EQ Works: "Our Competitors Can Only Dream About What We Offer"

TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

EQ offers a unique value proposition in the market as it gives its customers the ability to understand what consumers are looking for and then presents them with the most relevant content and advertising. Indeed, as their website says, "we are able to discern and leverage location behavior in ways our competitors can only dream of."

About EQ Inc. (TSXV: EQ; OTC: CYPXF)

EQ Works applies its proprietary SaaS platform to mine insights from location and geospatial data from 350,000,000 devices across North America to discern and leverage location behavior by using:

- unique and third-party data sets,

- advanced analytics,

- artificial intelligence,

- and machine learning

to create actionable intelligence for businesses to understand, predict, and influence customer behavior and in doing so to attract, retain, and grow customers.

An Example Of How EQWorks Works:

When one of the world's largest book publishers was developing a marketing strategy to launch 10 new titles across the United States, it looked to EQ for assistance to better understand who their highest value customers were and how best to target them.

To that end, EQ used its proprietary data platform (LOCUS) to map the pre-COVID consumer behavior from almost 2,500 book retail locations across the U.S. to identify more than 2 million "high-value" book enthusiasts. To better target these book buyers, the LOCUS platform merged additional demographic and habit information to each consumer profile and delivered a unique "call to action" in support of each book title launch.

According to an EQ news release, "Using EQ's award-winning Creative Studio, the publisher was able to tie deep data insights to interactive digital advertising that outperformed industry standards and helped close the last-mile in referring the consumer to an opportunity to purchase online."

Q3 Financial Review

In Q3 many of its customers renewed previously paused campaigns due to the COVID-19 crisis resulting in:

- revenues increasing by 64% sequentially to C$2.85M;

- gross margin improving to 50% sequentially from 37%;

- adjusted EBITDA loss improving to approximately C$(0.1)M sequentially from C$(0.6)M.

The above trends are expected to continue and to grow substantially going forward.

Data solutions revenue in Q3/2020 was C$0.7M and now accounts for 25% of the company's overall quarterly revenue. That being said, the largest ad market in the world, the U.S., currently accounts for only 7% of the company's revenue so there is unlimited potential for company growth. We await news of more U.S. deal signings.

Below is a revised summary of related company financials:

Source: Company Reports, S&P Capital IQ, eResearch Corp.

As identified above, eResearch Corp. - the new owner of munKNEE.com - projects the following growth on revenue and EBITDA:

- 2020E: Revenue $10.3 million; EBITDA -$1.1 million;

- 2021E: Revenue $17.8 million; EBITDA $3.0 million;

- 2022E: Revenue $23.2 million; EBITDA $5.6 million

(Click on image to enlarge)

Source: Company Reports and eResearch Corp.

In addition, eResearch forecasts an equal-weighted price target of C$2.00 based on a DCF valuation of C$2.24/share and a Revenue Multiple valuation of C$1.82/share. Go here to convert the above Canadian dollar figures into other currencies. (If you are interested in eResearch's 12-page Update Report on EQ please click here.)

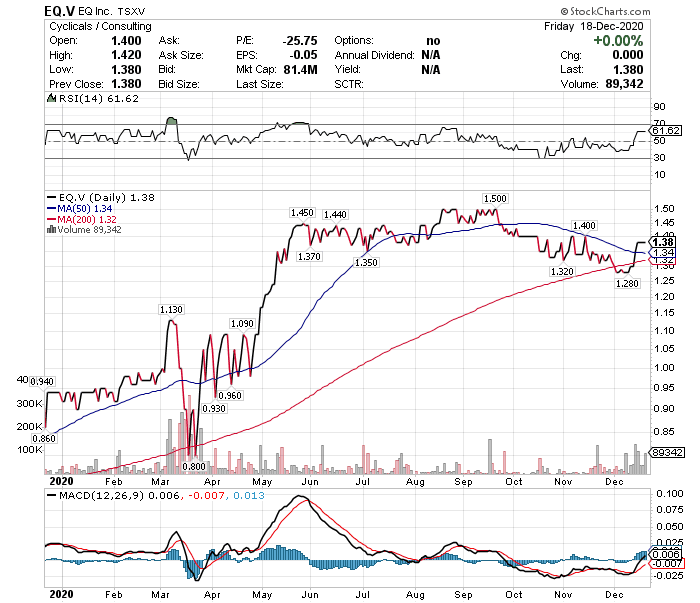

Stock Performance YTD (in Canadian dollars)

(Click on image to enlarge)

My research of EQ suggests that it has a bright future. I currently do not own any stock in the company but plan to buy some in early 2021 if their stock continues to hold up. For the record, I was ...

more