Etsy: Underappreciated Growth Story

Value versus growth investing has been a major topic of discussion in 2021. Money has rotated rapidly across different styles throughout the year, and investors are always trying to find out which style - value or growth - is going to deliver superior returns in the months ahead. However, from a broader perspective, the basic distinction between value and growth stocks is too simplistic and short-sighted.

Sustained growth can be a huge driver of fundamental value for a business, so a company with rapid revenue growth and attractive profit margins can be deeply undervalued even if valuation ratios look high in comparison to current sales and earnings. When you look at the valuation ratios, you have to assess those ratios in a broad context that includes other variables such as competitive strengths, the quality of the management team, long-term growth opportunities, and profitability.

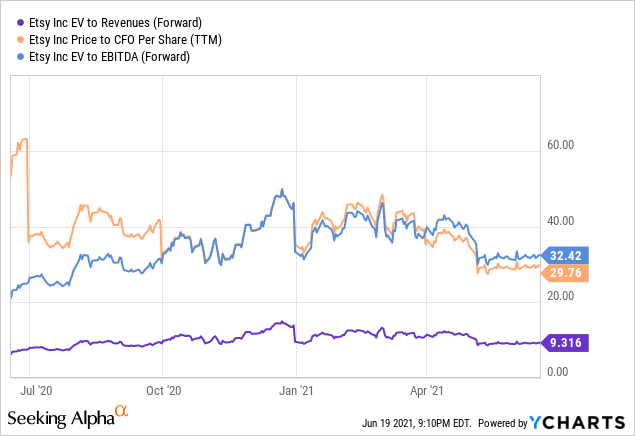

In the particular case of Etsy (ETSY), you don't even need to do much of an effort to justify current valuation ratios. The stock is trading at valuations levels that have remained stable in the past year, like if COVID-19 had never happened.

Revenue is expected to grow 32% in 2021, and the stock is trading at an inexpensive EV/Revenue ratio of 9.3 on a forward basis. Looking at both cash flows and EBITDA, it is hard to argue that Etsy is not fairly priced, especially in comparison to other growth stocks in the market.

Data by YCharts

Looking at these valuation levels, it seems to me like the market is underestimating Etsy and its long-term potential.

One of the main success drivers for Etsy has been mask sales in recent quarters. As the market is now looking at a future without masks, investors are staying away from companies previously seen as beneficiaries of the pandemic.

Besides, Etsy is a business with $2.3 billion in sales competing against a giant such as Amazon (AMZN), which makes $490 billion in annual revenue. Having bigger competitors with deep pockets is always an important risk factor to consider.

Nevertheless, there are strong reasons to believe that Etsy is well-positioned to deliver attractive returns in the years ahead. Etsy has a compelling business model powered by differentiation and the sustained competitive strength generated by the network effect. Management is executing at a high level, revenue growth is accelerating, and profit margins are expanding even as the economy reopens.

A High-Quality Business Model

Etsy has a well-defined mission: To keep commerce human. The company is the top online marketplace for homemade crafts and vintage products. Consumers go to Etsy in search of unique and differentiated products, which is very different from Amazon's approach.

If you are looking for a commoditized product, electronics, packaged food, or a pair of sneakers from a big brand, Amazon is unbeatable in terms of selection, prices, and logistics.

How do you beat Novak Djokovic?

You challenge him to a game of poker, or perhaps crosswords. But you never, under any circumstance, enter a tennis court against Djokovic.

Etsy is focused on handmade fashion and accessories, jewelry, home decor, and art. The company is also a big proponent of commerce with a human face, which is a big differentiator from Amazon. Etsy is not competing on price and convenience, it is competing on providing special things.

In fact, Amazon launched Amazon Handmade in 2015, and it has not hurt Etsy at all. Etsy has not only survived but even thrived in recent years, which validates the thesis that Amazon and Etsy are playing different games.

Etsy benefits from sustainable competitive strengths produced by a two-sided network effect, meaning that buyers and sellers attract each other to the platform in search of more and better opportunities. Supply creates demand and demand creates supply.

Being a platform that matches buyers and sellers provides enormous agility and speed. As the pandemic came in March of last year, masks were not easy to find at regular stores, but Etsy had an army of millions of sellers who started working intensely to satisfy that demand as quickly as possible.

Etsy charges sellers $0.20 for a four-month listing and a 5% transaction fee on every sale. In addition to this, transactions via Etsy Payments pay 3% and a $0.25 payment processing fee. The company is increasingly betting on advertising as another growth engine that is highly complementary to e-commerce and payments.

The economic side of the business model is clearly attractive, as Etsy gets to retain a relatively high take rate on transactions, and it leverages the ambition and creativity of sellers in order to guarantee that buyers are having access to the right products at the right time.

Strong Performance And Outstanding Execution

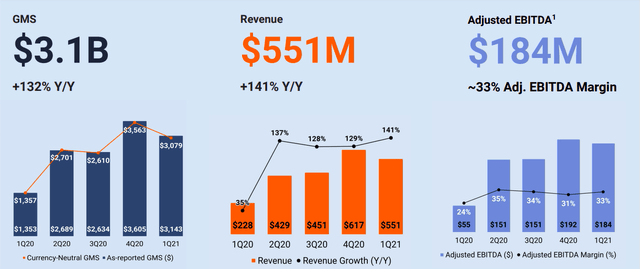

The numbers for the first quarter of 2021 are more than strong, with revenue increasing 141% and adjusted EBITDA margin reaching 33% of revenue.

Source: Etsy

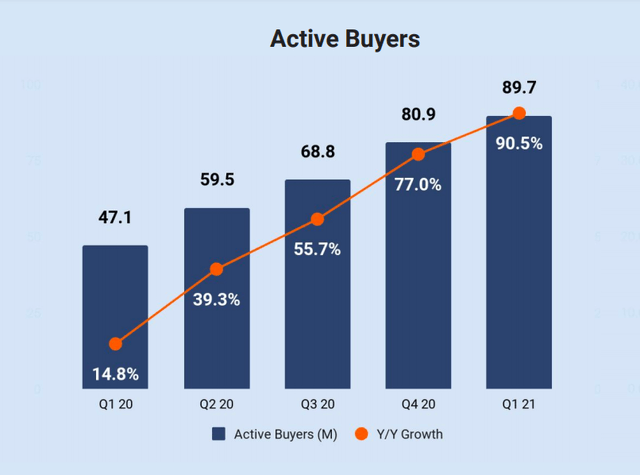

Etsy added 16 million new or reactivated buyers in the quarter, for a total of 89.7 million active buyers at the end of the period, up 90.5% year-over-year.

Source: Etsy

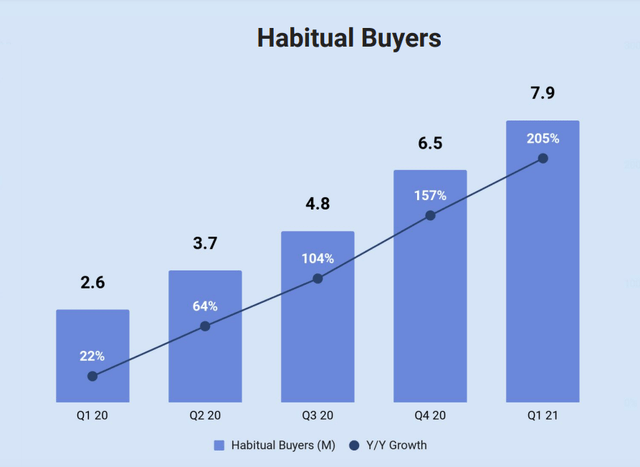

Habitual buyers are buyers who make at least 6 purchases per year on Etsy or who spend over $200 per year on the platform. This is the most valuable cohort for the company, and it delivered a huge acceleration to 205% growth year over year, a record growth rate for Etsy in this critical cohort.

Source: Etsy

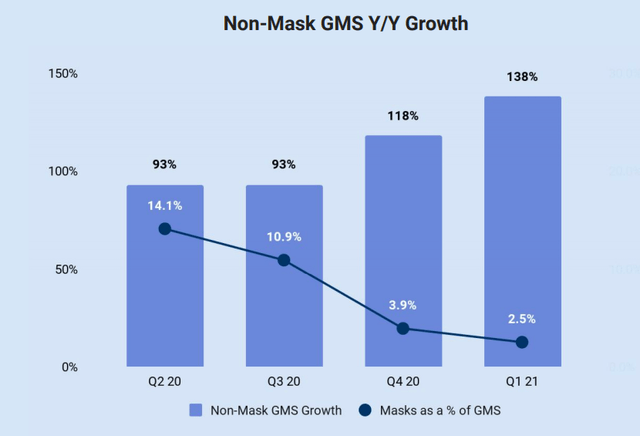

Non-mask GMS - gross merchandise sales - grew 138% last quarter, and masks currently account for 2.5% of GMS versus 14.1% in the second quarter of 2020. Masks provided a big boost to the business in 2020, but Etsy's success is about much more than masks nowadays.

Source: Etsy

On the back of accelerating revenue growth in recent quarters, management has made a series of investments to improve the user experience and drive sustained growth. Etsy now has better search engines that can be personalized in order to deliver superior results for each buyer's specific needs and tastes.

Sellers can upload videos showing not only the products but also the production process, and more conversations between buyers and sellers are encouraged in order to drive further personalization.

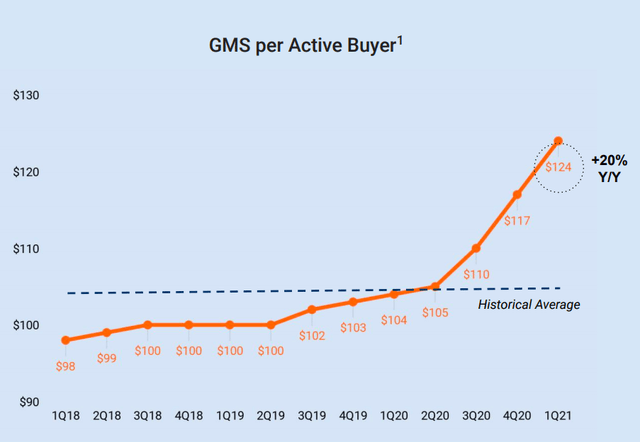

Looking at the consistent increase in GMS per active buyer, this strategy seems to be working well and driving accelerating engagement.

Source: Etsy

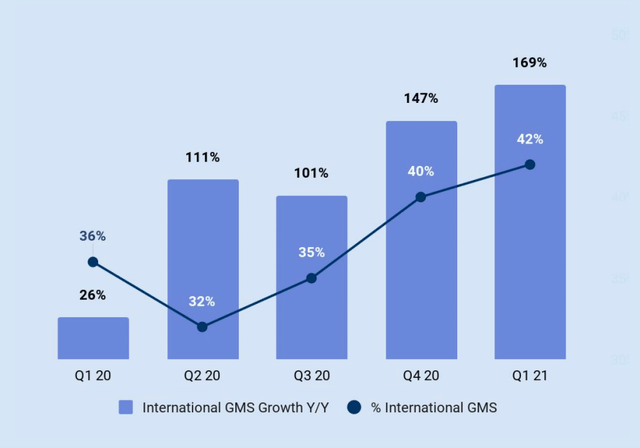

International GMS expanded 200 basis points sequentially to 42% of overall GMS during the quarter. International GMS grew faster than overall GMS growth, accelerating to 169%, and proving that international could be a powerful growth driver for the business in the years ahead.

Source: Etsy

The company has recently made some interesting acquisitions like global fashion resale marketplace Depop for $1.6 billion and Reverb, a marketplace focused on musical instruments, bought for $270 million in 2019. These acquisitions are not cheap, but they add a lot of strategic value by strengthening the marketplace and the network effect.

Now that Etsy has reached considerable scale and the company has the resources to continue making acquisitions in the future, it would make sense for acquisitions to become a big part of the company's strategy going forward. Acquisitions always carry some integration risk, but the strategy can make sense financially and strategically if management makes smart and prudent moves.

Risk And Reward Going Forward

Now that the economy is on track to fully reopen in the short term, many consumers may want to go back to the physical stores in some categories. However, this should not be much of an issue for Etsy over the intermediate-term. The lines between physical and online commerce have now been blurred, and Etsy is doing a great job at keeping customers engaged.

It is not so much the shift back to brick-and-mortar retail that could be a risk, but rather shifting consumer spending away from physical products towards services such as travel and restaurants. Clothing and fashion accessories could remain strong, but home products and masks will probably be under a lot of pressure in the near term. Besides, Etsy benefited from increased spending due to the stimulus checks lately, and this is not going to be a factor going forward.

Moving beyond the short-term cyclical considerations, the competitive landscape is very dynamic. Etsy has done a great job on that front so far, but the company has a relatively high take rate, and there is always the possibility that bigger players could steal some sellers away by undercutting Etsy in that area. At this stage, this is just a potential risk to keep in mind as opposed to a concrete threat to the business, but it is still worth noting.

Those risks being acknowledged, Etsy has a great business model and management is delivering at a high level. The company can easily grow revenue at 20%-25% or more in the coming years, and profit margins are consistently increasing. All this comes for a very reasonable price, as Etsy is trading at less than 10 times forward revenues.

All things considered, the conditions are right for Etsy stock to reward investors with generous returns over the intermediate and long term.

Disclosure: I am/we are long ETSY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more