Empire & Puzzles Acquisition Likely To Increase Zynga’s Net Income By 100% Or More

Summary:

- Zynga’s average monthly revenue based on its quarterly report is only $74.25 million.

- The $560 million purchase of an 80% stake in Small Giant Games helps Zynga earn $16 million in additional monthly sales.

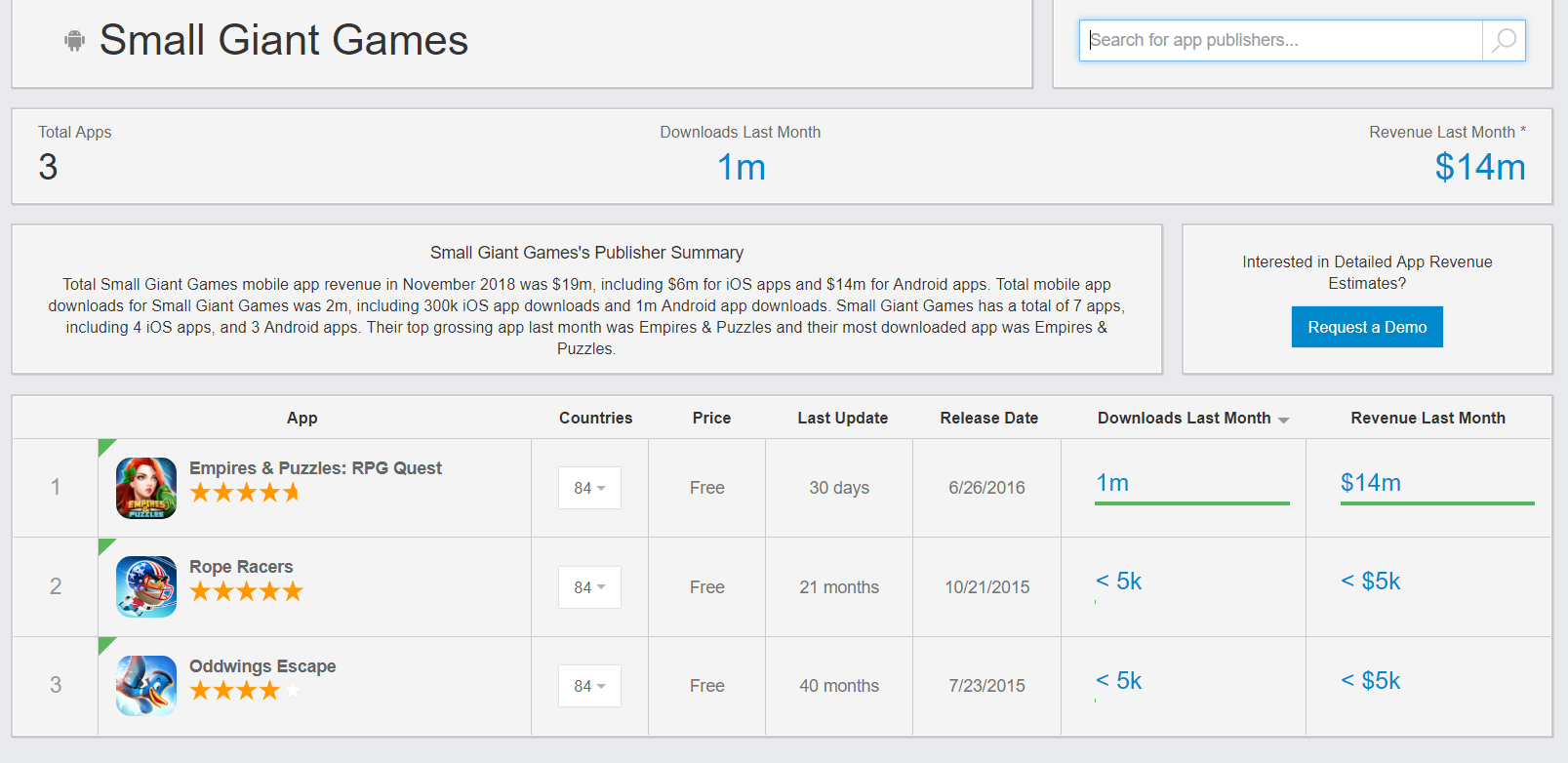

- Small Giant Games is the developer of Empire & Puzzles: RPG Quest, which has net global monthly sales of $6 million from iOS and $14 million from Android devices.

- The $700 valuation purchase price is a good deal for Zynga. It bought a game developer that makes around $240 million in net annual sales.

- A 21.5% monthly revenue boost just from buying one hit mobile game should also lift the profitability of Zynga.

I am more inspired to keep increasing my exposure to Zynga (ZNGA). Its recent acquisition of Small Giant Games can boost its monthly revenue by $16 million (+21.5%). Based on the quarterly earnings reports of Zynga, it only has an average monthly revenue of $74.25 million. Zynga obviously needed another hit mobile game to get nearer to $100 million in monthly revenue. Instead of wasting time and money in developing a new game, Zynga used some of its cash to jbuy another company’s hit mobile gam.

Small Giant Games is the Finnish developer of the hit mobile game Empire & Puzzles: RPG Quest. Empire & Puzzles is a mixed match-3, heroes-based card collecting game, and turn-based PVP combat online multiplayer game with estimated monthly net revenue of $20 million.

(Source: Apple iTunes)

The player-vs-player combat system compels competitive players to spend real dollars to acquire better heroes in Empire & Puzzles. It obviously has a strong gacha system that is helping Small Giant Games earn $20 million every month.

(Click on image to enlarge)

(Source: SensorTower)

Empire & Puzzles only had an estimated 1 million in downloads on Android last November, but it still managed a net sales of $14 million. It also netted $6 million from iOS device-using players last month. Zynga is paying $560 million to acquire 80% stake in Small Giant Games. This gave Small Giant Games a valuation of $700 million. This is cheap considering its estimated average monthly net sales is now $240 million.

Note that net monthly sales estimates from Sensor Tower already deducted the 30% cut of Apple (AAPL) and Google (GOOG ). Empire & Puzzles gross monthly global sales is therefore around $28 million. I do not think Zynga or NaturalMotion has a mobile game right now that is grossing more than $25 million.

Why It Matters

Getting a 21% improvement in its monthly revenue should also help Zynga’s profitability. Remember this 21% boost is just from one game, Empire & Puzzles: RPG Quest. It is a 2016-era mobile game by Small Giant Games. It already proved its longevity and appeal to paying players. Small Giant Games likely spends less than $5 million a month in marketing/advertising and updating Empire & Puzzles.

(Click on image to enlarge)

I guesstimate that Small Giant Games has monthly net profit of $8 million. Zynga’s Q3 net income was only $10.2 million. Eighty percent of $8 million is $6.4 million. My estimate therefore is that Small Giant Games can substantially increase Zynga’s quarterly net income to more than $20 million.

Zynga reporting Q3 2019 with a net income of more than $20 million could boost its stock’s price to above $5. This is reasonable price target. The average 12-month PT for ZNGA at TipRanks is $4.73. However, this average was based on price target numbers published prior to the acquisition of Small Giant Games.

(Click on image to enlarge)

(Source: TipRanks)

Conclusion

Inorganic revenue/net income growth through acquisitions is an easy way to earn the respect of more institutional and retail investors. The video games industry is a risky business. It takes a long time and lots of money to develop and test video games. It takes more money again to market them so they can become commercial successes. It is therefore smart of Zynga to just buy another game developer to quickly own a hit mobile game like Empire & Puzzles: RPG Quest.

My fearless forecast is that Empire & Puzzles will still emerge as Zynga’s no.1 grossing mobile game next year. It has the potential to out-gross Zynga Poker and Hit It Rich! Casino slots. It will take some time before Zynga’s Disney (DIS) licensed mobile games to be developed and released.

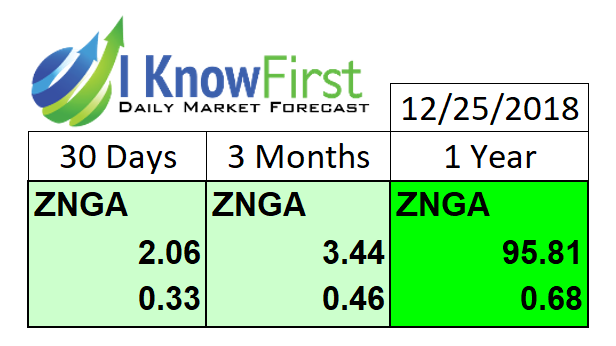

Past I Know First Forecast Success with ZNGA

I Know First has been bullish on ZNGA shares in past forecasts. On November 28, 2018 an I Know First algorithm issued a bullish 1 year forecast for ZNGA with a signal of 79.21 and a predictability of 0.68, the algorithm successfully forecasted the movement of the ZNGA share so far.Since last month the shares of ZNGA have risen by 6%.

Disclaimer: Please note-for trading decisions use the most recent forecast.

Disclosure: This article originally appeared on more