Etsy Is Positioned For Abundant Upside Potential

Etsy (ETSY) is benefiting from strong tailwinds due to accelerating demand for e-commerce during the pandemic, and management is translating these tailwinds into vigorous revenue growth and expanding profitability. Importantly, Etsy is about much more than a short-term phenomenon, the long-term growth story is barely getting started, and Etsy has plenty of upside potential versus current prices in the years ahead.

Outstanding Execution

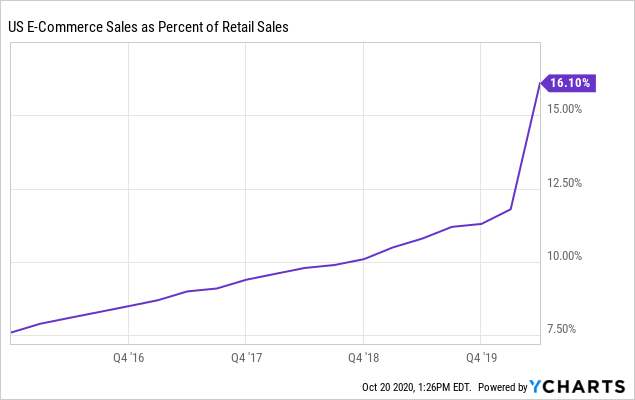

The e-commerce industry is benefiting from accelerating adoption over recent months, but not all companies are capitalizing on this tailwind to the same degree. The industry is savagely competitive, and most of the growth opportunities are being captured by the dominant giant that is Amazon (AMZN).

Data by YCharts

But Etsy is building a differentiated niche by focusing on its mission of making commerce human and specializing in handmade products, vintage items, and crafted goods. Importantly, this sets the company aside from Amazon, and it provides a layer of competitive differentiation.

In fact, Amazon launched its Handmade at Amazon site in 2015, and it did not do any damage to Etsy. It is not just about the products available on the platform, but also about the company's values and the cultural footprint of the marketplace. Most buyers and sellers on Etsy would hardly consider moving to such an enormous and "industrialized" platform like Amazon.

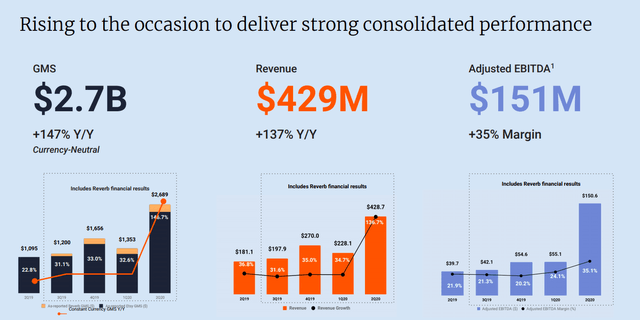

The business is firing on all cylinders as of the second quarter. GMS grew 147% versus the same period in the prior year, with marketplace revenue growing 146% and services revenue growing 110.7%. Overall, total revenue increased 137% to $428.74 million, comfortably surpassing Wall Street expectations by $98.75 million during the quarter.

Source: Etsy

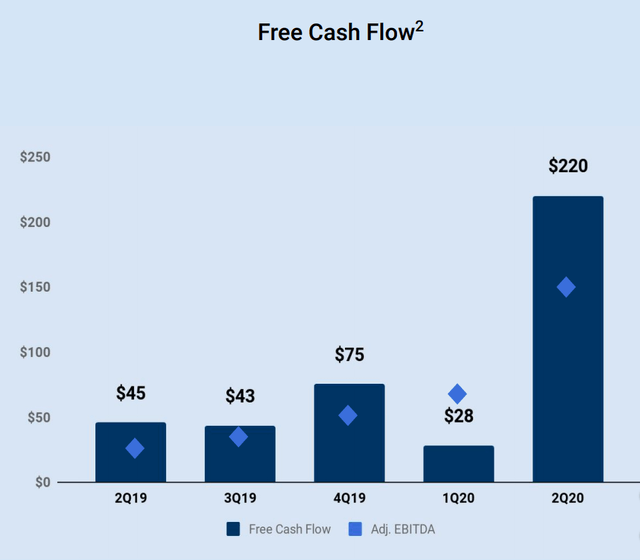

The business model is asset-light and it has low capital reinvestment needs. In spite of the fact that Etsy is dynamically investing in product and marketing, margins are expanding and both profits and cash flows are growing nicely.

Source: Etsy

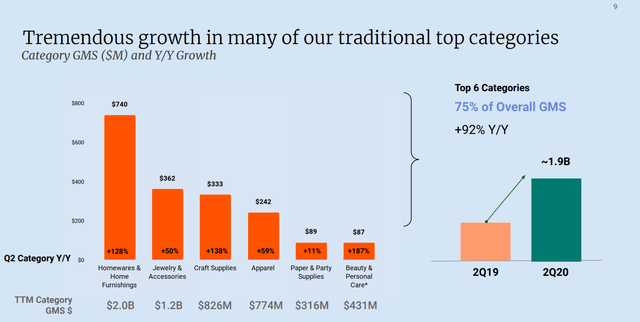

One reason for caution among investors in Etsy is that the mask sales have been a spectacular boom for the company, and this is a temporary driver. However, this perspective could be missing the forest for the trees, the company is actually doing very well across all categories, and many of the buyers and sellers who are initially attracted to Etsy in search of masks will generate recurrent businesses for the company in the future.

Etsy sold $346 million in masks during the second quarter, that's enough masks to stretch all the way from New York to London according to management. If you are looking at the company from a long-term perspective, you clearly have to assume that this category will probably go to zero as the world overcome the COVID-19 pandemic for good.

But the business is booming well beyond masks. Non-mask sales grew 93% in the second quarter, accelerating versus a 79% increase in April. Most of the customers who go to Etsy for the first time in order to buy masks end up buying other products too, and many of them will remain on the platform going forward. Masks are providing a short-term boost to revenue, but this category is also attracting lots of buyers and sellers to the platform while creating plenty of opportunities for the company going forward.

Source. Etsy

Abundant Upside Potential

In very simple terms, the returns that Etsy is going to produce in the future can be reduced to a basic equation. The price change will depend on how much revenue grows and how the price to revenue ratio evolves over this period.

When investing in high growth stocks, you are typically paying an elevated price to sales ratio because those revenues are expected to grow vigorously. For this reason, it is reasonable to expect the price to sales ratio to contract to some degree as the business matures and growth naturally slows down over time.

In the particular case of Etsy, however, the stock is trading at a very reasonable price to sales ratio of 10.3 times revenue estimates for 2021. Considering that the company has many years of vigorous growth ahead of it, the valuation is hardly excessive, and we could even make the case that Etsy is undervalued in comparison to other high growth stocks in the market.

Not only that, but the company is also making solid progress in terms of driving improving profit margins, and expanding cash flow generation. All else the same, the more profitable the business, the higher the value of each dollar in revenue, so higher margins could mean a higher price to sales ratio too.

Considering current valuation, expanding profit margins, and long-term growth opportunities, Etsy is offering a very reasonable entry price and plenty of room for appreciation.

The most important variable in this equation is clearly long-term growth opportunities, especially for investors who are planning to hold on to Etsy over the years to come.

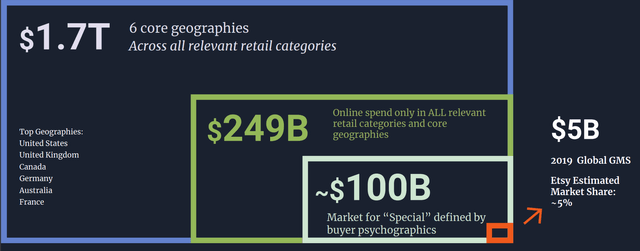

Back in 2019 management estimated that the total addressable market could be in the neighborhood of $100 billion when considering the market for "special products" across the top 6 geographies. However, this definition is far too limited.

Source: Etsy

For a company like Etsy, supply creates its own demand and demand creates supply. When sellers bring the right products to the platform, this attracts more buyers, and buyers looking for all kinds of items creates more business opportunities for sellers.

Nearly 30% of items being sold on Etsy are customizable, so consumers can actually get access to unique products not available everywhere else. The size of the market opportunity is not static, but it is rather being enlarged by the daily interactions of buyers and sellers.

In any case, the dividing lines between offline and online commerce are increasingly getting blurred, and nearly half of sellers are based on international markets, so the company is a truly global marketplace. The size of the market opportunity is clearly no limitation for Etsy in terms of assessing the company's growth potential.

In any case, the total addressable market is a widely overhyped term. For investors, execution is generally a much more important driver of returns, and the right management team can create additional growth opportunities over the years.

Etsy is on the right track to delivering sustained long-term growth and expanding profit margins in the years ahead. From current price levels, the stock should offer attractive returns to investors if management keeps leading the company in the right direction.

Disclosure: I am/we are long ETSY, AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more