E-Mini S&P 500 Hesistant

The monthly periodicity testing the macro bracket high for sellers and the weekly perspective closed with a swing failure which should be a quite a bearish sign based on this quick HTF observations. The market was trending once the weekly tested the EMA50 with a pullback.

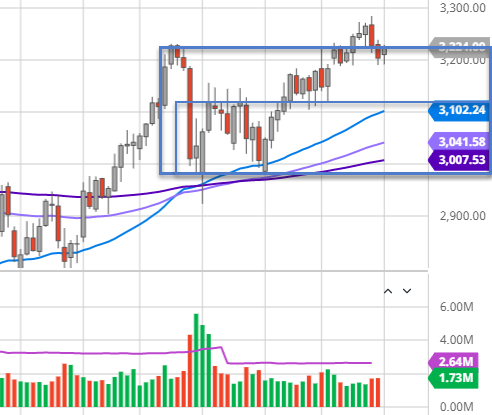

Moving forward to the daily perspective we can observe the recent break above the larger distribution or name it balance area. Currently, the market testing the upper area of this distribution for buyers. That should be reason enough to be rotational since Friday. The situation could lean to a microbalance area for now. Therefore we can leaning us on the extremes again to spot patterns such swing failure on the intra-day perspective to conclude a trade scenario.

Today the RTH market opened in the upper area of the previous balanced price range and surged higher. The rotational behavior around the high was a first sign of absorption or battle to conclude a short trade towards the noon. Followed by a pullback we can see reversal now. Still looking for the next possible short entry which is kind of rare at this day-type scenario (break-out of balanced price structure).

Anyway, besides that gold is trending higher and the yen is kind of strengthening in some way. Therefore I was sort of bearish but still open for the upside once we can spot some common scenarios in the market.

(Click on image to enlarge)

.

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more