Fastly And The TikTok Drama: Be Greedy When Others Are Fearful

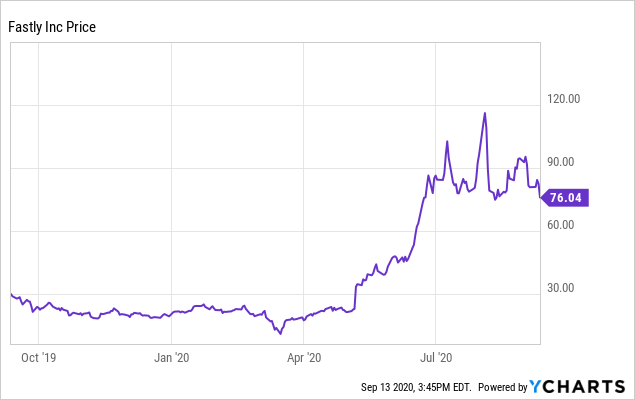

Fastly (FSLY) stock is under considerable pressure lately. The stock reached all-time highs at almost $118 per share on August 6, and then it declined by over 35% from those levels in a short period of time. As of the time of this writing - Sunday, September 13th - Fastly is trading in the neighborhood of $76 per share.

Part of this recent decline is due to fluctuating market sentiment. Many high-growth stocks in the technology sector got too extended to the upside a few weeks ago, and corrections are perfectly natural and even to be expected when this happens.

More importantly, Fastly announced in the most recent earnings report that TikTok accounts for 12% of the company's revenue. Investors are getting increasingly worried about the possibility that Fastly could lose this business due to the massive uncertainty surrounding the future of TikTok in the United States right now.

Nobody likes uncertainty, but short-term volatility can be a great source of opportunity for long-term investors with a strategic mindset, and this seems to be the case when it comes to Fastly stock in the current environment.

The Big Picture

Fastly declined by 35% from its highs of the year, but the stock is still up by over 150% in the past 12 months. In fact, Fastly is still trading at levels from a few days ago; so the decline is not as bad as it seems to be when you zoom out the time frame a little bit.

Data by YCharts

Growth stocks in general, and Fastly in particular, were exhibiting parabolic price charts before this correction, and nobody should be too surprised to see prices pulling back after such a steep rally. Corrections are not only necessary and unavoidable but even healthy.

It is not about market sentiment alone, though. Fastly makes 12% of revenue from TikTok, with approximately half of that coming from the U.S. Considering the much uncertain situation being faced by TikTok, this is generating a cloud of negativity around Fastly recently.

The most recent news - as of Sunday night - is that Oracle (ORCL) will become "TikTok's technology partner in the U.S" We still need to see exactly what this means for the companies involved, but it sounds like a venue for TikTok to continue operating in the U.S. without selling the company. Nevertheless, the situation has been spectacularly volatile and dynamic over time, and there are no confirmations regarding Fastly's relationship with TikTok going forward.

I am personally under the impression that the market is overestimating this risk, but that is beyond the point. For the sake of the argument, we can assume that Fastly is going to completely lose TikTok for whatever reason, and this still would not invalidate the long-term investment thesis in Fastly.

Fastly is one of the top players in edge networks, a market with massive potential for growth in the long term. According to data from Gartner, as quoted in this excellent article in hypergrowth:

Around 10% of enterprise-generated data is created and processed outside a traditional centralized data center or cloud. By 2025, Gartner predicts this figure will reach 75%.

Fastly can easily produce revenue growth rates well above 30% over the next several years, the business model scales very well and Fastly has enormous opportunities to expand into new areas over time. The recent acquisition of Signal Sciences is a great example.

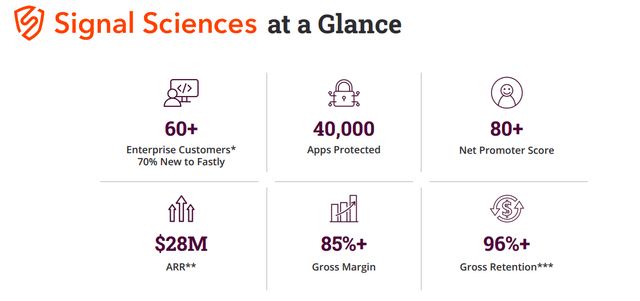

With this move, Fastly is making big inroads into security with a deal that has many advantages from a strategic perspective. The company is significantly broadening its portfolio and accelerating the adoption of Compute@Edge. Fastly is also gaining access to over 60 enterprise customers, 70% of them new to Fastly, and the transaction will have a positive impact on margins since Signal Sciences makes a juicy gross profit margin of over 85% of revenue.

Source: Fastly

As a Fastly shareholder, this is exactly what I want to see. Management executing well on a quarter to quarter basis and also planting the seeds of long-term growth by entering new markets and industries with abundant potential for expansion.

Risk And Reward Going Forward

Warren Buffett famously said that investors should be greedy when others are fearful. This piece of advice makes a lot of sense from an intellectual point of view, but being greedy when others are fearful is much easier said than done. This is precisely why it works, the strategies that produce superior returns generally require a long-term perspective and mental fortitude.

It is impossible to know how the TikTok situation will evolve and how it is going to affect Fastly in the short term. Nevertheless, even under pessimistic assumptions, Fastly is well-positioned for massive growth in the years ahead, with or without TikTok.

The stock is still not cheap at all at current levels, Fastly is currently trading at a price to sales ratio around 27 times revenues expectations for 2020 and 20 times sales estimates for 2021. These valuation levels are in line with those of the best companies in the sector; so Fastly can't afford to disappoint investors in terms of execution from current price levels.

But the company still offers enormous room for appreciation over the long term. Edge computing is a massive opportunity, and Fastly has both the technological capabilities and the management vision to become one of the leading players in this huge market over the years ahead.

The recent acquisition of Signal Sciences shows how innovative growth companies such as Fastly can expand into new sectors over time, which allows them to sustain rapid growth rates for much longer than the market expects. In simple terms, if the company can outperform growth expectations, this generally means that the stock is ultimately cheaper in comparison to fundamental value than the market assumes.

Fastly currently has a market capitalization value of around $8 billion, so the company is still relatively small and it has enormous room for expansion if it keeps executing well. It is not unreasonable at all to say that Fastly could be a $50 billion market cap company over the next 5 or 10 years. On a longer time frame, I think that Fastly can be worth much more than that.

The path to big cumulative returns for investors is always volatile and uncertain, and this is the way that it is supposed to be. Holding on to big winners is not supposed to be easy. If it were easy, everyone would do it, and this would erode the opportunities for superior returns.

Predicting price movements in the short term is always uncertain, and it is even more uncertain than usual when it comes to Fastly in the current situation. Nevertheless, chances are that investors willing to hold Fastly over the long term, ideally buying more on pullbacks, will be rewarded with superior returns over the years ahead.

Disclosure: I am/we are long FSLY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more