Even After Recent Surge This High-Frequency Trader Still Shows Value

Virtu Financial has rallied immensely since the start of the coronavirus bear market as volatility has soared through the roof not just on a regular basis but daily and even intraday. This historic volatility is precisely what fuels Virtu, even years after its 2015 IPO still relatively unique as a public high-frequency trading company. While volatility likely will eventually settle down and Virtu's immediate trading income similarly nonetheless this pandemic-spurred volatility has provided Virtu both likely ample new assets from trading income and greater market knowledge of how it can operate in extreme volatility environments.

Data by YCharts

Trading Cowboys Eventually Fall Apart But Virtu Seems To Play It Cautious

Virtu Financial is, in some ways, what happens when you say you take a few scattered trading desks across the Wall Street banks and merge them into a large, nimble, concerted institution devoted purely to trading, market making, and the furtherance of its trading technique. Virtu, self-described in a recent 10-K filed with the SEC as a company that "leverages cutting edge technology to deliver liquidity to the global markets and innovative, transparent trading solutions to our clients," occupies, therefore, an unusual space in-between the market-making exchanges and the trading desks of major banks.

It is worth noting that Virtu Financial is still a fraction of the trading revenue of the major bulge brackets. In 2019, for example, Virtu Financial made $912.316 million in net trading income as compared to Goldman Sachs' $10.157 billion in market making. In Q4 2019 Virtu Financial pulled in $228.705 million in net trading income as compared to Goldman's $3.480 billion in net revenue in its marketing making and trading global markets segment.

Virtu reported that as of the end of 2019 it had $773 million in cash and equivalents and $1.957 billion in long-term debt. For a company, even after its recent rallying with a market capitalization of about $4.57 billion these are extremely liquid, green numbers. Then again it needs to keep such good numbers as since it primarily is in the business of trading and market-making for it to suddenly find itself in the red or significantly stressed means there is an issue with its very business model.

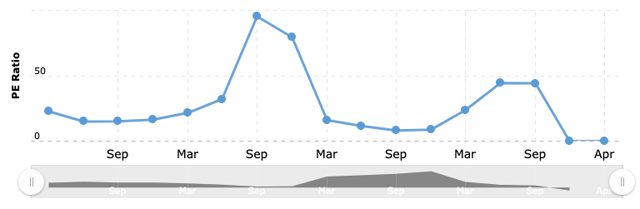

Virtu right now is hovering near the high of its historical P/E range, perhaps with the market believing that either more volatility is coming, that the trading income gained from the recent volatility will fuel Virtu's scale and operations, that is learning and gaining increased technique skill from this extraordinary environment, or all three. Just like how waves crash and return so does Virtu seem to always rake in cash when volatility sudden appears and suffer a moderate existence when markets are calm.

(Source: MacroTrends)

Data by YCharts

Virtu I believe is likely pushing forward on all three fronts and this gives it increased price stability and a prospect for some growth as well. It is worth noting that during the increased volatility of the past month after its initial surge it seems Virtu did not continue rallying much, likely having already priced in the above boosts described, and even falling in the mid-March general asset collapse perhaps amid worries over the stability of the corporate credit and even asset markets themselves.

Data by YCharts

It is beneficial that Virtu appears knowledgeable of the risks inherent in its business and in its quest for growth does not poke at leverage risks without need. For example its major acquisition earlier in 2019 of the Investment Technology Group was not financed with any debt or equity but rather an entire roughly $1 billion in just cash. It is likely that such cautious expansion will fuel Virtu's slow and steady growth over time and the recent market turbulence very likely has given Virtu a new windfall of trading income to secure its bases and find new opportunities with.

Conclusion

Virtu Financial is a strong company in an extremely delicate and narrow industry. Unlike the exchanges, it reaches beyond market making into the world of high-frequency profit-oriented trading and unlike the trading desks, it's not attached to a broader institution nor constrained, or supported, by such.

For these reasons Virtu Financial would be a bad bet if it were risky and over-leveraged or a trading wildcard as history is littered with the remains of such companies that chug along in glory until everything suddenly implodes. In reviewing Virtu Financial's actions and financials it seems they are quite cautious, whether in daily operations or in major corporate actions, and that supports both their stability as a company and the likelihood of their scale and operation growth plans being both successful and profitable.

Even if markets take another turbulent turn I don't believe Virtu Financial has much more immediate stock price rallying to gain from the current pandemic. As shown in the mid-March asset market collapse if markets begin falling apart too much even it feels the contagion risk. However, the income and data it has gained from this recent eruption of volatility likely will fuel it well to its next steps, whether that be more acquisitions, expanding current operations, or providing more stability cushion to already generally-positive current financials.

Disclaimer: These are only my opinions and do not constitute investment advice.