Embrace The Fear - Russell 2000 And S&P In 'Strong Buy' Territory

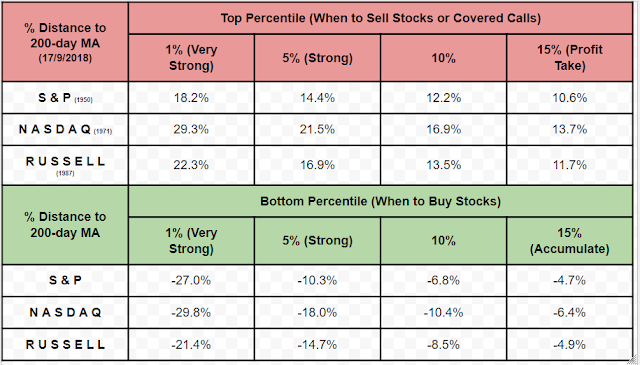

Since my last update markets have taken a bit of a spin. Investors should now take note that both the S&P and Russell 2000 fell into the 'Strong Buy' territory in the move to their respective swing lows. The Russell 2000 fell as far as 20% below its 200-day MA; note, if it reached 21.4% below its 200-day MA it would be in the 1% zone of historic weak action going all the way back to 1987; like it or not, this is a significant investor buying opportunity for Small Cap stocks.

However, the last few days have seen a bounce across the indices but it remains to be seen if this heavily oversold bounce will build into something more. Trading volume has been light in line with seasonal factors, although the Friday before the holidays was a massive distribution day. There is little confidence in the market and the New Year may see struggles if buying volume doesn't pick up.

In the case of the S&P this bounce could start to struggle if it makes it as far as the 20-day MA, particularly if this bounce has been driven by short covering rather than value buying.

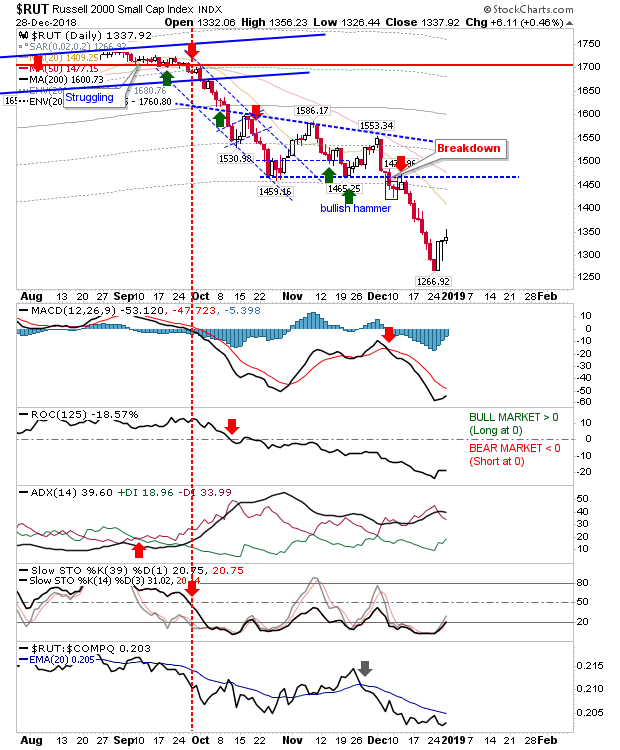

The Russell 2000 is the index which is offering the best holiday discount and the bounce is looking like the one most likely to succeed. There may be some weakness next week but near-term traders can look to measure risk on a loss of 1,266 with upside targets of 20-, 50-, and 200-day MAs as starting points. Investors should not overthink their commitment to buying but know they are getting a good price.

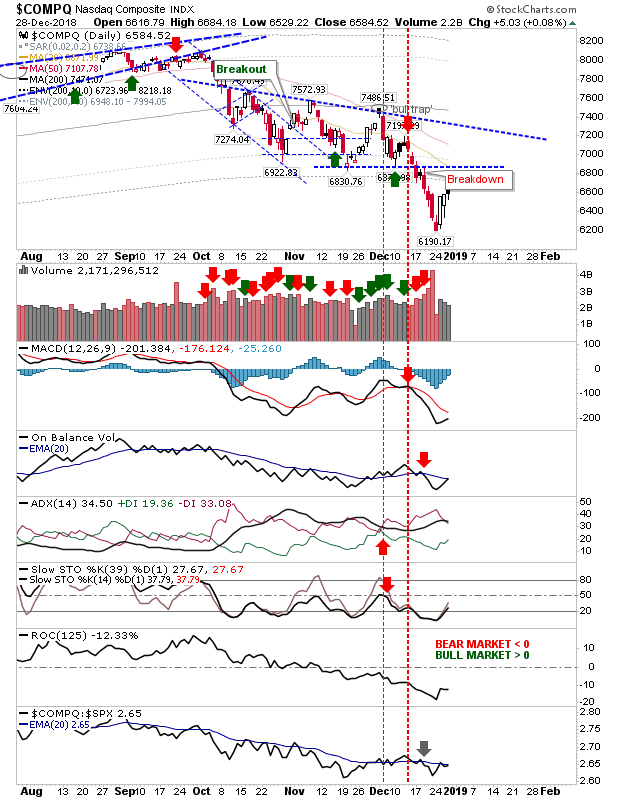

The Nasdaq is also offering excellent value even if it's caught a little between indices. Relative performance had flat-lined from November but it may be gaining a little interest as money cycles out of defensive large-cap stocks into more speculative technology and small-cap stocks.

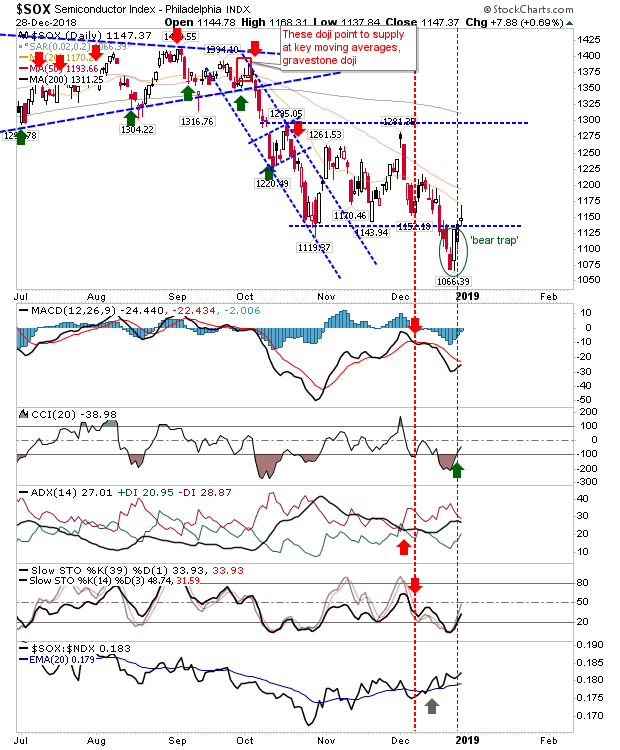

The Semiconductor Index is interesting in that the rally has managed to create a scrappy looking 'bear trap', which - if it holds - would set up for a decent rally in the Nasdaq and Nasdaq 100; 1,135 is key support in this regard.

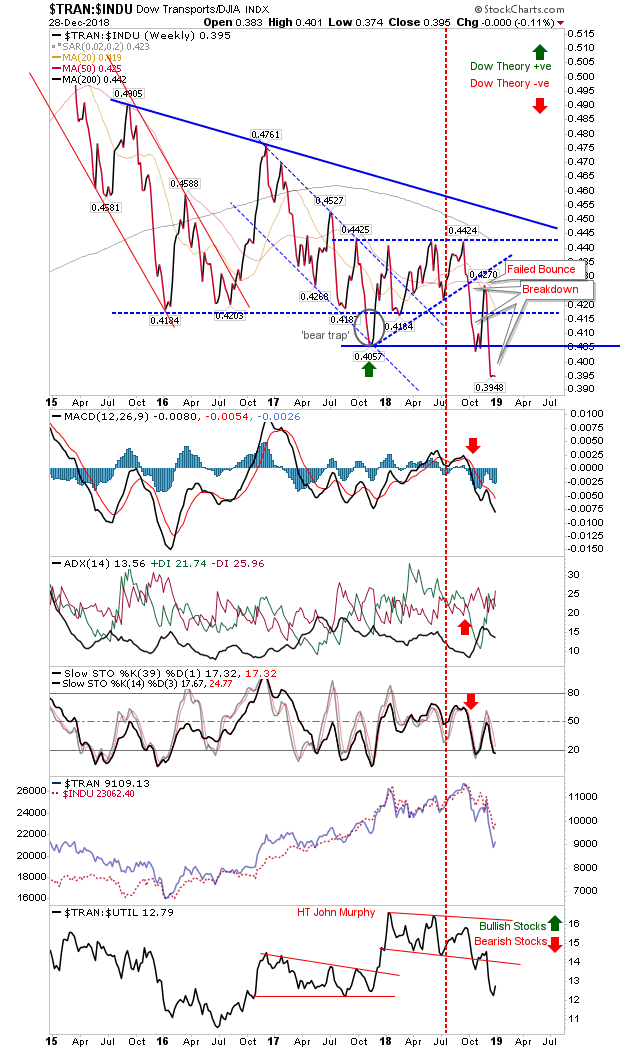

Of longer-term charts we have a breakdown and new swing-low in the relationship between the Dow Index and Dow Transports. This is a relationship which has been in decline since 2015 - effectively the last legs of the Obama era - from which Trump's crazy, deregulation-friendly presidency has managed to gloss over until now. What this means for the duration of the decline remains to be seen but this relationship will need to reverse course before lead markets bottom. With Mueller and Brexit to play out their final acts, 2019 could be a tricky year. Again, investors shouldn't worry and be happy to lap the chaos up, this situation has required nine years of waiting.

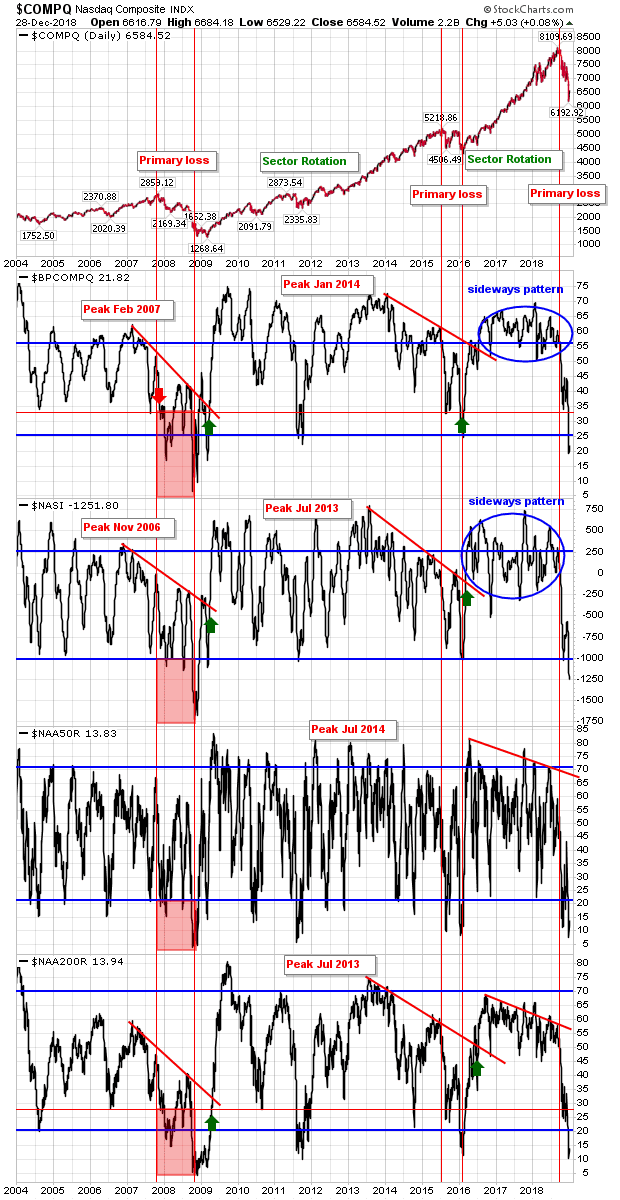

Nasdaq Breadth metrics are at levels last seen in 2011 and 2016, and are just a shade away from that in 2008. Again, we are looking at prior periods of deep value and the outlook should be one for optimism - not pessimism.

New S&P 52-week lows have created a marked spiked high, again, a scenario which has surpassed the swing lows of 2011 and 2016 and may ultimately, offer a stronger swing low than either of 2011 or 2016.

The Nasdaq offered its own 'buy' based on historical action in the percentage of stocks above the 200-day MA, finally tagging the support line reached in 2002 and 2011 - although not yet the levels seen in 2009.

The key take home about all these charts is that markets are in a major value phase. Things may still get worse with Trump and Brexit but we are at endgame purge of the post-credit bubble excess.

Donald Trump is threatening to close the border and all economic activity with Mexico. This could have a devastating effect on small business in America. Just FYI, Declan. I posted this with the NY Mag article link:

Let's not kid ourselves. Donald Trump hates Mexico. He wants revenge over those he hates. Read this and you will never doubt this truth again: nymag.com/.../...overnment-shutdown-recession.html