Exxon Mobil: Bridge To The Future

I was putting gas in my 61-year-old car at a filling station in my little town the other day when a tourist from California came out of the co-located shop and asked me, "What year is that car?"

"1959."

"Huh. What is it, some kind of MG or something?"

I smiled. "It's a Jaguar… XK 150."

"Hmmm. Well, it looks nice. Too bad it's a dinosaur."

OK, I've been to two county fairs, one war and a dog show that went ugly. I'm pretty even-tempered so I simply asked, "Why would you say that?"

"Well, in 10 years there won't be any gas stations. Just pollution-free electric battery charging stations for pollution-free cars like mine."

I allowed as how his car looked nice, too, then asked, "Where do you think the electricity that powers your EV -"

"It's not an EV, it's a Tesla!"

"Where do you think the electricity that powers that Tesla comes from?"

"That's a dumb question. It comes from the battery."

"And when the battery needs charging?"

"From a bigger battery, um, at the battery… places. Stations."

"And when they need to be recharged?"

"Who the hell cares? It's only important how… how green it is." He turned to respond to his wife who was driving the diesel pickup that was towing the gas-powered boat with the two gas-powered jet skis in the pickup bed with which they would soon be polluting my lake.

I never got to continue this illuminating conversation by pointing out that electricity, at least on a usable scale, was not produced by rubbing two balloons together. Nor is it a gift from the gods stored somewhere in Iowa or Nebraska or somewhere else that he might consider flyover country.

Electricity at the scale needed for transportation, lighting, heating, etc. comes from either the photovoltaic process where light is turned into electricity or from turbines that turn electric generators, effectively doing the same thing - excite and extract electrons into a moving flow. Those turbines might be powered by wind, water or biomass, but in most of the developed world, they are powered by the carbon fuel we call natural gas. (The developing world mostly uses coal, which is cheaper.)

The United States is the top producing country of natural gas in the world. Exxon Mobil (NYSE: XOM) is the biggest producer of natural gas in the United States.

The International Energy Agency, headquartered in Paris, is an intergovernmental organization established after the 1973 oil crisis. The IEA's initial charter was to advise member governments how to respond to disruptions in the supply of oil and to serve as a repository of statistics about the international oil markets. That charter was later broadened to include energy security, environmental protection (particularly climate change), and economic development.

Discussing global energy demand in November of 2019, the IEA concluded that global energy demand would continue rising at an increased pace. It specifically cited oil, considered by many to be at peak usage if not the old "peak oil" (then described as "Oh my God, the world is running out of oil,") as growing at least through 2030 and then plateauing as more vehicles, commercial and personal, switched to electric. (Enter natural gas…)

In the same report, the IEA noted that, as demand growth slows around 2030, the current rapidly depleting oil reserves will need to be replaced. The IEA predicts the increased cost of exploration should cause prices to rise from current levels to closer to $90 by 2030.

The IEA further predicts that the U.S.A. will account for 85% of the growth in production worldwide to 2030 between a renewed shale-oil boom and active exploration around the world. In fact, the organization expects that, within 5 years, U.S. production will reach 20.9 MM bpd, overtaking Saudi Arabia as the world's largest exporter of both crude and refined oil.

Exxon Mobil is the largest producer of oil in the US, with a production rate of 2.3mbbl per day.

Is Exxon Mobil "Over the Hill?"

XOM is regularly derided for not having been more aggressive in exploration when oil was more highly-priced and for not squabbling to get a greater share of acreage in the Permian Basin and other popular onshore US fields. Were they stodgy, as many claim "over the hill" as a company, or crazy like a fox? Exxon instead chose to look for elephant fields with less competition abroad and wait to see if they could buy assets more cheaply at home.

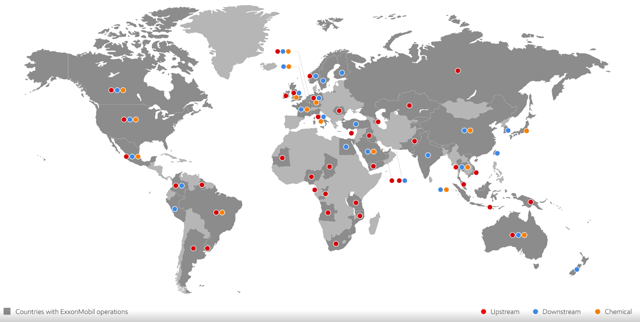

That plan may yet come a cropper in Guyana, as a result of a contested election there, with the usual possibility of an incumbent unwilling to follow the will of the electorate. Exxon has a sizable investment there. Of course, it is only one of many major projects Exxon has on the books:

(Click on image to enlarge)

Source: Exxon Mobil website

Here is just a sampling of some of these opportunities…

Guyana - I believe the current political turmoil will be resolved, and this will prove to be one of Exxon's better producing regions. It isn't XOM's first rodeo. They are well-accustomed to being thought of as a pushover for dictators and such. They are still standing while the dictators are long forgotten. Exxon Mobil Guyana has made 16 discoveries since in the past 5 years. Production began in December 2019 the first of these.

Qatar - The Qataris invited Exxon to be the only foreign participant in two domestic gas projects. XOM has also now partnered with Qatar Petroleum to develop the North Field, the world's largest non-associated natural gas field. (Often, natural gas is found in association with oil fields, which is why you used to see and still occasionally see natural gas flared off in producing oil fields. "Non-associated" means this field is all-natural gas.)

With these joint ventures, Exxon has a participation piece of 27 of the world's largest liquefied natural gas (LNG) ships, Qatar's largest condensate refinery, and 12 LNG trains. (An LNG "train" is a liquefied natural gas plant's liquefaction and purification facility.) The Qatari partnership might also open doors for Exxon in places they might not otherwise enter as easily, like Brazil, Argentina, and Cyprus.

Papua New Guinea - More LNG, a cleaner-burning fuel than the coal most often used in developing nations and in China. LNG in Papua New Guinea recently reached production equivalent of 8.3 million tons per year. Considered among best-in-class for reliability, to date the project has safely produced more than 19 million tons of LNG and loaded 262 cargoes for delivery to customers in Asia.

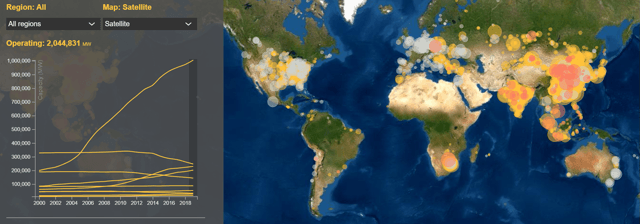

As an aside, the PRC (mainland China) talks a good story about being green. They are the world leader in using renewables. But that is merely a function of the size of the nation. China is also the biggest user of coal and the biggest builder of new coal-burning power plants of any nation in the world:

(Click on image to enlarge)

Source: carbonbrief.org

In researching various energy sources for this and future articles, I uncovered this brilliant graphic. As you can see from the legend on the left, most of the world is reducing coal usage. In fact, the white dots above represent coal-burning plants that are being shut down, the pinkish-red those that are being built. Only the lines representing India and "other Asia" are climbing slightly. Then, there is the PRC, which is increasing coal usage all out of proportion to the rest of the world.

I submit that any country - or company - that can produce gas and convert it to LNG at a scale that will allow it to be sold "almost" as cheaply as cheap coal is positioning itself for the future.

It isn't just natural gas or LNG that is needed in populous mainland Asia and island nations like Taiwan and Japan. Oil is also needed for transportation, lubricants, chemicals, medications, and so on. Which brings me to Exxon's second major producing country in the region:

Indonesia - Exxon has had a presence in Indonesia since 1898. (No, not 1998 - 1898.) Both natural gas and oil are produced in partnership with Indonesian companies. The Banyu Urip oil field alone holds an estimated 450 million barrels of oil and currently delivers 25 percent of the national oil production.

It isn't what passes for "news" these days unless it is a major catastrophe. So, even minor dust-ups receive 30-point bold headlines. However, what goes unnoticed is when things work pretty smoothly.

Certainly, partners will occasionally disagree. But Exxon is an example of a multinational company that hires extensively wherever it operates, provides specialized training that not only gives local people careers they would not have dreamed of, but also understands that community relations are key to the success of their operations in those nations.

I also see XOM as a powerhouse in the US, of course. Especially in the Permian Basin, America's own little Saudi Arabia. The key here is that scores of smaller producers of both oil and gas borrowed and borrowed because it was cheap to borrow. Now, their income has been slashed as a result of the glut of oil and, to a far lesser extent, of natural gas. Not enough cash flow to stay solvent and debt coming due - not a good combination for these smaller players. What will happen to them?

Many will go bankrupt, others would if they cannot find a Daddy Rabbit with superb cash flow and the ability to buy them out. I think this will be an easy decision for the Exxons and Chevrons of the world.

Why pay for exploration and production expenses like labor and equipment, or deal with the eccentricities of scores of local jurisdictions to get permitting, etc. when you can buy properties already permitted and often developed and ready to go on the cheap via the stock market? Exxon has the deep pockets to succeed here.

The first volley in this likely next chapter has already been fired by Chevron, when earlier this month, it agreed to purchase the assets of Noble Energy (NBL). This gives Chevron an entrée into the fabulous Leviathan field, and others to be developed, offshore Israel.

Just How Big a Factor is Exxon?

I like the way Forbes compiles their Global 2000 annual ranking of the world's biggest companies. Instead of using only market cap or only revenues, they use four different metrics:

Sales

Profits

Assets, and

Market Value.

Using the combination of these four metrics, no US energy firm cracks the top 10 of the world's biggest companies. Five of the ten are Chinese, which may not be exactly accurate, in that, yes, they are publicly traded, but all are state-owned, state-controlled, or "assisted" by the state. The only oil and gas company in the top ten is Saudi Aramco (ARMCO), at number 5.

The next oil and gas company among the 2000 biggest is… Exxon Mobil, tied (using those four metrics) with Alphabet (Nasdaq: GOOG) (Nasdaq: GOOGL) and Microsoft (Nasdaq: MSFT), at #13 in the world. The next biggest US oil and gas company, at #61, is Chevron (CVX). After that, we have to go all the way down to #186 to find Phillips 66 (NYSE:PSX), which is not an E&P (exploration and production) company, but rather a Midstream, Chemicals, and Refining giant.

Many analysts say that Exxon cannot do what Chevron just did, scooping up a smaller competitor, because of its high debt profile. Is that the case, or does XOM have the cash flow and the borrowing power to succeed here?

Is Exxon Mobil Too Debt-Laden?

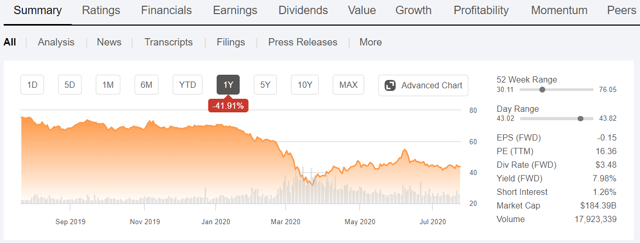

Exxon does carry a good amount of debt. Analysts disappointed in the stock price would like to see Exxon slash its dividend and pay down debt. Analysts are not the same as shareholders. Many shareholders trust Exxon's long-held commitment to paying a reasonable dividend.

Right now, with the stock near the lower end of recent prices, that dividend yields over 7.9%. I believe Exxon has much growth ahead, so to receive such a fine dividend, important to many of my clients and subscribers, is icing on the cake. Why buy some income-only stock with a lower quality rating when, with Exxon, you also have the opportunity for growth as well?

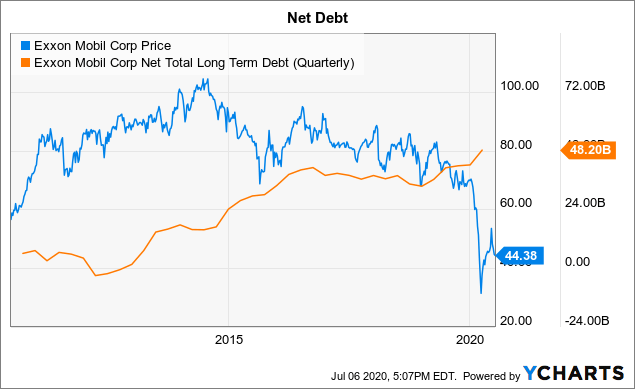

About that debt:

Source: YCharts

Exxon does have a whole lot of debt, nearly $60 billion worth. But this is also a company with $362 billion in assets. Can they borrow more if they choose to? I imagine they can. Whether they will or not depends upon their cash flow this year, the price of oil and gas, and the rates they might pay for debt.

Standard & Poor's rates Exxon as an AA borrower. Moody's gives them an Aa1 rating. Both downgraded XOM in the first quarter from, respectively, AA+ and Aaa. Some downgrade. There are very few companies that share such a lofty appraisal of their ability to meet their debt obligations, even after this downgrade!

Is Oil and Gas Passé?

The final "big knock" against Exxon is levied not only against them but the entire industry in which they are the leader. The naivete exhibited in this assault is based on equal parts of reality, hope and hype.

Yes, as a nation and as a community of world nations, we are doing what we can to move toward more renewable sources of energy. That is the subject of a different article I will write but, in summary, there is no free lunch. Solar and wind both have intermittency problems. I was in Germany not long after Angela Merkel decreed that all nuclear plants would be closed. In their place was to be solar and wind.

Central Germany is rather famous, or infamous, for its winter weather, which includes, not just in winter, little sunshine and a great deal of ground fog. All those solar arrays come at a cost, and the cost includes not being available at critical times. Not a lot of wind when the fog just clings to the earth, either.

As a result, Germany, often in the forefront of renewables "talk" (a la China) still has more than 40 operating coal-fired power plants which generate about 30% of Germany's power - double what natural gas contributes.

I use Germany and China as examples because they are often the most vocal in decrying other nations' use of carbon-based fuels. We will get there, but it will not happen overnight. The technologies will improve over time to produce lighter, more efficient, less balky wind turbines, perhaps with some sort of sound device that will reduce the current massive bird kill these wind turbines create. We will learn how to keep the photovoltaic electricity closer to the end-user so that so much of it is not lost in transmission. We will produce more efficient batteries to store excess power.

All this is iterative, not imminent. Just because EVs (Electric Vehicles) are available for those who can afford them, especially with all the federal and or state subsidies, does not mean we are "green" if we all drive EVs. If the power source for the electricity is coal, all the buyers of these vehicles have done is transfer the pollution to someone else's backyard. California may look greener as Wyoming gets dirtier.

For that reason, I am quite certain that we will still be using what I call "Nature's Batteries," carbon fuel already compacted for us by eons of compression, for at least the next 10-20 years, and I would imagine long after.

Looking for the best combination of size, breadth, cash flow, borrowing power, current production, likely future production, proximity of product to end users, and all at a reduced price and with an enviable dividend flow to investors, I would find what I believe is my best choice in this sector in Exxon Mobil. I own it and will buy more on any real price decline.

(Click on image to enlarge)

Source: Seeking Alpha

Disclosure: I am/we are long XOM.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due ...

more