Expeditors International Of Washington: An All-Around For Customers And Investors?

Summary

- One of the best quarter in the company’s history, with a 39% EPS increase.

- Betting on technology might be the key to success for the transportation business.

- A rocky road lays ahead with intensive competition showing up.

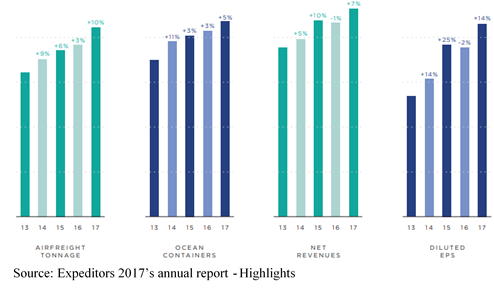

Expeditors International of Washington (EXPD) has observed a healthy growth during the last few years. The growth can be partly due to globalization and ease of doing business all around the world, but one does not stand long in markets with how competitive the transportation industry is if they cannot provide a value-added service. This is exactly why EXPD has been around for 40 years, stacking an impressive 24 years of dividend increase to their shareholders.

Understanding the Business

Founded in 1979, Expeditors International of Washington provides its customers an all-around transportation and logistics service. From regular day-to-day shipments to one of a kind needs, EXPD is up for the task. The company’s primary services are split into 3 categories: Airfreight Services, Ocean Freight, and Ocean Services and Customs Brokerage and Other Services. In 2017, 42% of their $6.92B revenue came from the Airfreight sector. 30% was earned by the Ocean sector and the remaining 28% by Customs Brokerage and Other Services. Although transportation is their main line of business, EXPD also offers supply chain solutions as well as warehousing and distribution.

The company now has regional offices around the world, having business partners in the Americas, Asia, Europe, Africa, India, and the Middle East. At the closing of 2017, EXPD employed over 16,500 workers around 177 offices.

Growth Vectors

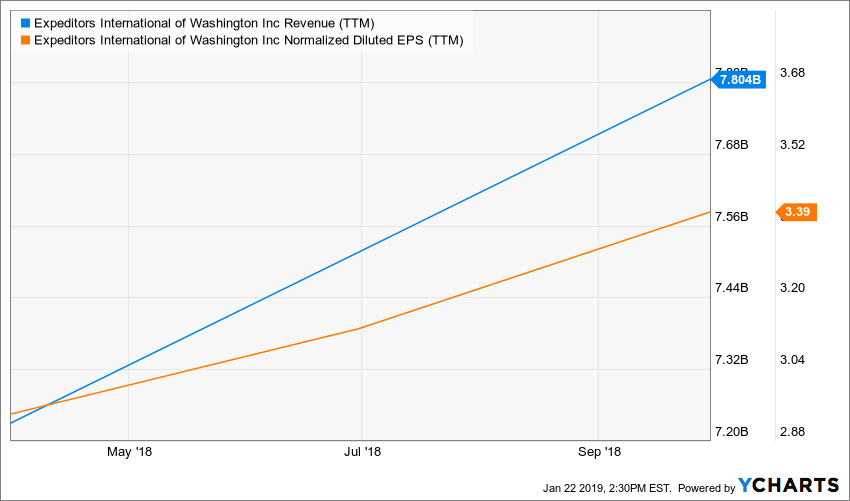

Source: Ycharts

As the company is evolving in an ever-changing, fast-paced world, combined with tighter deadlines each and every day, EXPD is relying on an upgraded technology in order for them to keep up with those requirements. Artificial intelligence and machine learning operations have become a critical aspect of their business, with efficiency being the main targeted goal.

While past growth was mostly organic, from knowledge-based operations and experience, the company has in the past acquired other businesses in order to grow their technology span and geographic coverage.

Latest quarter in a flash

On November 6th, the company reported the following results:

- EPS of $0.92, $0.13 over consensus and a 39% increase compared to 2017’s Q3

- Revenue of $2.09B, a 16.1% increase, beating estimates by $60M

- Declared dividend of $0.45$ per share

The CEO and President, Jeffrey S. Musser, had some encouraging words on those figures:

“We generated record third quarter profitability, with the highest net revenue and operating income in our history, as we continued to win new business and grow volumes with existing customers in an unpredictable rate environment […]”.

Dividend Growth Perspective

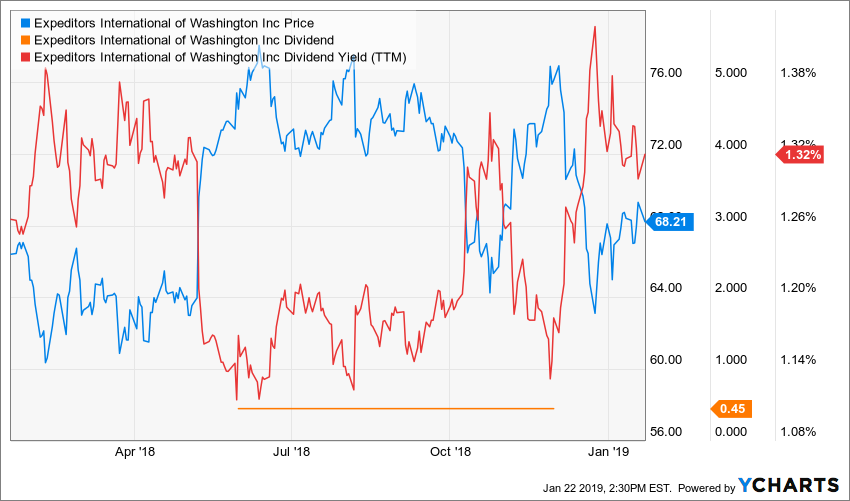

EXPD is now in its 24th year of dividend increase, almost granting them the Dividend aristocrat title. Latest dividends were $0.45 per share, for an annualized payout of $0.90, a 7.14% increase compared to 2017’s exercise.

Source: Ycharts

On a dividend yield basis, the stock is lacking some glow in my opinion. With a 1.30% yield EXPD falls below the transportation’s average of 1.72%. However, investors should not expect this figure to skyrocket in the upcoming quarters. Due to competition, margins are pushed towards those lower numbers, but there will be more on that later.

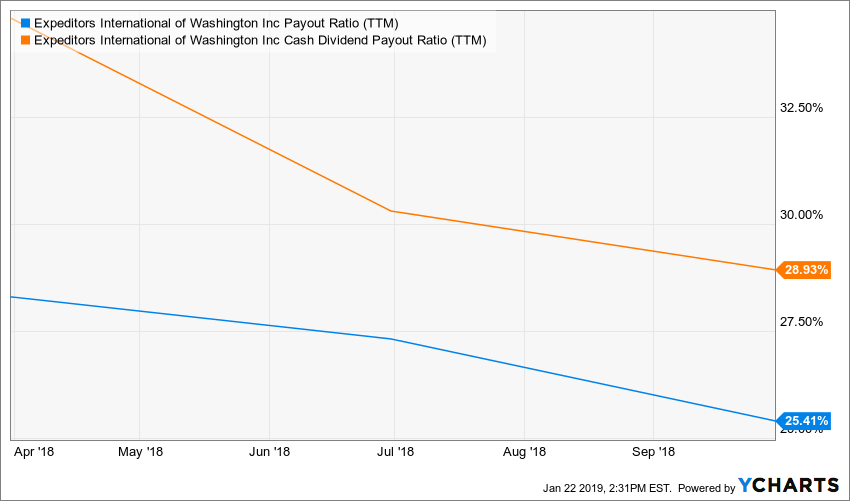

Source: Ycharts

While this chart might be disappointing for some, I think this slow slope reflects a well-aware management. I don’t think sustainability is a problem here, but as customers start to do business all over the world, EXPD needs to allocate substantial reinvestments in its operations. Those investments also come with affiliated costs, such as regulatory, human resources and of course, technology.

Potential Downsides

Downsides in the transportation and logistics business are numerous and important. First up, is everything related to international trade. This includes currency exchange rates, interest rates, labor costs, political environment (such as strikes, wars and other conflicts), natural disasters and more. All of those factors need to be accounted for and factored in when pricing customers, which is a tedious and never-ending task. Cost related to those factors can easily eat away those already thin margins.

As mentioned above, competition is also a reason why margins are so low. Customers are always looking for a cheaper and faster solution. This brings in more players in the industry, seeing a chance to acquire markets share, from all over the world. Amongst those competitors, C.H. Robinson (CHRW: NASDAQ), DSV (DSV:CPH) and Kuehne & Nagel (KNIN:SWX), all having financial latitude and power to drag those margins even lower.

Valuation

Currently trading at a $60 level, which represents a 3x multiple of its PE, we will use a DDM in order to find out if markets is correctly assessing EXPD potential.

Source: Ycharts

For this purpose, an annualized payment of $0.90 is factored in, along with a 7% short term growth and 6% for the longer run. Discounted at 10% seems a bit high, but considering the related downsides of the industry, I find it justified.

| Input Descriptions for 15-Cell Matrix | INPUTS | ||

| Enter Recent Annual Dividend Payment: | $0.90 | ||

| Enter Expected Dividend Growth Rate Years 1-10: | 7.00% | ||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | ||

| Enter Discount Rate: | 10.00% | ||

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $41.48 | $31.01 | $24.74 |

| 10% Premium | $38.02 | $28.43 | $22.68 |

| Intrinsic Value | $34.56 | $25.84 | $20.61 |

| 10% Discount | $31.11 | $23.26 | $18.55 |

| 20% Discount | $27.65 | $20.67 | $16.49 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

The model gives us an intrinsic value of nearly $26 per share. The market is trading the stock at a $68 level, which clearly indicates the stock is overvalued. While this might not be the best time to buy EXPD, keep in mind that this model is very sensitive to its inputs.

Final Thought

Taking every aspect discussed in this article, I think EXPD is on a good streak at this time. Experienced management, who knows its markets and where to put in the effort is a huge positive for any business. Providing services that are seeing an increased demand year after year will also help the stock grow in future exercises.

Now, should income-seeking investors get onboard? It’s hard to tell. While markets definitely see potential in the company, numbers are bringing this optimist down a notch. Monitoring the stock seems like a good plan at the moment, buying at a discount seems way out of reach at the moment, but as markets move, so does EXPD!

Disclosure: We do not hold EXPD in our DividendStocksRock portfolios.

Disclaimer: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to ...

more