Earnings Review: ZM, CRM, ZS, CRWD And DOCU

This week many of the best-performing stocks reported Q3 earnings. Zoom (ZM) kicked it off on Monday by beating earnings and revenue estimates and issuing better forward guidance. Revenues grew an astonishing 367%, while adjusted EPS grew 1000%.

Gross margins fell from 81% to 67% year over year as the company needed to spend more money to accommodate the surge in demand. Operating margins increased from -1% in Q3 last year to +25% in Q3 this year. R&D spend fell from 11% of sales in Q3 last year to 5%, and sales & marketing costs fell from 58% of sales in Q3 last year to 24%. Resulting in an operating profit of $192.2 million for the quarter. Unlike many of the high flying software plays, Zoom is profitable.

Take a look at the company’s financial results and you can see why the stocks is up 500%+ this year. Revenues over the last 4 quarters (trailing twelve months – TTM) has surpassed $2 billion.

While operating income during that same time frame has surpassed $400 million. Quite impressive for a company that’s only been public for less than 2 years.

So the stock is down 13% after earnings. It trades 72x sales, 147x forward earnings, this stuff can happen. It’s one of the reasons why I’ve reduced positions in many of these companies prior to this week. The surge in demand in 2020 will create very tough comps for 2021. I think the market is taking this into account now.

The company noted that growth was strong along every customer segment, but especially among the government and education sector. Zoom executives said a “significant percentage” of recent usage came from the education sector, which will end up being a drag on growth once schools reopen. Growth will certainly slow (perhaps slow significantly) when we return to normal, but the company has made strategic moves to ensure it won’t be going anywhere. I remain bullish on the company, but it's hard to be bullish on the stock price (at least in the short term) after such a run-up.

The above chart is the daily price chart for this year. I see a sloppy head and shoulders pattern potentially forming (red trend line). Price remains below the 50-day moving average and the high volume breakout day. A break below the trend line puts the open price gap at $325 in play. The measured move target of approximately $275 would seem like the next logical target if the short-term trend remains negative.

Salesforce (CRM) reported another strong quarter, crushing earnings expectations. Posting adjusted EPS growth of 132% year over year, on revenue growth of 20%. Gross margins ticked down from 74.9% to 74.3%, and operating margins improved from 1.44% to 4.13%, as marketing/sales expenses went from 46% of sales to 44%.

If I’m to nitpick I’ll point to the slowdown in sequential revenue growth. Starting with the quarter ending October 31, 2019, here are the sequential revenue growth numbers:

+33%, +35%, +30%, +29%, +20%, +17%* (*Revenue growth based upon the company’s forward guidance).

This is one software stock I’m not as worried about on a valuation basis. The biggest headline during the conference call was the announcement of the acquisition of Slack (WORK). Which I’m guessing is the biggest drag on the stock today. I don’t have a great read on this deal at the moment. My first reaction was it's a steep price to pay and you are going up against a juggernaut in Microsoft. But CRM does have a good track record, so I’m willing to give them the benefit of the doubt.

The August 25 open price gap at $216.05 will likely be key in the near term. Should that fail to hold, I’d be looking at support in the vicinity of $195, where I’d likely add to my position. Overall I thought it was an impressive report. I’ll need to keep an eye on revenue growth, as margin expansion will need to improve if revenue growth continues to moderate.

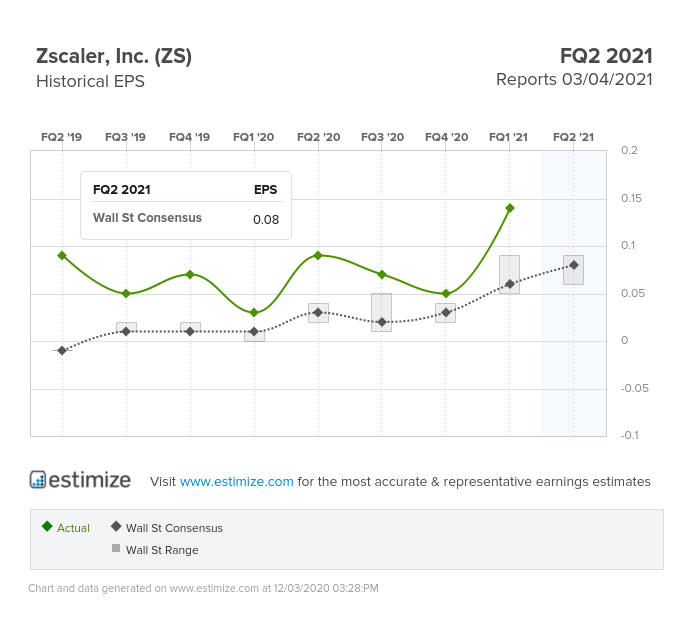

Cloud security companies Zscaler (ZS) and Crowdstrike (CRWD) continue to impress. Zscaler beat earnings and revenue estimates with an adjusted EPS growth rate of 367% on revenue growth of 52%, while Crowdstrike also beat earnings and revenue expectations with an adjusted EPS growth rate of 214% on revenue growth of 86%.

Crowdstrike’s margin improvement was noticeable. Gross margins improved from 70% to 73.5% year over year and operating losses improved from -30% to -10%, as operating costs as a percentage of revenue declined. Sales and marketing expenses fell from 55% of revenue to 45%, Research & development costs fell from 29% of revenues to 25%, and general & administrative costs also fell from 17% of revenues to 14%. The company is doing a good job of growing the business while managing costs. Subscription customers grew 85% to 8,416 as the pandemic forces the transition to remote work.

Zscaler margins deteriorated on a GAAP basis. Gross margins fell from 79.1% to 77.7%, while operating losses accelerated from -19% to -30%. On a cash flow basis, the picture looks better, as cash flow from operations improved from 23% of revenue to 38%, and free cash flow improved from 10% of revenue to 30%. While also raising full-year 2021 guidance above street expectations.

Both stocks are up +20% after earnings. Both stocks are up some 400%+ off the March lows. I wish they all worked this well!!!

I continue to own both companies although I did reduce positions in both this summer. The industry is hot and these companies continue to land fortune 500 customers every quarter. What more can I say.

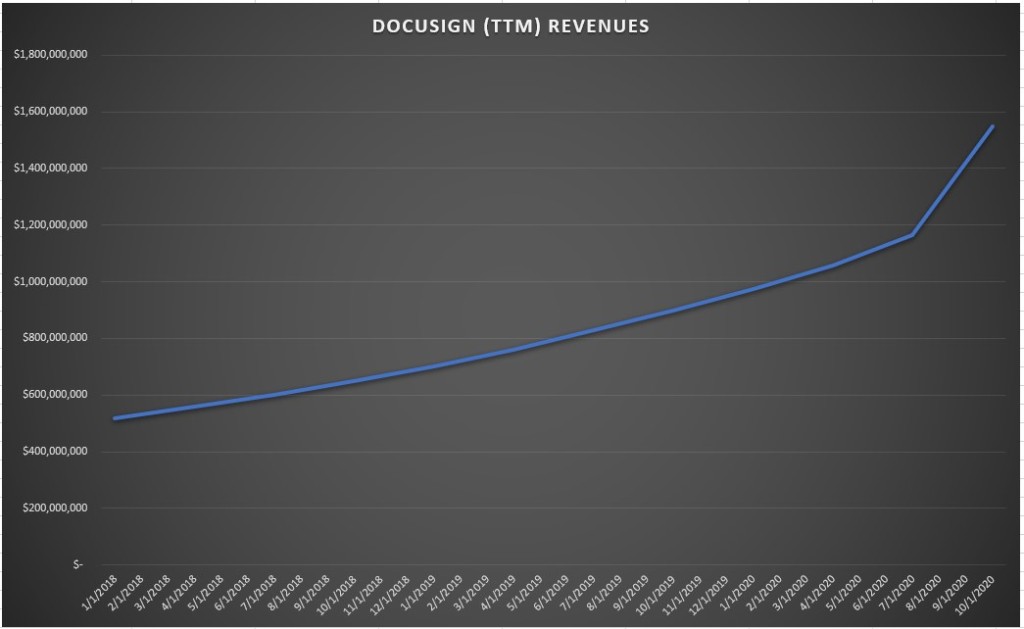

Lastly, Docusign (DOCU) also beat on earnings and revenue expectations. Adjusted EPS grew 100% year over year on revenue growth of 53%. This was the highest quarter of revenue growth since the company became public. Sequential quarterly revenue growth for the last 4 quarters is as follows, +37.63%, +38.82%, +45.24% and now +53%. The company gave guidance for revenue growth of between 47% to 48% for the next quarter.

Gross margins fell from 75% to 74%, while operating margins improved for -17.6% to -12.7%. Drilling deeper into the operating costs, sales, and marketing expenses improved from 59.8% of revenues to 54.8%, while R&D improved from 19.5% of revenues to 19.2%, and general & administrative costs also improved from 13.4% of sales to 13.1%.

DocuSign has now surpassed $1.5 billion in revenues over the last four quarters combined (trailing twelve months – TTM). Another very strong quarter overall. Clearly, the company is benefitting from the remote work environment, but the “Agreement Cloud” with services like remote notary and video collaborations, make me believe the growth is sustainable. International growth is still in its early stages and the company is a lot more than just e-signature.

To the price chart… the $185 level held well as support. The stock had been mostly stuck in a trading range for the last 5 months. Today the stock is up about 10% after earnings, the next upside target would be the open price gap at $265.16, and then all time highs at $290.23. Clearly, the stock has had a tremendous run this year. It’s another company I’m bullish on, but a lot of growth may already be priced into the stock.

I have no intentions of adding or reducing my position at these price levels. I had my eye on the $136-$150 area for a buy, but after today it looks like that won’t be happening anytime soon. It’s a hold for now.

Disclaimer: None.