Dutch Biotech Firm Argenx SE Set To Dual List

Argenx SE (ARGX) filed an F-1/A with the Securities and Exchange Commission for its upcoming initial public offering in the U.S expected to take place on 5.18.

The company intends to sell 3.6 million American depositary shares with a proposed maximum aggregate offer price of $75.2M. The company has 540,000 as an overallotment option for its underwriters. The underwriters for the IPO are Cowen and Company, Piper Jaffray, JMP Securities and Wedbush PacGrow.

The company is currently listed Euronext Brussels (EBR: ARGX) and plans to be dual listed on the Nasdaq, upon completion of this offering. The company will have a market cap value of $441M.

We first previewed the deal on our IPO Insights Platform.

Business overview

Argenx SE is a biotechnology company that is based in the Netherlands. It is focused on developing therapies for autoimmune disorders that are modeled on the immune systems of llamas.

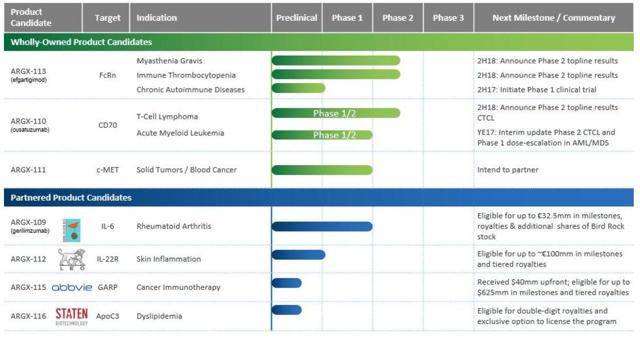

The company is in its clinical stage of development, and its most advanced candidate product, ARGX-113, is in its second clinical trials for the treatment of myasthenia gravis and primary immune thrombocytopenia. Phase two trials began in April 2017 for ARGX-110 for the treatment of cutaneous TCL. The company has seven product candidates it total.

The company has collaboration agreements with several pharmaceutical companies that are interested in its product candidates, including Shire, which has invested in the company and current holds a 12% stake.

(Click on image to enlarge)

Executive management overview

Tim Van Hauwermeiren co-founder Argenx and now serves as the chief executive officer, positions he has held since July 2008. He has also served as a member of the board of directors since July 2014. Van Hauwermeiren has more than 20 years of experience in management and business development in the consumer goods and life sciences sectors. He holds a Bachelor of Science and Master of Science in bioengineering from Ghent University and an executive Master of Business Administration from the Vlerick School of Management.

Eric Castaldi serves as the chief financial officer of Argenx SE, positions he has held since April 2014. Castaldi has 28 years of international financial executive management experience, including 19 years in the biopharmaceutical industry. Previously, he served as the CFO of Nicox SA (1998 to 2014). Castaldi holds an undergraduate degree in finance, accountancy and administration from the University of Nice.

Financial highlights and risks

Argenx SE does not have any product candidates that are available for commercial sale or generate revenue. Currently the company generates revenue through several collaboration agreements it has with other pharmaceutical companies. The company has shown an increase in revenue through these collaboration agreements in the more recent fiscal year. Revenue generated was €6.9M and €14.7M in 2015 and 2016, respectively. The company saw increasing losses as it increased spending on R&D. Total losses were €15.3M in 2015 and €21.3M in 2016. As of 2016, the company had cash and cash equivalents of €42.3M and an accumulated deficit of €72.5 million.

Conclusion: Consider Purchasing Shares

Despite the risk associated with investing in an early stage biotech company, we are excited about Argenx and the direction in which it's moving with growing partnerships and clinical trial successes. Its listing will enable it to secure capital funding to further its research and development.

We recommend investors comfortable with this risk consider making an allocation.

Several other biotech companies which have gone public in recent months have received a warm welcome; we expect Argenx may follow suit.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses ...

more