Fed Not Even Close To Guiding For Rate Hikes

Fed Meeting Coming

Fed’s September meeting is on Wednesday. We all don’t expect the Fed to raise rates for the next year at least, so it’s obviously not going to do so this week. In fact, you can't find anyone who thinks the Fed will raise rates at this meeting. The chart below shows Cornerstone Macro’s projection for the median dots in 2021, 2022, 2023, and the long run.

They see no change from the June meeting. Keep in mind, 2023 guidance is new because we are almost done with this year. Personally, I wouldn’t be shocked if the Fed raised rates in 2023 or even before then.

(Click on image to enlarge)

Remember, current guidance is about manipulating the current economy, not actually predicting in earnest when rates will change. If the Fed was to project a rate hike in 2023, it would cause the stock market to swoon because that’s a hawkish move. Speculation would be that if the Fed is willing to come out in favor of future rate hikes with the unemployment rate still high, imagine what they will do when the unemployment rate falls further.

People would speculate if this was the first change of many even if the Fed said that it wouldn’t change its guidance. Therefore, it’s impossible for guidance to change in the near term even though rates might be hiked in 2022 or 2023.

Guidance might not even change for all of 2021. It depends on how the new COVID-19 testing, treatments, and vaccines go. It will be interesting to see if the points made in the Jackson Hole speech slightly alter anything the Fed does. People are very interested in the Fed’s projection for the unemployment rate in 2021 since it has fallen so much recently.

Bad News For Mobility

Mobility took a hit this past week because the spike in traveling was related to the Labor Day holiday weekend. The chart below shows the 7-day moving average of the mobility composite index took a nosedive in the past few days. TSA throughput growth has been flat in the past few months as it is currently down 67% yearly.

(Click on image to enlarge)

The best day in the past few months has been down 55.95%. A decline in COVID-19 cases and deaths hasn’t encouraged people to travel more. If the Abbott tests are in all the airports and people can be assured no one on flights has the virus, traveling will pick up. We have seen a much bigger improvement in the past couple of months in Mexican air traffic. Eventually, the entire globe will be on the same page.

Countries can’t afford to lose business to others that allow travel. There is a race to get the economy back to normal. As soon as air travel is expected to come back, the airline stocks will rise, and Zoom ZM stock will fall. Zoom was up 5.36% on Monday (oversold rally).

Despite the decline in air travel following the holiday weekend, the JETS airline ETF was up 2.23% which was slightly better than the rest of the market. Buyers care more about the new tests, vaccines, and treatment than they do about current travel. Although, obviously an improvement in travel would be a positive.

The good news is that AstraZeneca AZN restarted its vaccine trial in Britain on Saturday after investigating 1 person’s serious side effects. The trial in America is going to be on hold until at least mid-week. Pfizer recently stated it will know if its vaccine works by the end of October. That’s going to be a huge event for markets. The firm is upping its trial population from 30,000 to 44,000.

Poor Can’t Work From Home

The economy needs to normalize. It’s not possible for the economy to exist in this manner sustainably. Too many industries have been disrupted in a bad way. We often hear of the word ‘disruption’ to mean a better technology such as video streaming beating out cable. This COVID-19 situation has been anything but a positive. We’ve utilized technology to make the economy work better, but it’s not a better solution in most cases.

As you can see from the chart below, it’s rare for people making under $75,000 to be able to work from home. That means the middle class and poor are either essential workers or aren’t working. This spring, being an essential worker was an issue because the virus was much more prevalent and deadly.

Now that the virus is more under control, the economic impact is a bigger problem as workers in the industries most affected by the virus become permanently unemployed.

(Click on image to enlarge)

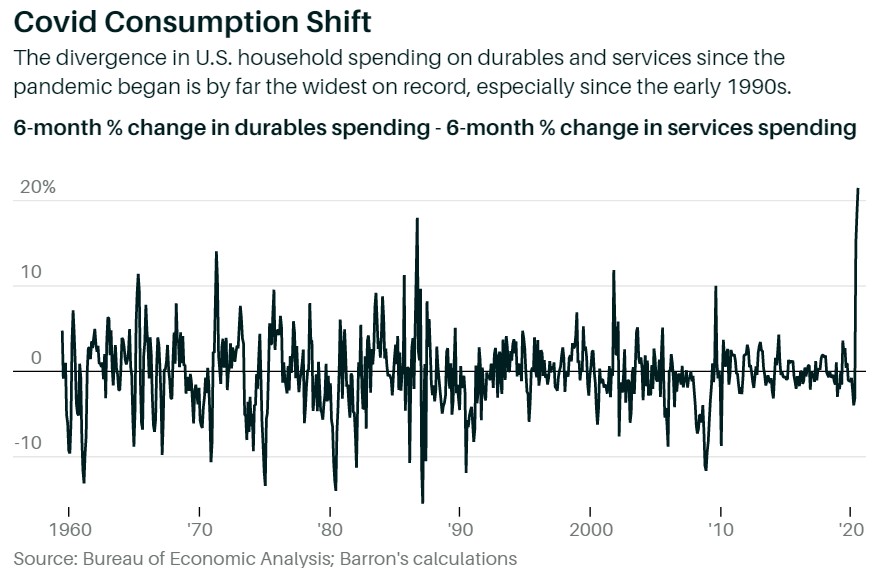

Big Spending Shift

COVID-19 crisis caused the biggest ever shift in spending in such a short period. As you can see from the chart below, the 6 month growth rate in spending on durables exceeded the 6 month change in services spending growth by the largest ever going back to 1960.

This is a services economy, so this is a major issue. There has been inflation in housekeeping supplies, appliances, and used cars and trucks because of this shift. It’s amazing the unemployment rate is this low with such a disruption in the sector that employs the most workers.

(Click on image to enlarge)

There is about to be a major boon in the labor force if the Abbott tests work. We already have seen a decline in COVID-19 cases and deaths. We just need an excuse or a fallback that allows businesses and consumers to go back to normal guilt-free. There was a major weekly increase in deaths and cases compared to last Monday because we lapped the holiday. There were 38,072 new cases and 480 new deaths.

The good news is there are only 29,795 hospitalizations. This recent decline below 30,000 is the first time it went below that marker since late spring. They were below 30,000 for just a couple weeks before the 2nd wave of hotspots cropped up. 7 day average of deaths should fall below the July trough with such low hospitalizations. It’s amazing to see no spike in cases despite some schools having kids in attendance.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more