Early Returns Look Bad For This Merger

Our latest featured stock is a beverage giant formed via merger in 2018. We pulled this highlight from last week’s research of 659 10-K filings.

Analyst Cody Fincher found several unusual items in the footnotes of Keurig Dr. Pepper’s (KDP) 2018 10-K.

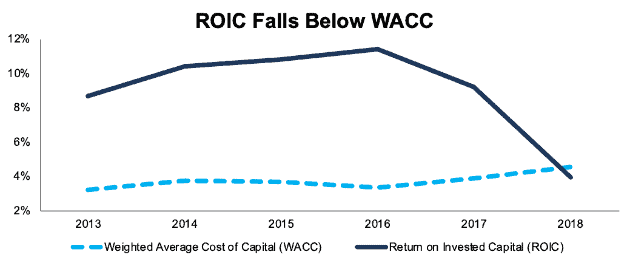

KDP was formed when privately held Keurig acquired Dr. Pepper Snapple in July of 2018, and the combined company began trading under the symbol KDP. As shown in Figure 1, Dr. Pepper Snapple earned consistently high returns on invested capital (ROIC), but the combined KDP earned an ROIC of 4% in 2018, which is below its weighted average cost of capital (WACC) of 4.5%.

Figure 1: ROIC vs. WACC for Dr. Pepper Snapple/KDP Since 2013

Sources: New Constructs, LLC and company filings.

In order to calculate the combined company’s ROIC, we made three significant adjustments related to the merger. Our two major income statement adjustments were:

- The removal of $131 million (2% of revenue) in inventory step-up costs disclosed on page 81

- The removal of $170 million (2% of revenue) in integration costs disclosed on page 113

KDP reported GAAP net income of $589 million in 2018, but our adjustments show that it earned net operating profit after tax (NOPAT) of $1.1 billion.

On the balance sheet side, we made a midyear acquisition adjustment to account for the fact that the merger closed in the middle of 2018. KDP had ~$46 billion in invested capital at the end of 2018 (96% of which consisted of goodwill and other intangibles), while Dr. Pepper Snapple started the year with ~$10 billion in invested capital. A simple average of these two numbers would yield $33 billion, but since the acquisition closed slightly more than halfway through the year we adjust and calculate the combined company’s average invested capital of ~$27 billion.

Our adjustments help strip out the accounting distortions surrounding the KDP merger and reveal that the combined company is failing to create value for shareholders. Executives will claim there are still “synergies” to be realized, but research shows that few acquisitions actually deliver the promised synergies. On the evidence we have so far, it appears that Keurig overpaid for Dr. Pepper Snapple.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

In total, we made the following adjustments to Keurig Dr. Pepper’s 2018 10-K:

Income Statement: we made $1.1 billion of adjustments, with a net effect of removing $492 million in non-operating expense. We removed $303 million in non-operating income and $795 million in non-operating expense. You can see all the adjustments made to KDP’s income statement here.

Balance Sheet: we made $21.3 billion of adjustments to calculate invested capital with a net decrease of $16 billion. You can see all the adjustments made to KDP’s balance sheet here.

Valuation: we made $22.2 billion of adjustments with a net effect of decreasing shareholder value by $22.2 billion.

The Power of the Robo-Analyst

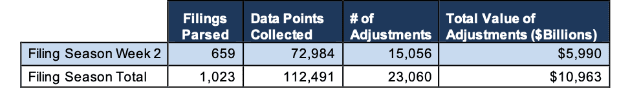

We pulled this highlight from last week’s research of 659 10-K filings, from which our Robo-Analyst technology collected 72,984 data points. Our analyst team used this data to make 15,056 forensic accounting adjustments with a dollar value of $6 trillion. The adjustments were applied as follows:

- 5,859 income statement adjustments with a total value of $375 billion

- 6,525 balance sheet adjustments with a total value of $2.6 trillion

- 2,672 valuation adjustments with a total value of $3 trillion

Figure 2: Filing Season Diligence for Week of February 25-March 3

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

No Substitute for Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to uncover the true profitability of a firm and make sound investment decisions. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how the adjustments we make contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can investors and advisors alike get beyond the noise and get the truth about earnings and valuation.

Disclosure: David Trainer, Cody Fincher, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.