Facebook: Nobody Can Compete

Shares of Facebook (FB) have been on a rip-roarin’ ride this year already with the stock up 17.7%. It was just earlier this year that I penned the article picking Facebook as the best stock to own for 2017 and Mr. Zuckerberg has not failed to produce exceptional results for fellow shareholders. But it is always important to keep one’s ego in check, not letting the head inflate too much by examining under the hood every once in a while to see what has been taking place at the company. I believe right now is a good time to do just that after shares were up 2% on a day where the market was flat on Wednesday.

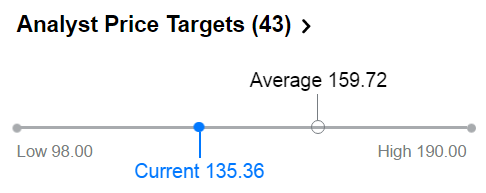

It feels as if the stock is constantly getting positive sentiment by analysts and Canaccord Genuity is one of those firms that showed some love for Facebook recently. The reiterated “buy” rating was predicated on the stock’s valuation metrics and predicts that the Facebook platform and Instagram will do much of the heavy lifting this year in terms of bringing in the revenue. The price target was set for $150, which is a good 11% from here. The average analyst price target has the stock at $159.72, or another 18% higher from these levels.

Source: Yahoo Finance

Also reiterating their “buy” rating on the stock, SunTrust Robinson Humphrey says their price target is more of a modest $142. The reiteration here is based on the analyst’s predictions that Instagram should be able to bring in more revenue than initially anticipated by the analyst for 2017 and 2018. The analyst believes that user growth will accelerate at a quicker rate, that more users will use the service for the first time, international expansion, and enhancements to the app will drive usage, thereby bringing revenues from the app higher. Instagram is definitely the crown jewel here now stealing users away from Snap.

Some of what Facebook has been doing to increase the popularity of the ecosystem includes things like adding group video chatting to the Messenger app. Most all of us have been part of a group text thread which can be fun at times depending on the topic of conversation, but now that Facebook has added video to the mix makes messaging even more appealing. The millennials these days can’t detach their phones from their hands and we’ve heard stories on how the cool new way to hang out with friends is just to stay at home and get on the iPhone/Android and video in for a hangout. There is undoubtedly increasing brand loyalty in the name because of the cool new innovative ideas they keep coming up with to keep the users engaged.

Not only is the company showcasing its tangible market-ready products such as group video messaging to the public, but it is also displaying its future work as well. Mr. Zuckerberg recently introduced his virtual assistant to the world. This endeavor into artificial intelligence should produce results which will eventually become beneficial to society in aggregate. The applications are limitless, from helping the elderly at nursing homes to personal assistants at the office. Artificial intelligence is the way of the future and investors would be better served by owning shares of companies like Facebook and Google (GOOGL) which are at the forefront of this industry.

But with every successful company there is always someone out there trying to bring them down and Facebook is no different. The young and successful company has a target on its back placed by the European Commission, currently in the form of “misleading information” with respect to the company’s acquisition of WhatsApp. The company was facing a 1% fine on its turnover for the predicament on an acquisition that originally cost the company $22B. WhatsApp was only making $10.2 million in sales at the time but Facebook saw it as an opportunity to expand its global reach back in 2014, and with the capability of monetizing that global reach was the end goal.

Facebook is going to start streaming MLB games on the platform this year, but if they’re looking for more revenue they need to be targeting soccer. Soccer is the world’s sport and fans across the globe will do anything to watch those games live on their handheld device at the office. Heck, my coworker today just confessed to me that when he was in school he used to ask for bathroom breaks so he could watch clips of Ronaldinho on YouTube. I’m not a big soccer fan but I was in Milan once and wanted to watch him play, it was magic. There isn’t a large market for soccer here in The States because the MLS puts out a bad product, but many Americans would pay for a streaming service to watch teams like Madrid, Barcelona, ManU; and Facebook has the users, all it needs to do is provide the product.

I actually initiated my position in Facebook in late November and have been pretty happy with the purchase thus far. I will only be purchasing shares if they are below $119 because I believe that is where Facebook offers additional value. I've selected $119 because it is the average of the 52-week range.

I swapped out of Priceline (NASDAQ: PCLN) for Facebook during the 2016 fourth quarter portfolio change-out because I ended up turning a profit in the name (32.7%, or 33% annualized) and wanted to lock in those gains. Since the swap, I have made out on some gains as Facebook has outpaced Priceline. For now, here is a chart to compare how Facebook and Priceline have done against each other and the S&P 500 since I swapped the names.

Source: Google Finance

When it is all said and done, it matters what the stock has done in an investor's portfolio. For me Facebook is one of my larger positions and has been doing well as I'm up 11.4% on the name while the position occupies roughly 9.5% of my portfolio. I will make purchases in the stock only if it is below $119.

I own Facebook for the growth portion of my portfolio and I will continue to hold onto the stock for now. My portfolio is up 16.9% since inception while the S&P 500 is up 13.7%. I closed quite a few positions in the portfolio on Tuesday but more to come on that in later articles. Below is a quick glance at my portfolio and how each position is performing. Thanks for reading and I look forward to your comments.

|

Company |

Ticker |

% Change |

% of |

|

Eaton Vance Corp |

EV |

17.03% |

5.23% |

|

Facebook, Inc. |

FB |

11.37% |

9.48% |

|

AbbVie Inc. |

ABBV |

6.24% |

3.89% |

|

General Electric Company |

GE |

-2.53% |

5.77% |

|

V.F. Corporation |

VFC |

-3.45% |

9.58% |

|

Silver Wheaton Corp. |

SLW |

-4.79% |

7.88% |

|

Gilead Sciences Inc. |

GILD |

-14.59% |

19.49% |

|

Cash |

$ |

|

38.69% |

Disclaimer: This article is in no way a recommendation to buy or sell any stock mentioned. This article is meant to serve as a journal for myself as to the rationale of why I ...

more

All the hype has been about #SNAP, but I think the safe bet is still #Facebook.

$SNAP $FB