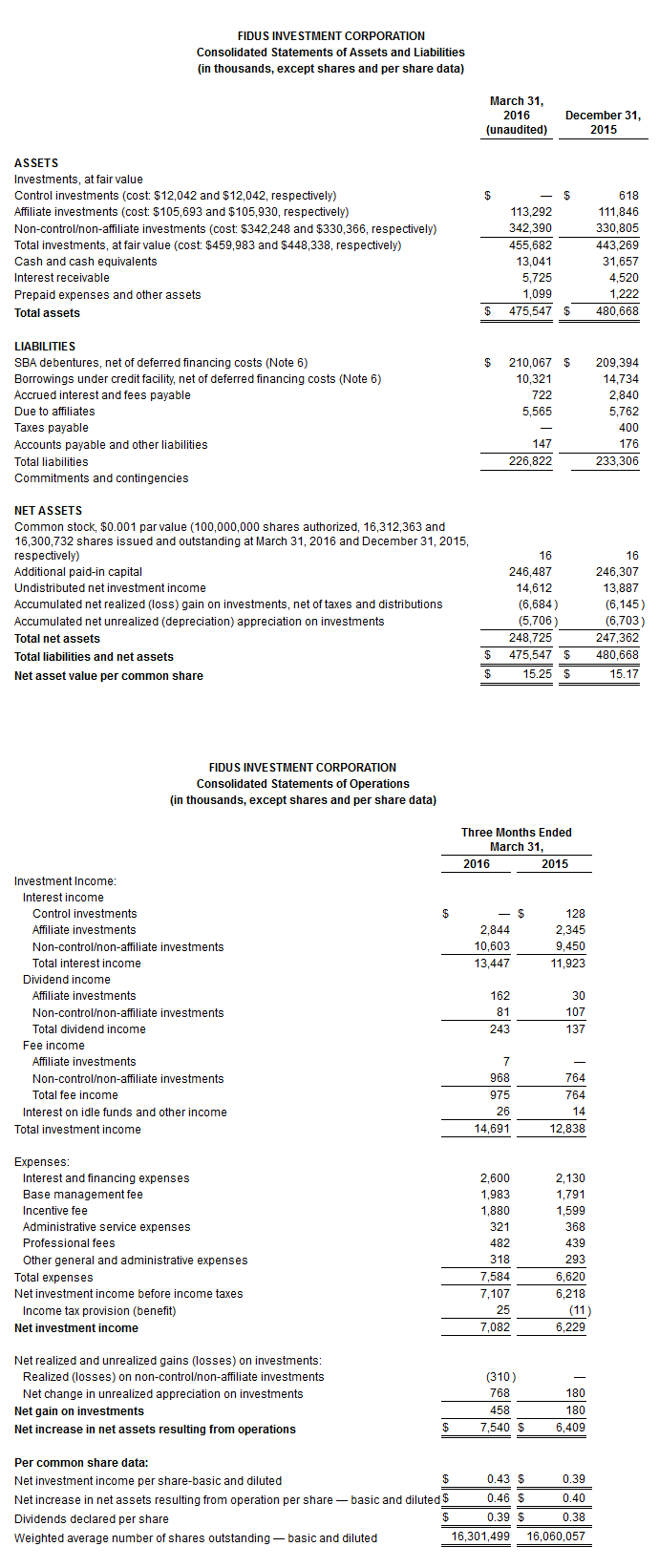

First Quarter 2016 Financial Highlights

- Total investment income of $14.7 million

- Net investment income of $7.1 million, or $0.43 per share

- Adjusted net investment income of $7.2 million, or $0.44 per share(1)

- Net increase in net assets resulting from operations of $7.5 million, or $0.46 per share

- Invested $42.3 million in debt and equity securities, including investments in three new portfolio companies

- Received proceeds from sales and realizations of $31.6 million

- Paid regular quarterly dividend of $0.39 per share on March 25, 2016

- Net asset value (NAV) of $248.7 million, or $15.25 per share, as of March 31, 2016

Management Commentary

“For the first quarter, our diverse portfolio continued to produce adjusted net investment income growth and covered our regular quarterly dividend. Compared to the same period last year, adjusted net investment income increased 12.8%,” said Edward Ross, Chairman and CEO of Fidus Investment Corporation. “From an investment perspective, the first quarter was relatively robust due in part to closings of new portfolio company investments from the fourth quarter’s pipeline. Although investment activity is currently slow relative to the past several quarters, we believe that adhering to our proven strategy of focusing on high-quality companies that generate strong free cash flow and have positive long-term outlooks will keep us well positioned to perform well over the long term.”

(1) Supplemental information regarding adjusted net investment income:

On a supplemental basis, we provide information relating to adjusted net investment income, which is a non-GAAP measure.This measure is provided in addition to, but not as a substitute for, net investment income.Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses.The management agreement with our advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses.In addition, we accrue, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate.As such, we believe that adjusted net investment income is a useful indicator of operations exclusive of any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. Reconciliations of net investment income to adjusted net investment income are set forth in Schedule 1.

First Quarter 2016 Financial Results

For the three months ended March 31, 2016, total investment income was $14.7 million, an increase of $1.9 million, or 14.4%, over the $12.8 million of total investment income for the three months ended March 31, 2015. The increase was attributable to a $1.5 million increase in interest income resulting largely from higher average levels of debt investments outstanding, a $0.1 million increase in dividend income due to increased levels of distributions received from equity investments and a $0.2 million increase in fee income resulting from a higher level of prepayment activity for the three months ended March 31, 2016, as compared to the three months ended March 31, 2015.

For the three months ended March 31, 2016, total expenses, including income tax provision, were $7.6 million, an increase of $1.0 million or 15.1%, over the $6.6 million of total expenses, including income tax provision, for the three months ended March 31, 2015. Interest and financing expenses for the three months ended March 31, 2016 were $2.6 million, an increase of $0.5 million or 22.1%, compared to $2.1 million for the three months ended March 31, 2015 as a result of higher average balances of SBA debentures and borrowings under the Credit Facility outstanding during 2016. The base management fee increased $0.2 million, or 10.7%, to $2.0 million for the three months ended March 31, 2016 due to higher average total assets less cash and cash equivalents for the three months ended March 31, 2016 than the three months ended March 31, 2015. The incentive fee for the three months ended March 31, 2016 was $1.9 million, a $0.3 million, or 17.6%, increase from the $1.6 million incentive fee for the three months ended March 31, 2015 which was primarily the result of a $0.2 million increase in the income incentive fee to $1.8 million. The administrative service fee, professional fees and other general and administrative expenses totaled $1.1 million for both the three months ended March 31, 2016 and March 31, 2015.

Net investment income for the three months ended March 31, 2016 was $7.1 million, which was an increase of $0.9 million, or 13.7%, compared to net investment income of $6.2 million during the three months ended March 31, 2015 as a result of the $1.9 million increase in total investment income and the $1.0 million increase in total expenses, including income tax provision.

For the three months ended March 31, 2016, the total realized loss on investments was $0.3 million. During the three months ended March 31, 2016, Fidus recorded a net change in unrealized appreciation on investments of $0.8 million attributable to (i) the reversal of net unrealized depreciation on investments of $0.9 million related to the exit or sale of investments, resulting in unrealized appreciation, (ii) net unrealized depreciation of $5.9 million on debt investments and (iii) net unrealized appreciation of $5.8 million on equity investments.

Fidus’ net increase in net assets resulting from operations during the three months ended March 31, 2016 was $7.5 million, or an increase of $1.1 million, or 17.6%, compared to a net increase in net assets resulting from operations of $6.4 million during the prior year period.

Per share results for the first quarter ended March 31, 2016 are based on weighted average shares outstanding of 16.3 million, compared to 16.1 million weighted average shares outstanding for the first quarter of 2015, an increase of 1.5%. This increase reflects shares sold under the at-the-market offering.

Portfolio and Investment Activities

As of March 31, 2016, Fidus had debt and equity investments in 53 portfolio companies with an aggregate fair value of $455.7 million, or approximately 99.1% of cost. The average portfolio investment on a cost basis was $9.2 million (which excludes three investments in portfolio companies that sold their operations and are in the process of winding down) and Fidus held equity ownership in 84.9% of its portfolio companies. During the first quarter ended March 31, 2016, Fidus invested $42.3 million in debt and equity investments, including three new portfolio companies and received proceeds from sales and realizations of $31.6 million. As of March 31, 2016, the weighted average yield on debt investments (excluding any debt investments on non-accrual) was 13.3%.

First quarter 2016 investment activity included the following new portfolio company investments:

- OMC Investors, LLC, doing business as Ohio Medical Corporation, a manufacturer and distributer of medical suction and oxygen therapy products and source equipment. Fidus invested $10.5 million in subordinated notes and common equity.

- Thermoforming Technology Group LLC, a designer and manufacturer of thermoforming equipment, tooling and aftermarket parts. Fidus invested $13.9 million in subordinated notes and common equity.

- Hub Acquisition Sub, LLC, doing business as Hub Pen, a supplier and decorator of promotional writing instruments. Fidus invested $12.1 million in subordinated notes and common equity.

Fidus had debt investments in one portfolio company on non-accrual status as of March 31, 2016, which represented 1.1% of the portfolio cost and 0.0% of the portfolio fair value as of that date.

Liquidity and Capital Resources

As of March 31, 2016, Fidus had $13.0 million in cash and cash equivalents. SBA debentures outstanding were $214.0 million and unfunded SBA commitments totaled $11.0 million as of March 31, 2016. Fidus had $11.0 million of borrowings outstanding on its senior secured revolving credit facility as of March 31, 2016. The weighted average interest rate on debt outstanding as of March 31, 2016 was 4.1%.

Second Quarter 2016 Dividend of $0.39 Per Share Declared

On May 2, 2016, the Company’s Board of Directors declared a regular quarterly dividend of $0.39 per share for the second quarter of 2016 payable on June 24, 2016 to stockholders of record as of June 10, 2016.

When declaring dividends, the Company’s Board of Directors reviews estimates of taxable income available for distribution, which differs from consolidated income under generally accepted accounting principles due to (i) changes in unrealized appreciation and depreciation, (ii) temporary and permanent differences in income and expense recognition, and (iii) the amount of undistributed taxable income carried over from a given year for distribution in the following year. The final determination of 2016 taxable income, as well as the tax attributes for 2016 dividends, will be made after the close of the 2016 tax year.The final tax attributes for 2016 dividends will generally include ordinary taxable income but may also include capital gains, qualified dividends and return of capital.

Fidus has adopted a dividend reinvestment plan (“DRIP”) that provides for reinvestment of dividends on behalf of its stockholders, unless a stockholder elects to receive cash. As a result, when the Company declares a cash dividend, stockholders who have not “opted out” of the DRIP at least three days prior to the dividend payment date will have their cash dividends automatically reinvested in additional shares of the Company’s common stock. Those stockholders whose shares are held by a broker or other financial intermediary may receive dividends in cash by notifying their broker or other financial intermediary of their election.

First Quarter 2016 Financial Results Conference Call

Management will host a conference call to discuss the operating and financial results at 9:00am ET on Friday, May 6, 2016.To participate in the conference call, please dial (877) 810-3368 approximately 10 minutes prior to the call. International callers should dial (914) 495-8561.Please reference conference ID # 84418533.

A live webcast of the conference call will be available at http://investor.fdus.com/events.cfm.Please access the website 15 minutes prior to the start of the call to download and install any necessary audio software.

A telephone replay of the conference call will be available from 12:00pm ET on May 6, 2016 until 11:59pm ET on May 10, 2016 and may be accessed by calling (855) 859-2056 (domestic dial-in) or (404) 537-3406 (international dial-in) and reference conference ID # 84418533.An archived replay of the conference call will also be available in the investor relations section of the Company’s website.

ABOUT FIDUS INVESTMENT CORPORATION

Fidus Investment Corporation provides customized debt and equity financing solutions to lower middle-market companies, which the Company generally defines as U.S. based companies having revenues between $10.0 million and $150.0 million. Fidus’ investment objective is to provide attractive risk-adjusted returns by generating both current income from our debt investments and capital appreciation from our equity related investments. Fidus seeks to partner with business owners, management teams and financial sponsors by providing customized financing for change of ownership transactions, recapitalizations, strategic acquisitions, business expansion and other growth initiatives.

Fidus is an externally managed, closed-end, non-diversified management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940, as amended. In addition, for tax purposes, Fidus has elected to be treated as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue Code of 1986, as amended, or the Code. Fidus was formed in February 2011 to continue and expand the business of Fidus Mezzanine Capital, L.P., which commenced operations in May 2007 and is licensed by the U.S. Small Business Administration as a small business investment company.

FORWARD-LOOKING STATEMENTS

This press release may contain certain forward-looking statements. Any such statements, other than statements of historical fact, are based on management’s current expectations, estimates, projections, beliefs and assumptions about the Company, its current and prospective portfolio investments, and its industry. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the Company’s control, difficult to predict and could cause actual results to differ materially from those expected or forecasted in such forward-looking statements. Actual developments and results are likely to vary materially from these estimates and projections as a result of a number of factors, including those described from time to time in Fidus’ filings with the Securities and Exchange Commission. Such statements speak only as of the time when made, and Fidus undertakes no obligation to update any such forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Schedule 1

Supplemental Information Regarding Adjusted Net Investment Income

On a supplemental basis, we provide information relating to adjusted net investment income, which is a non-GAAP measure.This measure is provided in addition to, but not as a substitute for, net investment income. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses.The management agreement with our advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year.In addition, we accrue, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate.As such, we believe that adjusted net investment income is a useful indicator of operations exclusive of any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income for the three months ended March 31, 2016 and 2015.

(1) Adjusted net investment income per share amounts are calculated as adjusted net investment income dividend by weighted average shares outstanding for the period. Due to rounding, the sum of net investment income per share and capital gains incentive fee accrual expense amounts may not equal the adjusted net investment income per share amount presented here.

Company Contact: Edward H. Ross Chief Executive Officer Fidus Investment Corporation 847-859-3940 Investor Relations Contact: Jody Burfening LHA (212) 838-3777 jburfening@lhai.com

Disclosure: None.