Emerald Exposition Poised For Another Bump From Quiet Period Expiration

The quiet period for Emerald Expositions (NYSE: EEX) is scheduled to expire on 5.23.

At that time, its underwriters will be able to conduct analyses and release detailed positive reports and recommendations for the first time since the company's IPO on 4.27. The underwriters include: BofA Merrill Lynch, Barclays, Goldman Sachs, Citi, Credit Suisse, Deutsche Bank, RBC Capital Markets, and Baird.

For the past five years, our firm has studied price movement around IPO quiet period expirations and found abnormal positive returns in the day (-5) to day (+2) range, surrounding the quiet period expiration event day (0).

We first covered Emerald Expositions ahead of its IPO on our IPO Insights platform and recommended investors consider purchasing shares given its strong position in a growing industry, steady revenue growth, and improving gross margins. We view the upcoming quiet period expiration as a second buying opportunity for this growing firm.

Business overview

Emerald Expositions owns and operates business-to-business trade shows throughout the US and as of its IPO was operating 50 trade show events annually. Its trade shows operate in all industries including: general merchandise, sports, hospitality and retail design, jewelry, photography, decorated apparel, building, healthcare, and military.

Emerald Expositions began operations in 1994 and has grown through a series of acquisitions. In 2013, it was acquired by PE firm Onex.

Management

David Loechner currently services as CEO, president, and board member. He was previously the Senior Vice President (2006 - 2010) at the company before taking over the CEO role. Loechner has over 33 years of experience in the trade show industry and holds a B.A. in Business Administration from Principia College.

Philip Evans has served as CFO and Treasurer since joining the company in October 2013. Previously, he was CFO of ProQuest LLC (2009 - 2013). Evans holds a B.A. (Honors) in Accounting & Finance from the University of Lancaster.

Financial highlights

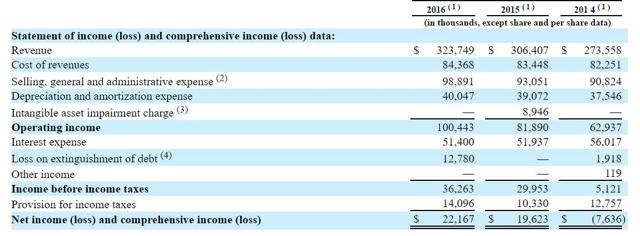

Emerald Expositions posted growing revenue and improving gross margins. Gross margins increased from 26% in 2015 to 31% in 2016. The vast majority of its revenue is generated through live events with less than 10% coming from marketing services, including digital media and print publications.

Emerald Expositions is one of the largest players in a highly fragmented industry. The four largest trade show organizers (Emerald Expositions, Reed Exhibitions, UBM and Informa Exhibitions) account for 9% of the market. Emerald Expositions' large size gives it more power to negotiate on price with suppliers and vendors than some of its smaller competitors.

(Click on image to enlarge)

(S-1/A)

Performance since IPO

Since making its debut on 4/27, the stock has performed well and is up 24.4% (pre-market session 5.16). The company raised $264M through the offer of its 15.5M shares. Shares were priced at $17 per share, which was below the initial price range of $18-$20, but then moved up quickly throughout the date. Emerald Expositions finished it first day of trading up 14.75%, and is currently priced at $21.05 per share. We expect positive reports from underwriters could push that stock price higher.

Conclusion: Chance To Buy Ahead Of Event

Emerald Expositions' revenue growth and strong market position were critical reasons that we were bullish on this company heading into its IPO.

As we expected, EEX has performed well since its debut, and given its powerful roster of underwriters, we expect a second bump in price surrounding the quiet period expiration date.

We recommend that investors consider a modest purchase of Emerald Expositions shares ahead of the quiet period expiration on 5.23.

Disclosure: I am/we are long EEX.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more