Facebook: Libra Potential Push-Out, Ad Boycott, Not Great

Co-Written with Elazar Advisors, LLC.

On Friday, Facebook (Nasdaq:FB) stock dropped more than 8%. This comes after a boycott protesting the platform's response to spreading hate. The revenue loss could spook investors. Boycott aside, the recession will likely also slow Facebook's ad revenue growth. A potential source of alternative revenue, WhatsApp Pay, has been halted by Brazil's Central Bank. That story could be a big hint that Libra gets pushed out. For now, we’re sidelines on Facebook.

Libra: Hints To This Thing Getting Pushed Out

If Facebook ever figures out how to launch Libra, we think the stock can be a straight line higher. But based on some of our work, we deduce that Libra keeps getting pushed out.

Quick Background

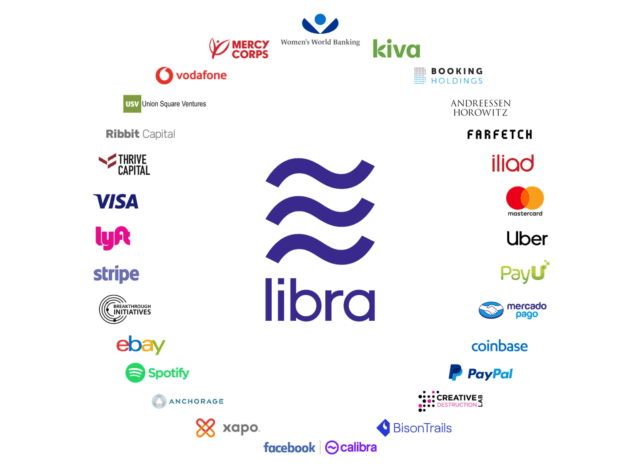

A year ago, Facebook revealed details about their cryptocurrency project: Libra. It started with the support of Facebook, Visa (NYSE:V), Uber (NYSE:UBER), and others.

The aim was to create a global digital currency that promotes financial inclusion for the unbanked. Unlike bitcoin, the goal with Libra was to create a stablecoin. That means that the coin’s price wouldn't fluctuate much.

The hype didn’t last. Just a few months later, PayPal (Nasdaq:PYPL), Visa, Mastercard (NYSE:MA), eBay (Nasdaq:EBAY), Stripe (STRIP), and Mercado Pago withdrew from the project.

The project also received scrutiny from governments because of concerns it could heavily disrupt the global financial system. Governments didn’t want to cede control over their currencies. This project threatened their “monopoly” of money and thus was not very welcome.

There are also regulatory issues related to crime and money laundering, as well as the power of the Libra consortium to affect the global economy.

Facebook vowed to get US approval before launching the project, so they had to revamp their plans. They are considering the inclusion of other currencies issued by central banks and working to create a product that is acceptable by authorities.

The launch date is unclear. This report states that Calibra, Facebook’s digital wallet, is set to launch in October 2020. The wallet will support multiple currencies, of which Libra is just one. However, there was no mention of either Libra or Calibra on Facebook’s Q1 earnings call.

Libra could be huge for Facebook, but not for the reason many expect. Mark Zuckerberg explained that the end goal with Libra is to increase the price of digital ads. He anticipates Libra, by being a universal form of payment, will reduce the friction of online buying, which will lead to more online sales and thus increase the value of ads to businesses.

There could also be fees associated with the use of Libra or Calibra, but it hasn’t been confirmed. This could be another potential source of revenue.

Why Do We Think Libra Gets Pushed Out? Look At WhatsApp Pay!

Facebook’s had a tough time launching WhatsApp Pay, which we think is a big hint that Libra is going to face even worse scrutiny.

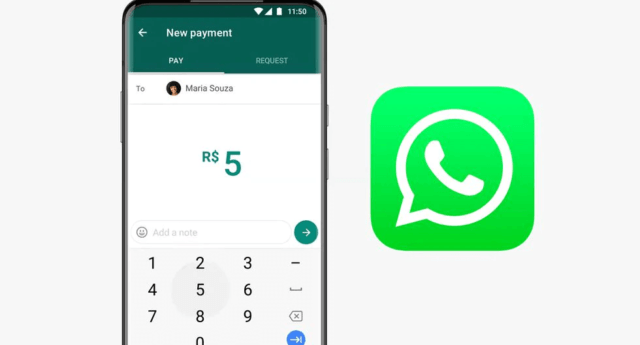

Facebook recently launched WhatsApp digital payments, partnering with Visa.

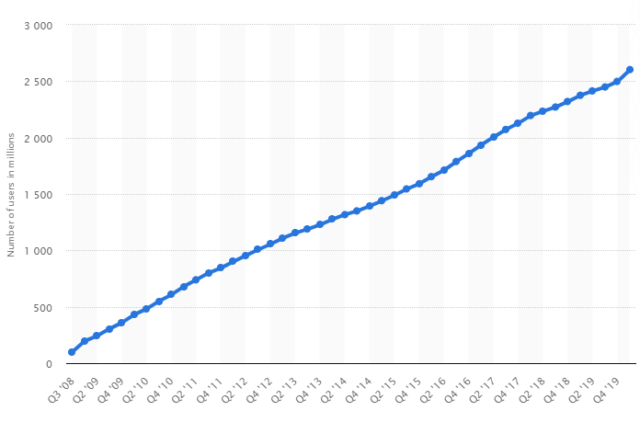

WhatsApp has around 2 billion users, compared to Facebook’s 2.5 billion and Instagram’s 1 billion. The potential is huge.

The launch hit a roadblock though. After launching in one of WhatsApp’s largest markets, Brazil, the Central Bank suspended the system. They are worried about competition, efficiency, and data privacy.

WhatsApp’s other largest market, India, is also having trouble with the launch. Regulators expressed similar concerns to the ones the Brazil government had.

So you have two of WhatsApp Pay’s largest countries not getting comfortable with it legally. Could you imagine Libra ever launching there?

We think this is a clear sign that launching Libra is turning into the biggest long shot, unfortunately for Facebook. Countries are not letting this semi-social-monopoly spread its wings into finance.

The pushback from Central Banks and regulators might have been unexpected. Other financial institutions could have pushed for this. Without support from central banks, there's no future for this feature.

Keep in mind that even with Visa, Facebook is having a tough time launching WhatsApp Pay in these countries. Libra lost big supporters like Visa which will make Libra even tougher to get off the ground.

Boycott Risk

A civil rights coalition launched the #StopHateForProfit campaign. They call for corporations to stop advertising on Facebook to protest the proliferation of hate on the platform. Since the campaign started, Facebook stock is down almost 10%.

More than 90 companies have joined, suspending ad spending on Facebook and Instagram. Some of the most noteworthy are: Unilever, Verizon, Hershey's, Honda, The North Face, Ben & Jerry’s, REI, Patagonia, Eddie Bauer, Upwork, Mozilla, Magnolia Pictures, Birchbox, Dashlane, TalkSpace and, LendingClub.

Even Nancy Pelosi urged advertisers to push companies to crack down on disinformation. There's a risk that more will continue to join.

Facebook generated $69.66 billion in 2019 from Ad revenue, 98.5% of total revenue. Their relationship with ad partners is of course critical.

Facebook was having enough economic headwinds. Now a boycott makes revenue trends get even tougher.

Pandemic And Recession Ad Spending Slump

Ad spending typically falls in recessions.

Facebook CEO Mark Zuckerberg talked about it on the last earnings call:

... if history where a guide, would suggest that the potential for an even more severe advertising industry contraction.

The company is expecting a slowdown in growth from advertising which should hit EPS.

Google's (Nasdaq:GOOG) (Nasdaq:GOOGL) and Facebook's revenues are expected to get hit by the pandemic. Facebook’s ad revenue growth is expected to slow to 5% from 26% last year.

Google’s growth was expected at 13% before the pandemic, it’s now expected to be -5%, an 18% swing.

Facebook's P/E is still high at 32.7 so they need growth.

Fitch Ratings expects ad spending to fall this year and next:

We expect overall advertising spending to contract in the mid-to-high single-digits range during 2020 and in the low-to-mid-single digits during 2021.

Neil Begley, senior vice president of Moody’s, had a more positive view. He said:

Potential broader coronavirus contagion in the U.S. will have a short-term negative effect on U.S. advertising, stemming from a swift and deep economic pullback. However, the duration of the sector’s contraction may be short-lived.

Advertising and marketing executives were recently surveyed about the slowdown. 86% of them expect a major negative impact on ad spending in Q2. Also, 77% said they expect at least a minor effect on ad spending on Q1 2021. 89% said they’re looking at coronavirus-related reasons to resume spending, while 51% said they're looking at economic-related reasons.

With the second wave of coronavirus, ad spending could slump again. The second wave could also have a more lasting economic effect. Facebook could see slower growth even next year, depending on how fast the pandemic is dealt with.

Monthly User Growth

One bright spot in all this is user growth, which accelerated. The Street was willing to look past poor revenue and earnings growth projections last quarter in favor of strong user growth metrics.

Source: Facebook: active users worldwide | Statista

You see the acceleration in Q1 here. We and the Street do like acceleration. It won’t benefit EPS near term but it does help investor psychology.

|

Q1 2020 |

Q1 2019 |

Q1 2018 |

Q1 2017 |

|

|

Active Users (Millions) |

2603 |

2375 |

2196 |

1936 |

|

YoY Growth % |

10% |

8% |

13% |

17% |

User growth should continue strong and could cushion the other headwinds to some degree.

Model And Price Target

Facebook stock is up just 3% YTD. Our model (see full model: paywall) doesn’t show FB has much stock price upside potential based on our below-the-Street earnings estimates.

Even though Libra is likely getting pushed out, if it ever takes off, earnings won’t matter and the stock will likely fly on hype alone.

Conclusion

Facebook is a mixed bag right now. EPS drives stock prices, and we believe that in Facebook’s case, their EPS won’t be enough to justify their current valuation. Trends are going the wrong way with a boycott and recession. And Libra, Facebook’s once silver lining is probably not happening so fast. We believe we have other stocks in our model portfolio (see portfolio: paywall) with a much better risk-reward ratio at the moment.