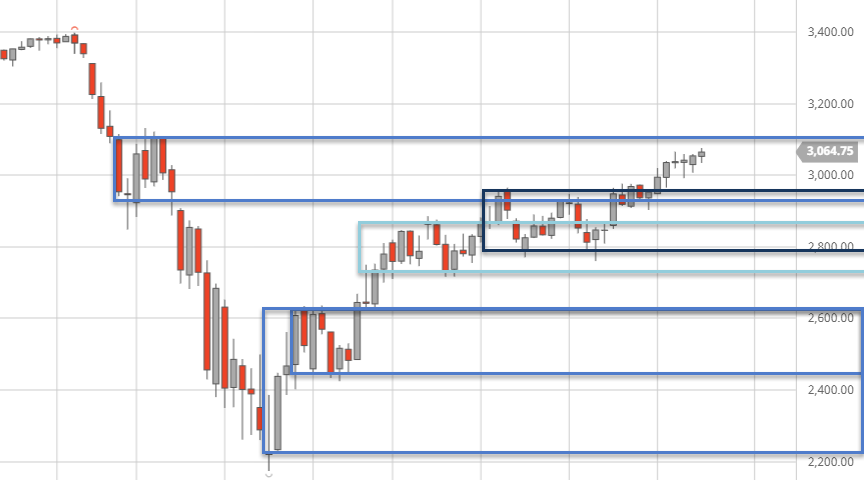

E-Mini S&P 500 Plain Perspective (ESM0 - SPX)

For the sake of simplicity and diversification, it's a good idea to take look at the plain view of a market. Looking at the continuous back-adjusted daily periodicity of the E-mini S&P 500 Futures contract (ESM0, June) we can observe a trend higher towards a prior bracket high which should be the next level of potential resistance. Also, to be noted is yesterday's close as an inside day. We can conclude either an inside day failure or a break. Therefore we can attempt to spot absorption patterns above the particular inside day to conclude an id failure and to position ourselves bearish. We can also conclude a break higher and awaiting a pullback to position ourselves bullish - depending on the current market situation and how it evolves over the day.

(Click on image to enlarge)

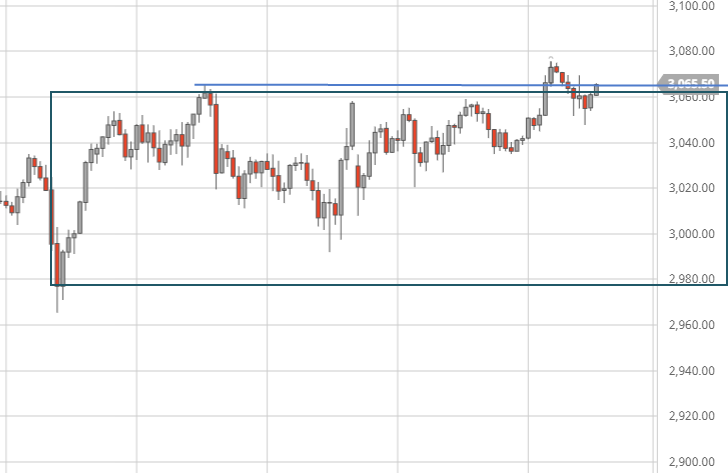

Moving forward to the hourly perspective we've seen a break above the highs, therefore we were able to conclude a possible pullback to spot absorption patterns. An area of supportive interest at a pullback would be the mean of balance areas in this particular case. Finally, looking at the lower timeframe as a recap we can see support around a previous microbalance area below a recent swing low with absorption. The next level of interest would be higher area above the swing high for potential resistance. Now we can combine this quick observation with tools such as the VWAP to find level of confluence.

(Click on image to enlarge)

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more