Etsy Just Hit The Lower Rail Of An Upwardly Sloped Trend Channel

The work from home economy has produced a number of interesting scenarios over the past year, both on the bullish side and the bearish side. One of the companies that has benefitted, or at least seen its stock climb sharply, is Etsy, Inc. (ETSY), the online marketplace operator. Since the low last March, the stock is up almost 600% and at its high it was up 672%.

It hasn’t been a case of the stock rallying while the earnings and revenue were flat either. Earnings jumped by 332% in the fourth quarter and they are expected to jump by over 700% in Q1 2021. Revenue was up 129% in Q4 and is expected to jump 140.5% in Q1. Over the last three years, earnings have increased by an average of 83% annually and revenue has increased by an average of 52% per year.

Those huge growth numbers can be attributed to the pandemic and people staying at home more. There were also factors like mask sales that helped boost revenue. The company was already growing before the pandemic, but the growth rates accelerated sharply after the pandemic hit.

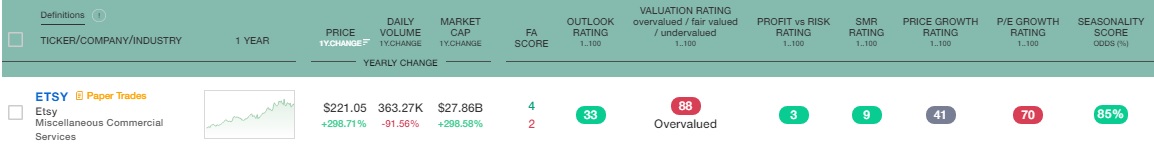

The growth figures combined with the profitability measurements are very attractive and they combine to form the SMR rating. The return on equity is at 60.8% and the profit margin is at 21.2%. Looking at the fundamental analysis screener from Tickeron, the company’s SMR rating is a 9—an extremely high score.

(Click on image to enlarge)

The SMR rating isn’t the only fundamental rating that is extremely high either. The Profit vs. Risk rating is a 3 and the Outlook rating is 33. There is also a Seasonality Score of 85% that could help boost the stock in the coming months.

When you look at all of these fundamental factors and the technical factors, it’s no wonder that Etsy is considered a “strong buy” on Tickeron’s scorecard. Something to remember about Tickeron’s scorecard is that it is based on artificial intelligence. The algorithm takes all fundamental and technical factors into account and then calculates whether the stock is a buy or not.

Most “buy” and “sell” ratings are formed by a human analyst. Sure they may look at the same factors, but the ultimate rating comes down to a human or a group of humans determining what to rate the stock.

I bring this up because there are 15 analysts following Etsy at this time and 13 of the 15 have the stock rated as a “buy”. There is one “hold” rating and one “sell” rating at this time. If we look at the buy ratings as a percentage of the total, the buy percentage is 86.7% and that is extremely high. That is one concern I have about the stock. Looking back at the fundamental screener, the stock is overvalued at this time and that is a secondary concern.

Momentum is Still to the Upside

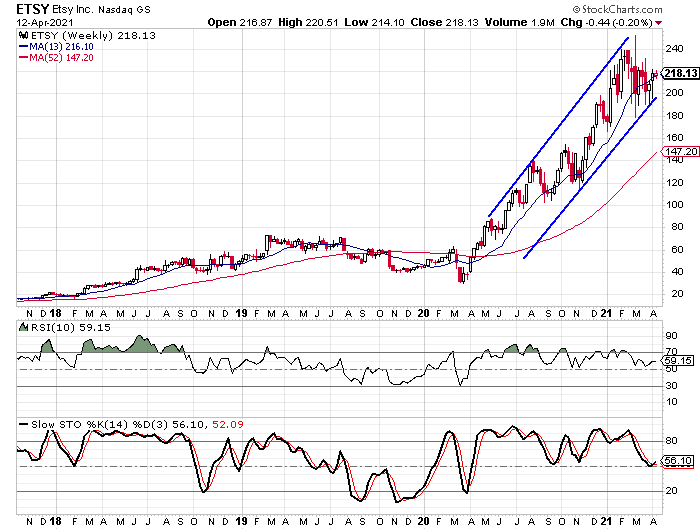

Shifting our focus to the technical analysis, we see on the weekly chart how a trend channel has formed over the last 13 months. The upper rail defines the angle more than the lower rail at this point. The highs from last May and August, along with February of this year, form the upper rail. The parallel lower rail connects the low from last November with the lows from last month.

(Click on image to enlarge)

Looking at the overbought/oversold indicators we see that the weekly stochastic indicators dropped down near the 50 level in the last few months and have now made a bullish crossover. We see similar circumstances in September and November of last year. The stochastic indicators haven’t been below the 50 level since last April.

The 10-week RSI is hovering around the 60 level and it also hasn’t been below the 50 level since last April.

Looking at the Tickeron technical analysis screener we see that the stock has received three bullish signals in the last few days. The MACD indicator, Momentum indicator, and the Moving Average indicator all generated bullish signals two trading days ago. All three signals show a high probability of another move higher in the coming weeks. I should mention that the technical analysis screener is based on daily technical indicators rather than weekly ones.

(Click on image to enlarge)

Etsy is set to report earnings again in the first week of May. I couldn’t find the exact date on the company’s investor relations page, but three different sites have the report coming out on May 5 or 6.

Expectations for the earnings report are pretty high. Over the last 60 days, the consensus EPS estimate has jumped from $0.40 to $0.87. There have been 11 analysts move their estimate up and there are only 12 analysts with estimates. This tells us that optimism is running pretty high and it could be setting a very high bar for the company to clear.

I mentioned earlier how bullish analysts are toward the stock and that is only one sentiment indicator. Another indicator that shows above-average optimism is the short-interest ratio. The ratio is at 2.03 currently and that is lower than the average which falls in the 3.0 range. The number of shares sold short has dropped sharply over the last year, falling from 14 million last April to 6.16 million in mid-March. The current short interest level is the second-lowest reading in the past year.

The overall outlook for Etsy is pretty solid based on the technical and fundamental factors. The sentiment and the valuation measurements are a concern investors need to keep in mind if they establish a long position on the stock. Personally, I look for Etsy to continue its upward trend over the next few quarters at the very least. We may see some spikes and pullbacks long the way, but I look for the trend channel to help guide the stock higher.

Disclaimer: Although our services incorporate historical financial information, past financial performance is not a guarantee or indicator of future results. Moreover, although we believe the ...

more