Dynex Capital: Short-Term Headwinds Threaten The 13% Dividend Yield

Dynex Capital (DX), (CHP-UN.TO) is a mortgage Real Estate Investment Trust (mREIT) that offers a lucrative 12.8% yield, making it a potentially attractive ‘high yield’ stock. You can see the full list of ~400 stocks with 5%+ dividend yields here.

Dynex Capital also pays its dividends on a monthly basis, which is rare in a world where the vast majority of companies that pay a dividend, pay them quarterly. There are currently only 41 companies with monthly dividend payments.

Dynex Capital’s high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though its dividend payment has been declining in recent years.

However, as with many high-dividend stocks with yields above 10%, the sustainability of the dividend is in question. This article will analyze the investment prospects of Dynex Capital.

Business Overview

As an mREIT, Dynex Capital invests in mortgage-backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non-agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest-only securities.

Agency MBS have a guaranty of principal payment by an agency of the U.S. government or a U.S. government-sponsored entity, such as Fannie Mae and Freddie Mac. Non-Agency MBS have no such guaranty of payment.

Dynex Capital, Inc. was founded in 1987 and is headquartered in Glen Allen, Virginia.

The company is structured to have internal management, which is good because it can reduce conflicts of interest. Additionally, when they increase total equity, there is no material impact on operating expenses. Over time, Dynex’s management team has built a strong track record of generating attractive total returns for shareholders:

(Click on image to enlarge)

Source: Investor presentation, page 19

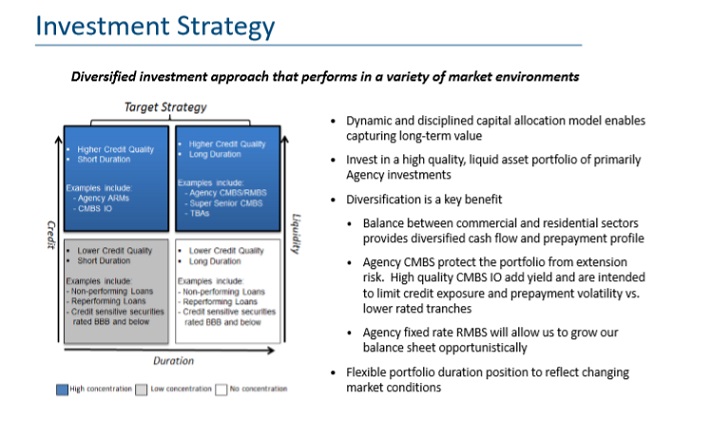

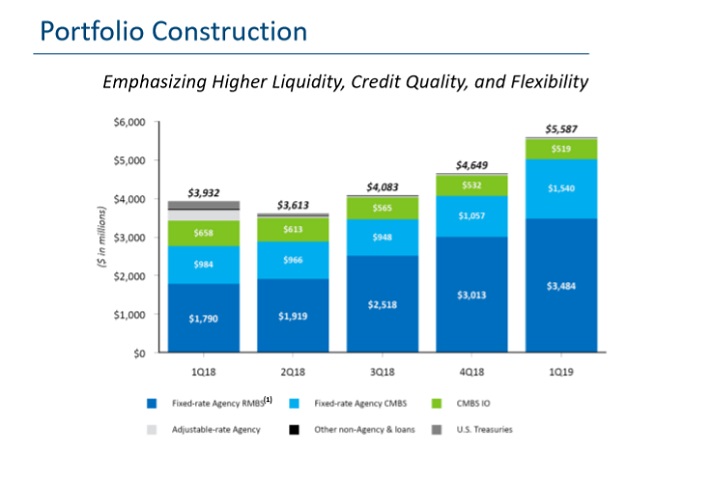

Dynex’s portfolio is structured to be widely diversified across residential and commercial agency securities. This diversified approach creates an attractive risk to reward balance that has benefited the company for many years.

Over time, the mix of CMBS and RMBS investments have reduced the negative impacts of prepayments on portfolio returns. Furthermore, agency CMBS acts as a cushion in the event of unexpected volatility in interest rates.

Finally, the high quality CMBS IO are selected for shorter duration and higher yield, with the intended impact of limiting portfolio volatility.

Ultimately, 90% of Dynex’s Agency 30 year RMBS fixed rate portfolio has prepayment protection via limits on incentives to refinance.

Management anticipates opportunistically increasing leverage in the high quality asset portfolio while avoiding credit sensitive assets that are leveraged with short term financing. As a result, the company enjoys a highly flexible portfolio that frees management to rapidly pivot to other attractive opportunities as markets remain volatile.

In the company’s most recent quarter, core net operating income came in at $0.18 per common share while book value per common share increased $0.22 per share, or 3.7%, to $6.24.

Meanwhile, the net interest spread and adjusted net interest spread of 0.84% and 1.19%, respectively, declined compared to 0.93% and 1.24%, respectively, for the fourth quarter of 2018 primarily due to lower TBA dollar roll income and the tighter spread between 3-month LIBOR and repo rates.

This poses a challenge for growth moving forward and requires management to further leverage positions (i.e., take on more risk) in order to sustain income levels. This was evidenced by the fact that leverage positions increased by half a turn sequentially in the first quarter to 8.5x shareholders’ equity.

Growth Prospects

Given that interest rates are expected to remain in a narrower and lower range for a longer period than ever seen in recent history, returns will likely suffer substantially.

This is because the economies of the world will continue to be weighed down by large pools of negative yielding debt, forcing central banks to remain accommodative in their monetary policy.

That being said, such a low yield environment creates an opportunity in high quality real-asset backed loans.

While numerous short term headwinds remain (as we will discuss next), Dynex still benefits from several long-term factors that could enable them to continue growing.

First, an aging population in a low yield world should foster a growing demand for the cash flow that their business can generate, thereby boosting valuations and making attracting capital easier for mortgage REITs.

Second, as the Federal Reserve attempts to reduce its investment in Agency RMBS and GSE reform opens new investment opportunities, demand for private capital in the US housing finance system should grow.

Third, the shortage of affordable housing means that there is a need for additional investment into the sector.

(Click on image to enlarge)

Source: Investor presentation, page 30

Finally, Dynex brings to the table several competitive advantages which should enable it to generate strong returns for investors throughout business cycles on the back of these long term tailwinds.

These include the company’s experienced management team with expertise in managing securitized real estate assets through multiple economic cycles, their emphasis on maintaining a diversified pool of highly liquid mortgage investments with minimal credit risk, and the attractive dividend yield.

Risk Considerations

While the long term outlook is more promising, several challenges remain in the near term.

First and foremost, this includes a shrinking spread between 3-month LIBOR and short-term repo rates as repo rates remain elevated due to the Fed’s pause at 2.5% on Fed Funds.

That being said, management has structured the portfolio so that any change in the Fed’s policy towards an ease in 2020 will offset the headwind to earnings.

(Click on image to enlarge)

Source: Investor presentation, page 14

Another risk is that prepayment speeds that could rise due to seasonal factors. Additionally, the drop in mortgage rates could increase refinancing activity, further cutting into profits.

While some cash-out refinancing is already factored into the company’s prepayment expectations and their portfolio has been structured to hedge against some of this, there will still likely be some lost profits.

Dividend Analysis

The latest earnings results revealed a dividend that was barely being covered, as the $0.18 per share dividend paid in the quarter matched the $0.18 per share in quarterly earnings.

Given the short term headwinds, management may find it challenging to sustain the current dividend payout.

That being said, their book value should continue to increase due to their existing mortgages increasing in market value (due to having higher relative interest rates), which should offset some of the dilution from any reductions in cash flow.

Ultimately the safety of the dividend will depend on how long and how low the interest rates and spreads go and how well management’ adaptive techniques play out.

Final Thoughts

Dynex Capital’s high dividend yield and monthly dividend payments make it stand out to high yield dividend investors. However, we remain cautious on the stock.

While the company is covering its dividend currently, the declining interest rates will continue to force the company ever further out on the risk spectrum to maintain its cash flows as its older mortgages roll off the balance sheet. This sets them up for potentially steep losses if the economy slips into recession and defaults rise.

On the other hand, if they are forced to cut their dividend yet again, it will likely continue the stock’s sell-off. This makes the investment highly speculative right now. Investors looking for monthly income have much better choices with more favorable growth prospects, higher yields, and safer dividends.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more