Exxon Soars Above $100 For The First Time In 8 Years And Just Off Record High, As Wall Street Rushes In

Back in the fall of 2020, when Exxon (XOM) stock crashed to the lowest price in two decades, trading below $40, and just couldn't catch a break with Sell reco across all of Wall Street's penguin brigade, we started recommending it first to members of our premium service, and eventually broadened our advice to everyone.

Got XOM? pic.twitter.com/zxjonMru0y

— zerohedge (@zerohedge) October 20, 2021

Well, in a time when most "hedge" funds are running around like headless chickens, their unhedged FAAMG portfolios losing billions for among the Housecat Local community, we are delighted to tell readers that Exxon just rose above $100 for only the first time in 8 years, and was last trading at $102, a price saw eight years ago in June 2014, when XOM was also the largest company in the world.

Of course, now that Wall Street is finally rushing in with the Buy recos...

- Exxon Raised to Outperform at Evercore ISI; PT $120

- Exxon Raised to $115 from $102 as Credit Suisse analyst Manav Gupta sees higher natural gas prices and higher refining earnings

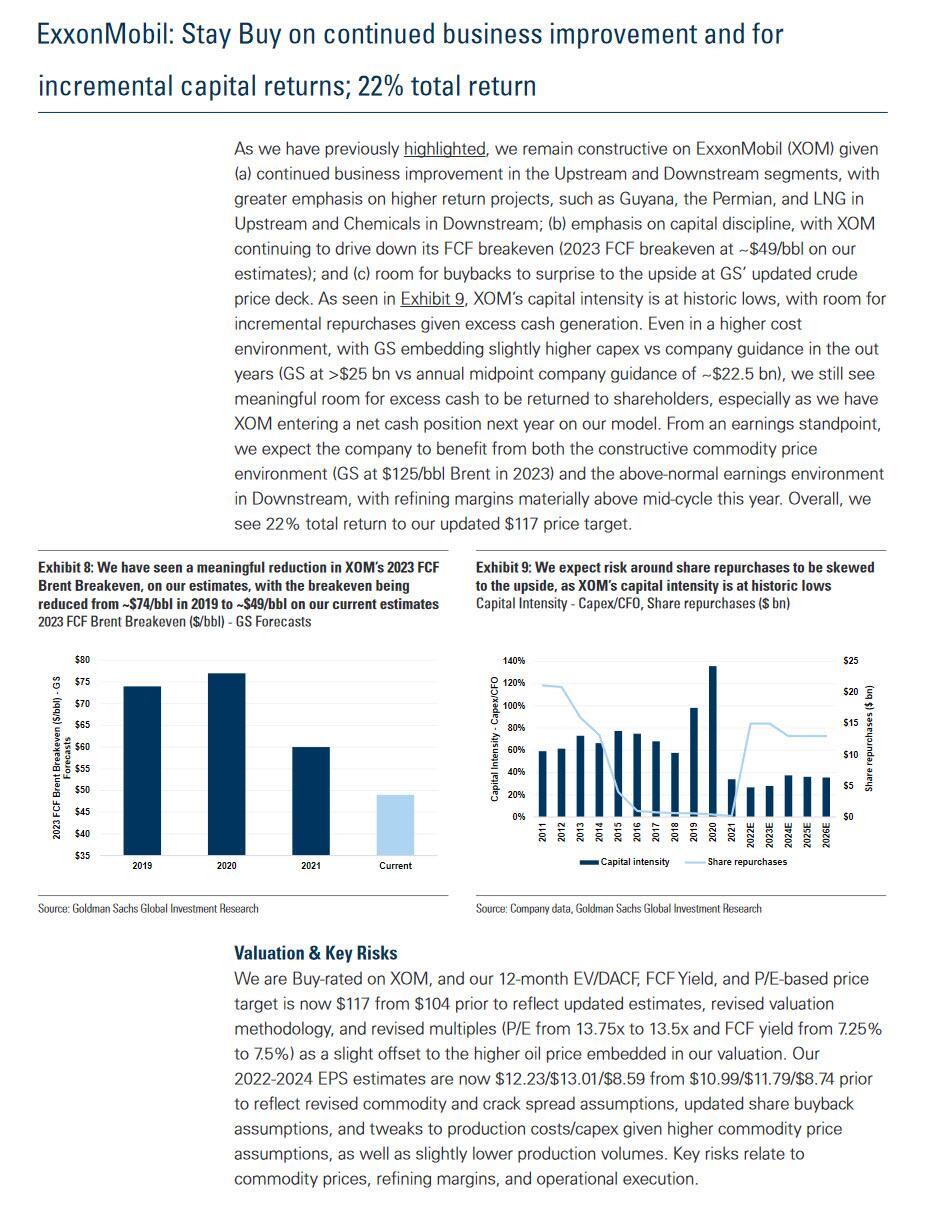

- Exxon Raised to $117 from $104 at Goldman to reflect the bank’s conviction of higher oil prices this year

(Click on image to enlarge)

... and even Cramer is bullish on the sector, some may say it's time to sell, and certainly all those who bought when we first brought up the name at $40 should take some profits, but the reality is that there is still much more upside because of things like this:

- TRAFIGURA CEO SAYS SEES $150 PER BARREL OIL PRICE AS REALISTIC NUMBER, COULD GO HIGHER

... and this:

... as well as the fact that energy still remains a tiny portion of most portfolios: at just under 5%, big-cap energy is more than 50% below where it was after the financial crisis, which means much more natural buyers coming...

Energy is now 4.8% of the market cap of the S&P500-- still well below its 13% mark immediately after the Great Financial Crisis. Small-cap energy is 8.8% of the Russell 2000, above the prior cycle's high. pic.twitter.com/Md1648C11P

— Gina Martin Adams (@GinaMartinAdams) June 7, 2022

... last but not least, the fact that refiners such as XOM continue to print money, with the 3-2-1 Spread the highest it has ever been meaning refiners are literally printing money, with $6 gas looming... as well as complete devastation for Democrats in the November midterms.

Best of all is that this is happening as markets finally revolt against the fraudulent bullshit that is ESG by rewarding all those who never complied with the moronic groputhink of all that is "green" (see "Anti-Green Blowback: ESG Funds Suffer Biggest Monthly Outflows On Record") and pushing "evil, dirty" fossil fuel companies to all time highs. Congrats, hypocrite PMs, you went woke and while you may not be broke yet, you get to enjoy watching who all those who didn't make fat stacks while you cower in fear that the next phone call will be your termination.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more