Eagle Point Credit: Don’t Speculate On This 14% Yielder

Eagle Point Credit Company (ECC), (CHP-UN.TO) is a Collateralized Loan Obligation (CLO) fund that offers a covered 13.6% yield, making it a potentially attractive ‘high yield’ stock. You can see the full list of high yield stocks here.

Eagle Point Credit Company also pays its dividends on a monthly basis, which is rare in a world where the vast majority of companies that pay a dividend, pay them quarterly.

Eagle Point Credit’s high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though its dividend payment has been stagnant in recent years.

This article will analyze the investment prospects of Eagle Point Credit in detail.

Business Overview

Eagle Point Credit is a closed-end fund launched and managed by Eagle Point Credit Management LLC. It was formed on March 24, 2014, and is domiciled in the United States.

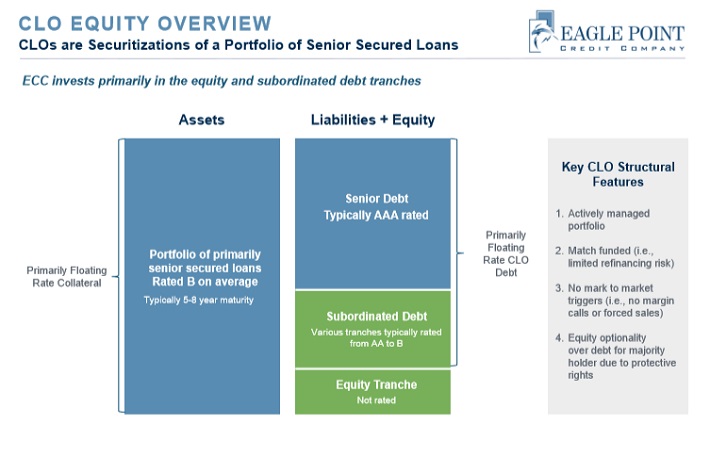

It invests in fixed income markets of the United States, primarily equity and junior debt tranches of collateralized loan obligations that mainly consist of below investment grade U.S. senior secured loans.

Eagle Point Credit is a popular CLO fund among institutional investors thanks to management’s long term buy-and-hold philosophy and conservative approach to running the business. Eagle Point Credit’s business consists of primarily owning a large portfolio of CLOs.

CLOs are composed of a significant amount of senior secured loans that are grouped together into tranches. The returns on these tranches are risk-adjusted, meaning that the higher the credit rating of the tranche, generally the lower its yield.

(Click on image to enlarge)

Source: Investor presentation, page 20

Eagle Point Credit – in an effort to maximize yield for investors – focuses on the bottom tiers as well as the equity position in the CLOs. Unfortunately, this means that their portfolio is also higher-risk as the equity position is the lowest in the priority list for returns and the lower tranche CLOs in general are considered riskier.

That being said, Eagle Point has a remarkable track record of outperformance using this strategy by mitigating risks through taking activist positions in order to influence key terms and conditions in its investments.

Since the company IPO’d, it has outperformed its broader index – the Wells Fargo BDC Index (WFBDC) by over 2-to-1 with a total return of 57.18% against a total return of just 26.79% for the index.

This alpha-generating activist approach is considered more akin to private equity style investing rather than the more passive approach employed by peers. It includes proactive sourcing of deals, utilizing a methodical and rigorous investment analysis and due diligence process, involvement in the CLO formation and structuring, and ongoing monitoring and diligence throughout the investment.

This hands-on approach enables them to hand pick investments that display the qualities that facilitate their ability to influence the key terms and conditions in the investment that will drive outperformance.

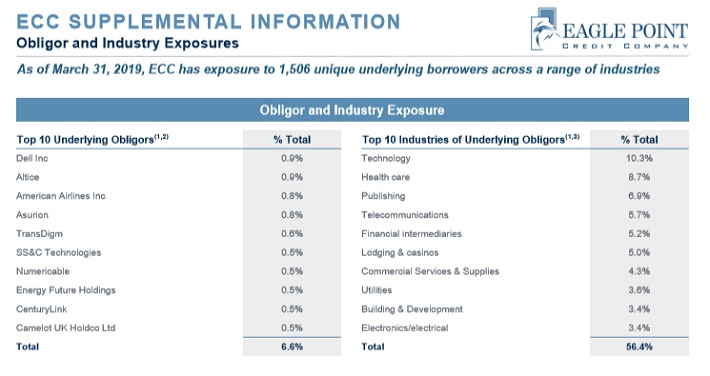

To further mitigate risks, the company invests across a wide variety of borrowers (1,506 unique borrowers) and industries. No underlying borrower accounts for more than 0.9% exposure and no sector accounts for more than 10.3% exposure.

(Click on image to enlarge)

Source: Investor presentation, page 30

Growth Prospects

Eagle Point Credit’s growth prospects could get a tailwind from outflows in senior loan ETFs, which would result in lower prices and higher effective yields. The company is poised to profit from price dislocations in the senior loan market, which would make their capital raises more accretive.

Furthermore, the CLOs that dominate ECC’s balance sheet of investments will benefit from widening bank loan spreads.

In the meantime, many of their CLOs are older and are therefore at risk of being called and generating lower returns. If management can effectively sell out of its debt tranches and further move into equity positions to boost yield, they can offset this and keep returns healthy.

At the same time, however, they need to exercise care not to take on excessive risk, especially so late in the cycle. Management is also looking to lengthen investment periods through resets and re-financings in order to boost yield.

The negative of this move, however, is that refinancing activity disrupts cash flows and also incur additional fees which eat into short term returns.

Risk Considerations

The number one risk here is obviously an acceleration in defaults and bankruptcies in underlying borrowers which would lead to increased losses and a rapid deterioration in net asset value for Eagle Point Credit.

The good news here is that the company employs a very aggressive hands on approach to its investments and also employs wide diversification, mitigating this risk significantly. Still, in a broad downturn in the economy, this is a very real risk.

Furthermore, the fund’s leverage could force it to issue equity or sell assets at dilutive prices in order to sustain its mandatory debt coverage ratios.

These risks aside, CLO equity does offer attractive return potential late in the credit cycle. A look back at the financial crisis shows that some of the best performing CLO equity tranches were issued immediately prior to the economy crashing. This in large part due to the reinvestment option inherent to CLO equity.

Dividend Analysis

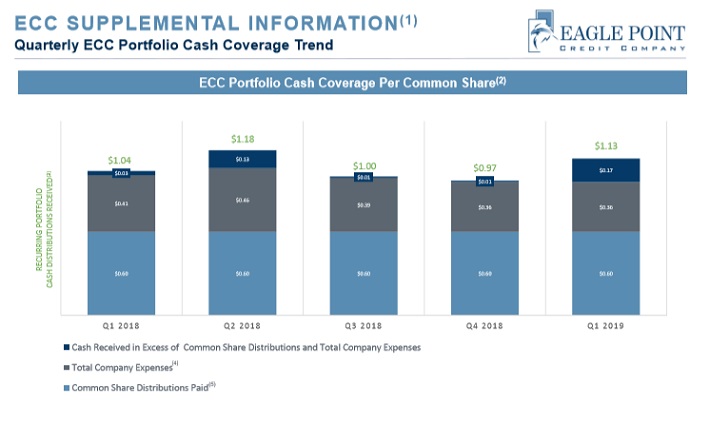

Management recently reiterated that the company’s monthly dividend is under no threat of being cut or modified as they are (barely) covering their dividend.

(Click on image to enlarge)

Source: Investor presentation, page 23

However, looking ahead, if their number of refinancings decline moving forward, that will remove a significant expense and help them to better cover their dividend, offsetting some headwinds from falling interest rates on new investments.

Overall, provided the economy remains stable and management can continue its track record of successfully navigating the elevated risk of investing in equity positions, their dividend looks sustainable.

Final Thoughts

Eagle Point Credit’s high dividend yield and monthly dividend payments make it stand out to high yield dividend investors. However, we remain cautious on the stock.

While the company is covering its dividend currently, the declining interest rates will continue to force the company ever further out on the risk spectrum to maintain its cash flows as its older loans roll off the balance sheet. This sets them up for potentially steep losses if the economy slips into recession.

This makes the investment highly speculative right now. Investors looking for monthly income have much better choices with more favorable growth prospects, higher yields, and safer dividends.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more