FANG Dominates The Market: Can You Go Long Anything Else?

COVID-19 Update

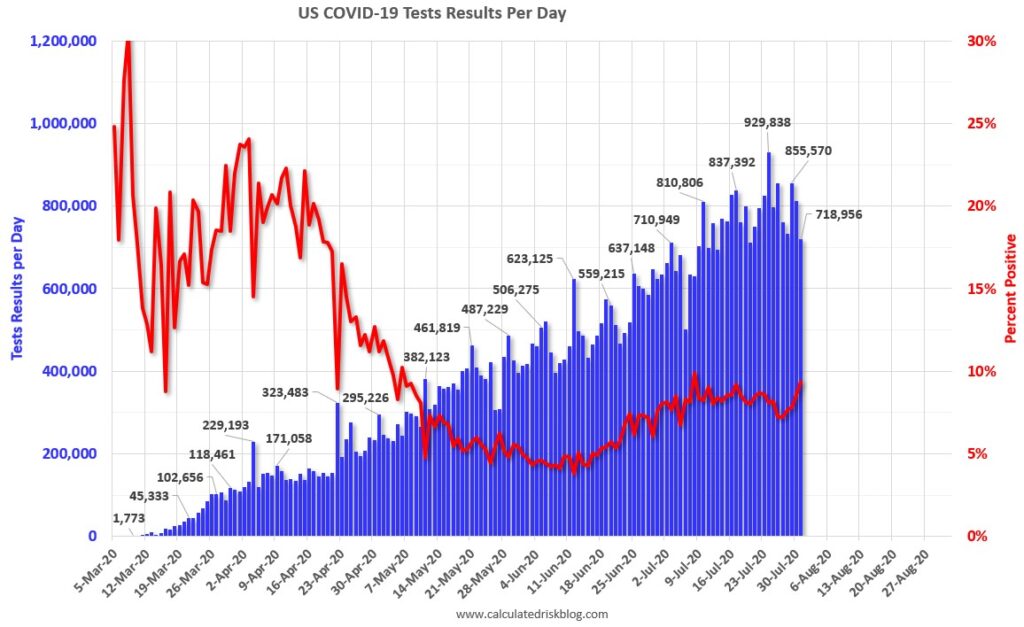

There is a seesaw-like relationship between the number of COVID-19 tests and the positive rate. If there is a huge spike in tests, cases will likely increase modestly and the positive rate will likely fall. If testing falls, cases fall and the positive rate rises. That’s what we saw on Friday, July 31. As you can see in the chart below, there were only 718,956 tests, which pushed up the positive rate.

Did people decide they didn’t need to get tested, or was there a limit in the number of tests that could have been done? With the rate in the single digits, most people are testing negative. The government isn’t encouraging widespread testing for people who don’t have symptoms. If less people feel they need a test, testing will fall and there’s nothing we can do about that. This is why hospitalizations and deaths matter. Those aren’t a choice.

Specifically, there were 70,904 cases on Friday, which sounds bad, but it actually brought the seven day average down because there were 78,407 last Friday. There are almost always the most cases on Friday, and the least on Sunday and Monday. There were 1,462 new deaths.

We can expect next week to either show no increase in deaths or a slight decrease. A decline will pick up steam as August goes on. Hospitalizations peaked along with cases, which means deaths will fall. Major League Baseball is grappling with the prospect of canceling the season which likely hurts sentiment on the possibility of children going back to school. At least the hotspots have cooled off modestly in the past week.

FANG Rules The Day

In the past couple months and the past six years, the FANG stocks have ruled the market. In fact, the bottom 495 stocks have barely had any returns in the past few years. Friday was a continuation of the trend, except extreme. NYSE advance decline was -526.

In the afternoon, there was a point where the Nasdaq 100 was up 1.25% and 75% of the stocks in it were down. S&P 500 closed up 0.77% and the Nasdaq closed up 1.49%.

The Dow was only up 0.44% even though its biggest member, Apple (AAPL), was up 10.47%. Apple is 11% of the index. Its stock is splitting into 4, which means its weighting in the Dow will fall because it is price weighted. The Dow looks extremely outdated, as Apple and Microsoft (MSFT) are the only exciting tech stocks in it.

If Intel (INTC), Cisco (CSCO), and IBM (IBM) were taken out of the Dow in favor of Amazon (AMZN), Alphabet (GOOGL), and Facebook (FB), the Dow would explode. On the other hand, such an action might symbolize a top. If one had to guess, you could say IBM is the most likely to leave, with Alphabet being the most likely to replace it.

It was a bad day for most stocks even though the big indexes did well. Russell 2000 fell 0.98% and the small cap value index fell 1.11%. Most stocks rallied in the last hour of the day, potentially because some managers wanted to show they were long at the end of the month.

It’s possible they thought there would be a stimulus at the end of the week. In that situation, you’d expect small cap value to do well, but managers don’t want to show they own those stocks.

Sentiment Is Euphoric

CNN fear and greed index rose 3 points to 65, which is greed. That’s the least of our worries. NAAIM exposure index fell just 0.44 to 97.44, which means it has been in the high 90's for two weeks and above 90 for three weeks. That’s a very bad sign. In the past year, this has never happened. That’s pretty impressive, because 2019 was a fabulous year for stocks.

We can predict the NAAIM index won’t be above 90 in the next reading. There doesn’t necessarily need to be a large decline to get it there. The market would probably need to fall a couple percentage points this upcoming week. And the longer it stays above 90, the more likely a large correction is coming. You already know these firms are crowding into the big tech names. Their long exposure isn’t in cyclical manufacturers.

As you can see from the chart above, the 40 day average of the put to call ratio is the lowest since 2000, right after the tech bubble burst. To be clear, this ratio was lower in 1997, which was three years before the bubble burst. If one were to guess, we are 70% to 80% through this bubble, but it can end at any moment. It’s difficult to time these moves because it’s basically a bet on how insane things will get.

Multiple Expansion Gone Too Far

AAII investor sentiment survey showed there were only 20.8% bulls and 48.5% bears. That’s among the lowest 40 net bullish readings in the past 1,700 weekly surveys. There have been more bears than bulls 23 weeks in a row, which is a new record. This record will likely keep going for a long while.

The percentage of bulls only rises when stocks fall. We’d need to see a 15% correction for this to come in balance. This survey is a contrarian signal. These investors responding are most likely veterans.

small caps vs 2 CHART

30% of people, when asked about the rise in the Nasdaq, said this is a bubble that will end in a recession. When you have people believing that, there needs to be a major shakeup to change their mind. We’ve never seen this survey more stubbornly bearish.

A 5% decline in the Nasdaq would do nothing to change these bears’ minds. One person said, “The shares of too few companies drive the market’s cumulative results and fail to convey the broad weakness of the economy. I fear this is a formula in the U.S. for a more realistic retrenchment of the overall market. The Nasdaq’s highs appear to be vulnerable.”

This respondent is correct. As you can see from the chart above, Apple and Amazon combined are $1 trillion more than the Russell 2000.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more