Early Stage Status For Dimension Therapeutics Keeps Us Cautious On This IPO

Dimension Therapeutics (NASDAQ: DMTX) expects to raise $82.5 million in its upcoming IPO. Based in Cambridge, Massachusetts, Dimension Therapeutics is a biotechnology company with a gene therapy platform for developing treatments for rare diseases associated with the liver.

We previewed DMTX on our IPO Insights Platform last week.

Dimension Therapeutics will offer 5.5 million shares at an expected price range of $14 to $16. If the underwriters price the IPO at the midpoint of that range, DMTX will have a market capitalization of $373 million.

DMTX filed for the IPO on September 14, 2015.

Lead Underwriters: Citigroup Global Markets and Goldman Sachs

Underwriters: Cannacord Genuity, Cantor Fitzgerald and Wells Fargo Securities

Business Summary: Biotech with Gene Therapy Platform

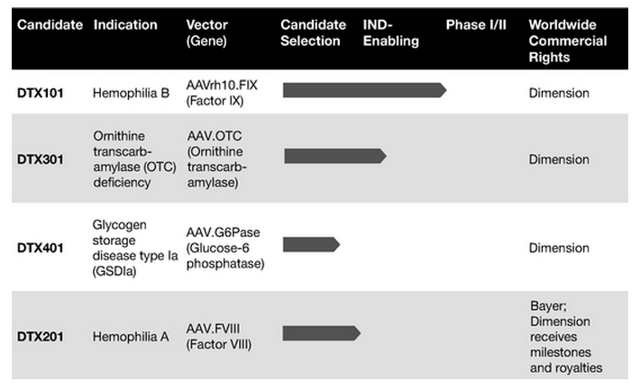

Dimension Therapeutics is a biotechnology company with a gene therapy platform for developing treatments that target rare liver diseases and other disorders caused by genetic mutations. The company's lead product candidate is DTX01, which is a gene therapy designed to deliver Factor IX gene expression for individuals with hemophilia B. Other products include DTX301, a gene therapy product candidate to treat individuals with a deficiency of ornithine transcarbamylase; DTX201, a gene therapy to treat patients with hemophilia A; and DTX401, a gene therapy treatment for individuals with a specific variation of a glycogen storage disorder.

(click to enlarge)

(Source)

In August 2015, the company submitted an Investigational New Drug application (IND) to the FDA for its lead product candidate, DTX101, for the treatment of hemophilia B. In September, Dimension Therapeutics received the green light to proceed with Phase I/II clinical trials of DTX101. In addition, DTX101 received Orphan Drug Designation and Fast Track Designation for treating hemophilia B. Currently, the company intends to initiate those clinical trials by the end of this year.

Future research and development will focus on product candidates that will address rare monogenic diseases associated with the liver for which only symptom management currently exists.

Dimension Therapeutics intends to use the net proceeds of the IPO to fund clinical trials, pay down certain debts and working capital.

Executive Management Overview

CEO, President and Director Dr. Annalisa Jenkins, MBBS, MRCP, has served in her position since September 2014. Her previous experience includes senior positions at Merck Serono S.A., Bristol-Myers Squibb, Ardelyx and the British Royal Navy as a Medical Officer. She graduated in Medicine from St Bartholomew's Hospital London and trained in Cardiology with the UK National Health Service.

CFO and Treasurer Jean Franchi has served in her position since August 6, 2015. She has held senior financial executive positions at Good Start Genetics, Genzyme and bioMerieux Bitek. Ms. Franchi earned her Certified Public Accountant Certificate in Massachusetts, and she holds a Bachelor's degree in Business Administration from Hofstra University.

Potential Competition: Pfizer, BioMarin, Novo Nordisk and Others

Gene therapy treatments represent the cutting edge of new drug development and many companies are pursuing development and marketing of such treatments. These companies include Baxalta Inc. (NYSE:BXLT), Novo Nordisk (NYSE:NVO), uniQure (NASDAQ:QURE), Chiese Farmaceutici, Spark Therpeutics (NASDAQ:ONCE), Pfizer (NYSE:PFE), Sangamo BioSciences, Alnylam, Bioben, Arcturus Therapeutics, Bioblast Pharma, Telethon Institute and Synlogic.

Financials: Increasing operating revenues, early-stage net losses

Dimension Therapeutics provided the following figures from its financial documents for the six months ended June 30:

|

2015 |

2014 |

|

|

Revenue |

$3,336,000 |

$159,000 |

|

Net Income |

($15,312,000) |

($5,865,000) |

As of June 30, 2015:

|

Assets |

$88,121,000 |

|

Total Liabilities |

$28,465,000 |

|

Stockholders' Equity |

($29,239,000) |

Conclusion: Consider Holding Off

We like Goldman-led healthcare IPOs. GBT posted a whopping 115% first-day return in early August. DMTX's focus on genetics is enticing, as well.

The usual risks tied to early-stage biotech firms apply: pre-clinical and hard to predict if product candidates will gain approval and market traction. Along these lines, DMTX's product candidates are not yet even dosed in patients.

For these reasons, we are cautious on DMTX and suggest investors consider holding off.

Disclosure: None.