Earnings Still Looking Good, But…

(Click on image to enlarge)

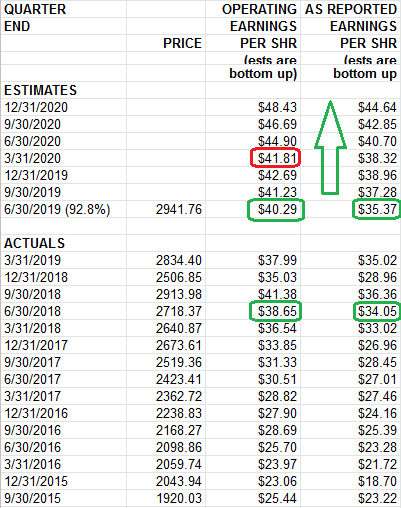

This week we will use Howard Silverblatt’s EPS numbers from S&P Global. His most recent numbers (published on 8/15 – featured above) show better than expected earnings year on year for Q2 2019 [both “as reported” and “operating” earnings (see green circles)].

Estimates are also strong moving forward (with the exception of Q1 2020). The concern for Q1 2020 is that operating earnings are expected to drop sequentially from Q4 2019. The last times we had sequential drops in operating earnings (of 1 quarter) we got 10-20% short term corrections. This not only happened in Q4 2018 and Q4 2015 but consistently over the past 30+ years of data (sequential drops in operating earnings tend to yield corrections).

So that’s the bad news. The good news is we should have ample room to run up materially to new highs ahead of that temporary slowdown – provided we get adequate liquidity from global central banks and trade tensions simmer. Furthermore, it’s possible the two latter items could resolve sooner and estimates could be revised up – avoiding any volatility in Q1 (but it is not in the numbers at present).

Looking out to the end of 2019 looks very constructive for the markets and we will adapt with the numbers as we get closer to Q1.

Disclaimer: Not investment advice. For educational purposes only: https://www.hedgefundtips.com/terms-of-use/

The market will rally because no one expects it to. People will shrug, scratch their heads, and count their winnings. Same playbook as usual.

And what are you basing that theory on?