Endless Rally On Stimulus Without Anything Passing

Another Small Cap Rally

The stock market is getting close to being overbought again which is amazing because a few weeks ago the market was down 10%. It’s amazing how many days the market can rally on the potential for a stimulus. This reminds us of when the market would rally on trade talks without a deal occurring. It’s fair to say the market is responding to a potential cyclical acceleration because of how well small cap value stocks and banks have done.

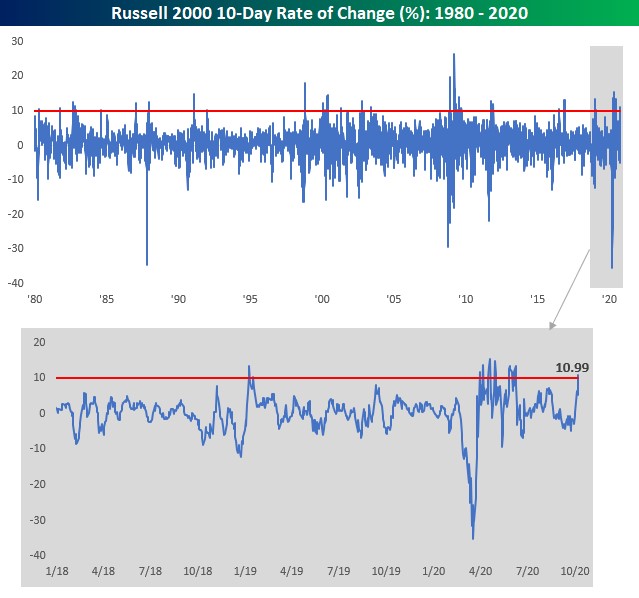

Russell 2000 was up 1.09% which continued its amazing October. As you can see from the chart below, this has been one of the best 10-day runs in the past 40 years for the small cap index. It’s up 10.99% which is almost as much as it was up after the bear market in March. Relatively speaking, small caps have underperformed this year, but they didn’t exactly start the month as oversold as they were in late March.

(Click on image to enlarge)

Positive news on a potential stimulus without anything actually happening is becoming a trend. Most of us have given up on a stimulus passing before the election, but we will likely see one soon afterwards. News on Thursday was that Nancy Pelosi and Secretary Mnuchin spoke at 3 PM for 40 minutes.

Frankly, most people think there would be a deal if it wasn’t for Congress not following their lead. Many don’t think their talks mean a deal is imminent. However, we'd all rather them talk than not. Fact that they are talking probably means they think something is at least possible.

Details Of Thursday’s Trading Session

On Thursday the S&P 500 was up 80 basis points which means it is quickly inching towards a new record high. It’s up 6.5% since September 23rd and it’s only down 3.7% from its peak. This time it’s being led by cyclicals rather than tech. As you can see from the chart below, the Dow Jones Transports index hit a new record high on Thursday. FedEx FDX is up an enormous 20% in the past month. It’s up 200% since the bottom.

(Click on image to enlarge)

To be clear, it’s not as if the tech stocks are falling. Nasdaq was up 50 basis points. Cloud index was up 32 basis points which put it just 2.9% off its record. It's unlikely that it will surpass that high for many years. August was probably the peak of euphoria in the software industry.

It was yet another great day for small cap value as the index rose 1.6%. It has been on an amazing run as it is up 13.6% since September 23rd. The regional bank index was up 1.5% as it is up 18.3% since its recent bottom.

Draftkings, Penn Gaming, & GameStop

The wildest action on the day was from the gambling stocks and GameStop GME. Draftkings DKNG continued its terrible losing streak by falling another 4.1%. It’s now down 19.8% in 4 days. It’s oversold in the short term, but it’s still very overvalued. Penn Gaming PENN joined the fun by falling 4%. It’s down 11.7% from it’s top on September 22nd.

It will be interesting to see how the stock reacts to its earnings report later this month. The actual business is doing terribly. Casinos are weak and online gambling has only launched in one state.

GameStop exploded 44.1% on the day as it announced a partnership with Microsoft. In reality, it’s just using Teams, Microsoft 365, surfaces, and selling Xbox systems. This isn’t really a partnership. The stock was halted and then exploded because it is highly shorted.

Any good news is like lighting up a powder keg. The stock is up 225% since August 3rd. This is a bad business that is benefitting from a short squeeze. At one point, more than 100% of the shares were held short.

Not A Bubble In The Big Companies?

As you can see from the chart below, the largest 5 companies as a percentage of the S&P 500 are bigger than they were at the peak in 2000. However, their average PE multiple is about half. That doesn’t mean they are safe investments. Their estimates could be too high or they could be subject to regulatory woes.

Democrats say they want to break them up. It’s amazing how the bottom 495 firms have a higher PE ratio than the top in 2000 because they haven’t increased much in the past few years. Maybe their earnings estimates are too low.

(Click on image to enlarge)

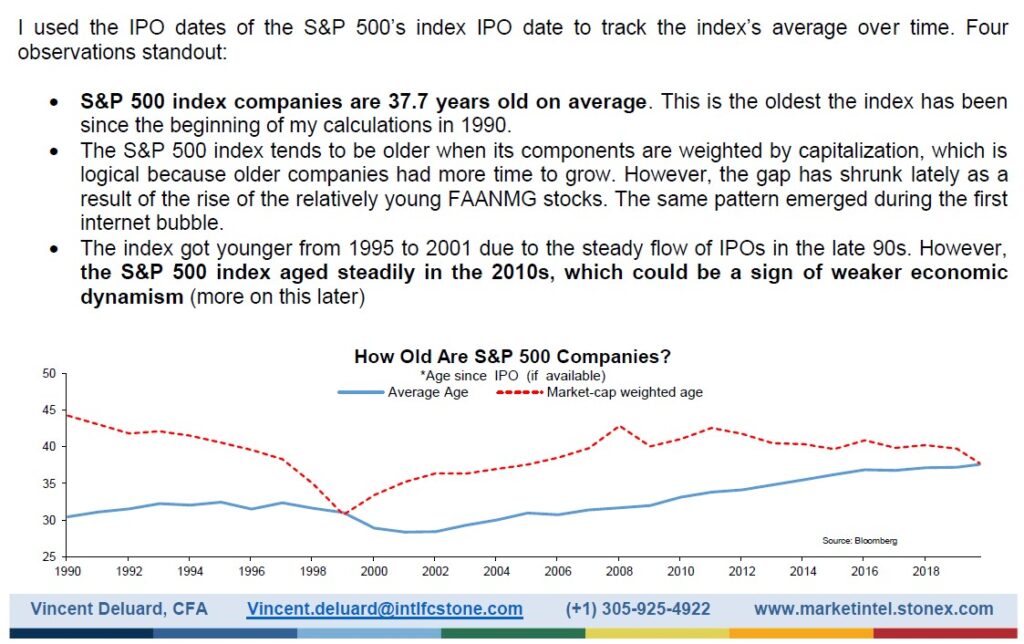

Average S&P 500 firm is 37.7 years old which is the oldest average since tracking started in 1990. And average age weighted by market cap as compared to the regular average is the same. Usually, the age-weighted by market cap is higher because companies have time to grow.

But now younger companies are doing well just like during the tech bubble. While valuations are stretched, we still want new companies to flourish because that signals there is healthy competition.

(Click on image to enlarge)

COVID-19 Data Starting To Look Problematic

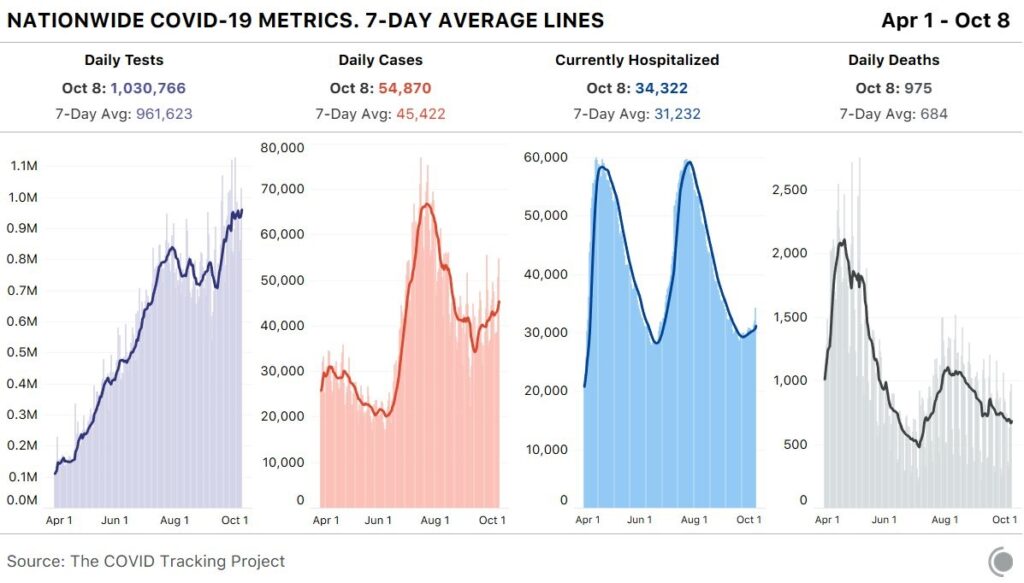

COVID-19 situation keeps getting worse in the Midwest as it caused there to be 54,870 new cases on Thursday which pushed the 7-day average up to 45,422. We are experiencing a 3rd wave. It’s certainly not a disaster, but it’s concerning for the areas hit the hardest.

The worst news seen in the chart below is there are now 34,322 people in the hospital because of the virus which is over 5,000 more than the trough. The 7-day average has risen to 31,232.

(Click on image to enlarge)

Good news is there were 1.03 million tests which put the 7-day average at 961,623 which is a new record high. Some were looking for it to hit 1.5 million by October 15th. That has to be pushed back to October 31st. The good news is the 7 day average of deaths is only 684 which is still low. It will likely increase to above 750 in the next 2 weeks because of the rise in hospitalizations.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more