Exact Sciences Is Going Higher

Exact Sciences (EXAS) grabbed our attention yesterday after falling 12% yesterday morning following an earnings report that saw a top and bottom-line beat. The company is also making it official and combining with genomic health (GHDX) which will create a leading global cancer diagnostics company. The market was sour on the news and we felt this is a fantastic opportunity to get into shares for both the short and medium-term. The rally is underway and although shares are up 20% from our trade, we want long-term investors to consider the name right now. Let us discuss.

Source: Exact Sciences Website

First take a look at the chart, as you can see this is a sizable pullback following all of the growth:

(Click on image to enlarge)

Source: BAD BEAT Investing Chartist

We have outlined the very simple zones here based on the statistical metrics applied by our in house chartist John and his calculations. Essentially we have a simple play here, and think if you can get this at the $100-$102 range it is a steal:

Current price: $104 (we think it comes lower and look for entry beneath this)

Target entry: $99-$102

Target exit: $115-$120+ on the trade

Stop: $83-$86

Medium-term? We think the growth trajectory can continue and see $150-$170 as likely in 2020, provided the story does not change. So what is the story here?

Discussion

Exact Sciences has shown incredible revenue growth over the last decade, but the company operates at a loss with more losses expected for 2020. The balance sheet shows that the company operates with moderate debt levels, ahead of this merger with Genomic Health. The long-term debt is currently $688 million representing 45% of its total asset value. The company's total liabilities represent 55% of its total asset value.

Excluding the merger, Exact Sciences operates with ample working capital (with a current ratio of 2.3) meaning that its short-term assets (such as cash and deposits) easily cover its short-term liabilities (bills the company has to pay). Even ahead of the merger Exact Sciences' forecast earnings are for losses through to 2020 (at both the net income level and operational level) which means the forward PE is not applicable as it's negative. So that hits the valuation analysis. Keep in mind the company booked a loss for the 2018 fiscal year.

So why be bullish? Exact Sciences has a history of unbelievable revenue growth with its revenue increasing an average of 209% per year over the last decade. We believe the growth continues. Why?

Addressing cancer

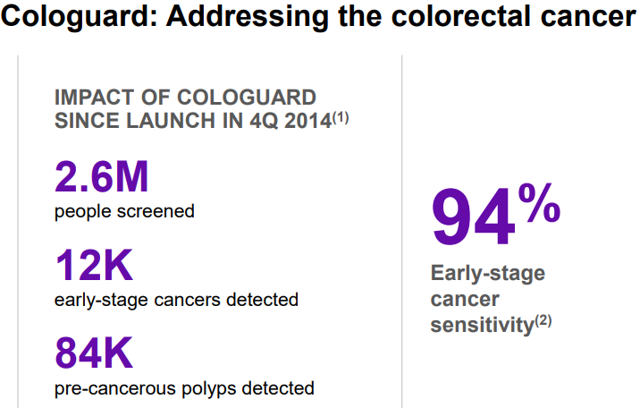

Exact Sciences operates in an industry that is undeniably the most important one - cancer detection. The company's flagship product is Cologuard which is an FDA approved test for the early detection of colorectal cancers.

Source: Investor presentation

The company estimates there are 87 million average risk Americans between the ages of 15 and 85, which represents a significant portion of the American population. Exact Sciences plans to increase the number of average risk people using Cologuard with a long-term goal of capturing at least 40% of the colon cancer screening market. It currently has 6% of the market.

Source: Investor presentation (linked above)

In order to reach their goal, Exact Sciences entered into a promotional agreement with Pfizer (PFE) to utilize their marketing expertise for the promotion of Cologuard. Under the agreement, Exact Sciences will manufacture the test kits and perform the laboratory tests on the samples; while Pfizer will share the marketing expenses and take a share of the gross profits. This is paying off, as use of Cologuard is up 93%.

Results continue to shine

We see this as a classic bad beat, with the stock getting hammered following all good news, but the market uncertain about the pending merger. That uncertainty creates opportunity. Today the company announced that the company generated revenue of $199.9 million, up 94% and screened approximately 415,000 people with Cologuard during Q2.

Average Cologuard recognized revenue per test was unchanged at $479 while average Cologuard cost per test was $123, an improvement of $2 per test. Overall, Gross margin was 74%, an increase of 30 basis points. This is winning. Of course as revenues rise so do expenses more often than not and operating expenses were $182.1 million, an increase of 68%

Yes, the company continues to operate at a loss. Net loss was $38.4 million, or $0.30 per share, compared to $36.4 million, or $0.30 per share. Cash, cash equivalents and marketable securities were $1.2 billion at the end of the quarter.

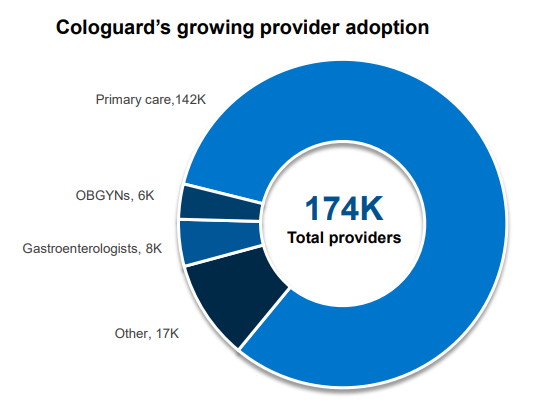

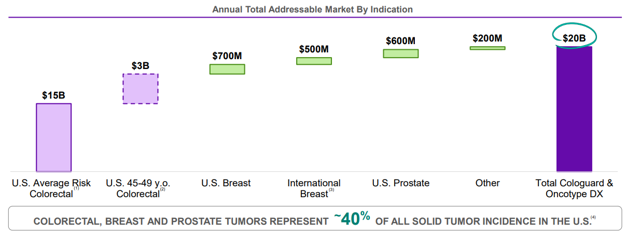

More than 13,000 healthcare providers ordered their first Cologuard test during the second quarter, and nearly 174,000 have ordered since the test was launched. Exact Sciences' Cologuard has a total available U.S. screening market of $15 billion, with an additional potential $3 billion opportunity among people ages 45-49. We believe these numbers cannot be ignored.

The amazing thing here is that the penetration is amongst primary care doctors. Many people do not visit specialists unless something is drastically wrong. But a lot do have a primary care physician. And as such, they will run such tests. I called my physician. They are ordering Cologuard as well, and to me that is a Peter Lynch investing style piece of data. Sweet.

Looking ahead and the merger

Ok, so let us be clear. The company dramatically RAISED guidance not even counting the merger. The company anticipates revenue of $800-$810 million during 2019, an increase from prior guidance of $725-$740 million. This is a double-digit percentage hike in the outlook here folks. Again, the company's updated guidance does not include the impact of the pending combination with Genomic Health.

Source: Investor presentation (linked above)

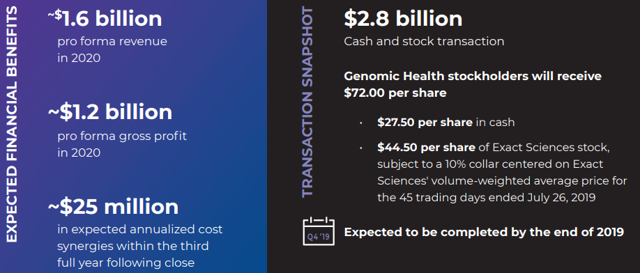

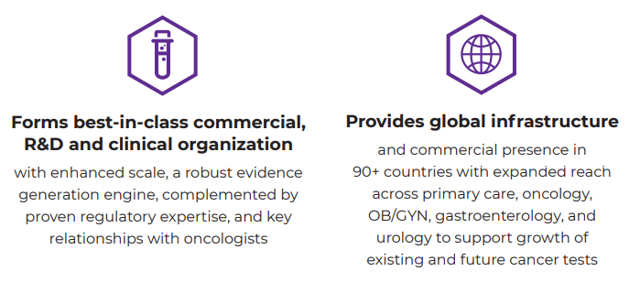

So what is up with this merger? The deal was unanimously approved by the Boards of Directors of both companies, as it is the best for both groups of shareholders. The deal is expected to be completed by the end of 2019 if not sooner.

This move joins two of the strongest brands in cancer diagnostics into one larger company and provides a platform for continued explosive growth. Both Cologuard and Oncotype DX from Genomic Health will respectively continue to help detect colorectal cancer and inform treatment decisions in colorectal, breast and prostate cancer, which collectively represent approximately 40% of all solid tumor incidence.

(Click on image to enlarge)

Source: Investor presentation (linked above)

Genomic Health's Oncotype IQ portfolio has guided personalized treatment decisions for more than one million cancer patients worldwide, and delivered more than 19% year-over-year overall revenue growth in the second quarter of 2019. Genomic Health estimates that its Oncotype DX suite of products in oncology and urology have a total available market of $2 billion.

Source: Investor presentation (linked above)

This merger creates a massive presence and sets the diagnostic company up to have major control of the diagnostic market for colorectal and other cancer tests.

Take home

This pullback represents an opportunity to get long a fast-growing name. We believe that with the merger, investors should be looking for earnings positive results by the end of 2020. In the meantime, revenue growth continues to be astounding. The company will capture more and more market share. We think that despite our initial trade returning 20% in less than 24 hours, investors should consider the name here as it is going to move much higher

Disclosure: I am/we are long EXAS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock ...

more